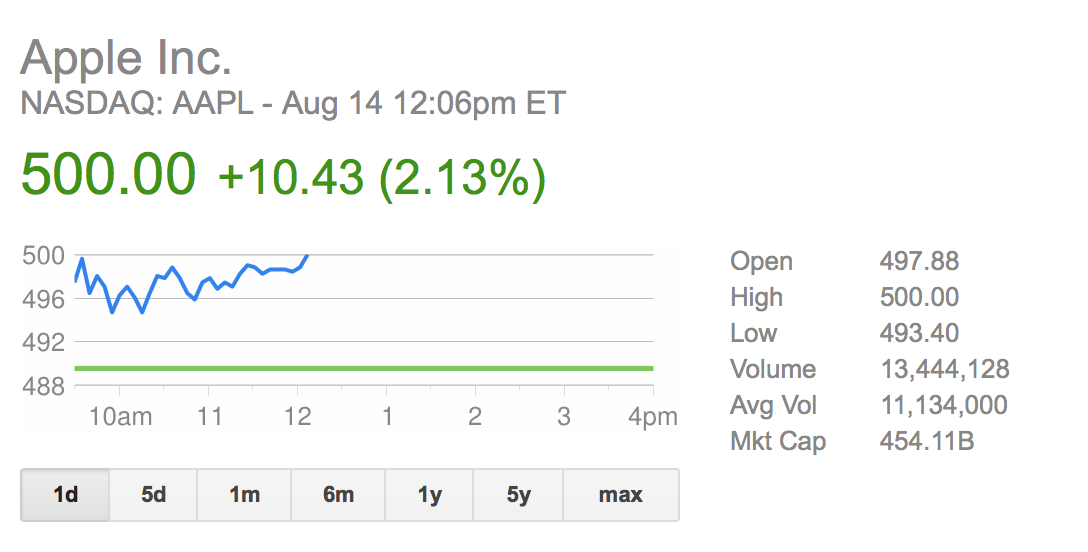

Another reason you might want to hide one of the iPhone’s default apps: your financial health …

With Apple not allowing us to delete its pre-installed iPhone apps, may of us take to hiding them away inside a folder on the ‘back’ screen where they at least don’t get in the way. But a report in the WSJ suggests there’s another reason you may want to hide the Stocks app: using it too often can lead you to make poor investing decisions.

The report references a phenomenon known as myopic loss aversion, in which people are likely to sell stocks when they see frequent downward movements – even if the long-term trend is up.

When people are frequently told how their investments are doing—say, if they are given a daily update on their long-term investments, by smartphone or any other digital device—they are more likely to make poor financial decisions and possibly sell at the wrong time.

The reason frequent checks are risky is that the more often you look, the greater the chance you’re going to see a drop in the price. And that has nothing to do with the stock’s performance, it’s just stats.

If you check every single day, there’s a roughly 47% chance that the market will have gone down, based on its past movements. But what happens if you check once a month? The numbers will start to look a little better, as the market will only have gone down 41% of the time. Years are better still, as the S&P generates a positive return seven years out of every 10. And if you check once a decade, then you’re only going to get bad news about 15% of the time.

So if you want to make the best investment decisions, it seems the smart money is on leaving the Stocks app well alone.

Apple has come under criticism for continuing to offer a 16GB iPhone in 2015, but defended the decision on the basis of cloud storage and app thinning.