Nuance announced it is releasing the Dragon Express Mac App Store app today to seven new countries in three new languages. Originally released last year, the app is now available in the following countries for around $50:

Nuance announced it is releasing the Dragon Express Mac App Store app today to seven new countries in three new languages. Originally released last year, the app is now available in the following countries for around $50:

Dragon Express 1.1 now supports the French language in Canada, France, Belgium, Luxembourg and Switzerland, the German language in Austria, Germany and Switzerland, and the Italian language in Italy.

Austria, Belgium, France, Germany, Italy, Luxembourg, Switzerland (French), Switzerland (German)

According to iPhonehellas [translated], Nuance also held a press event today in Greece to announce the availability of Dragon Dictation for June 6.

The full press release from Nuance is below:

Nuance’s Dragon Express for Mac OS App Store Now Available in French, German and Italian Languages

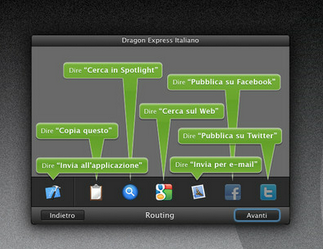

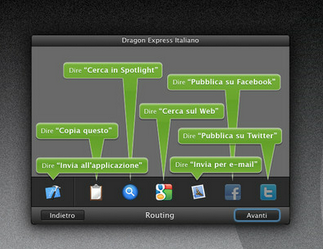

BURLINGTON, Mass., – May 31, 2012 – Nuance Communications, Inc., (NASDAQ: NUAN) today announced that its Dragon Express App, an introductory voice recognition app for Mac OS X Lion, has debuted in seven additional countries, supporting three additional languages. Dragon Express 1.1 now supports the French language in Canada, France, Belgium, Luxembourg and Switzerland, the German language in Austria, Germany and Switzerland, and the Italian language in Italy. Available exclusively for download from Apple’s Mac App Store, Dragon Express is an easy and fun way to put words to work without the hassle of typing, allowing users to do more in less time.

Released in late 2011, Dragon Express quickly rose to the top of the charts in the Mac App Store. It’s a fast, hands-free way to quickly turn speech into text, whether sending email, surfing the Web or posting an update to Facebook and Twitter. Dragon Express is priced to provide people with an opportunity to experience the power and performance of speech recognition.

“The excitement for Dragon Express has been overwhelming, and we’ve heard our customers’ requests for additional language support,” said Peter Mahoney, chief marketing officer, senior vice president and general manager, Dragon, Nuance Communications. “We know that people around the world are embracing speech as a useful and fun interface, and we’re excited to bring the Dragon Express app to a broader worldwide audience.”

Dragon Express can be conveniently accessed from the menu bar at any time and doesn’t require a network connection. Users dictate directly into the Dragon Express window, using the internal Mac microphone or a USB headset microphone (which can be purchased via http://www.nuance.com), and the text instantly appears in the Dragon Express window. When finished, Dragon Express places the transcribed text into the application of choice. The download comes with a short enrollment so that the app can better recognize a user’s unique voice.

Dragon Dictate, the most full-featured and advanced speech recognition software for Mac OS, was recently updated to version 2.5. Dragon Dictate 2.5 includes many features beyond those in Dragon Express. These features include the ability to dictate directly into applications, edit, format and correct recognition errors by voice, open and close applications by voice, control the mouse by voice, create custom voice commands and support for the Dragon Remote Mic app for iPhone.

Nuance announced it is releasing the Dragon Express Mac App Store app today to seven new countries in three new languages. Originally

Nuance announced it is releasing the Dragon Express Mac App Store app today to seven new countries in three new languages. Originally