AAPL’s performance & prospects make it a paradoxically difficult investment, say fund managers

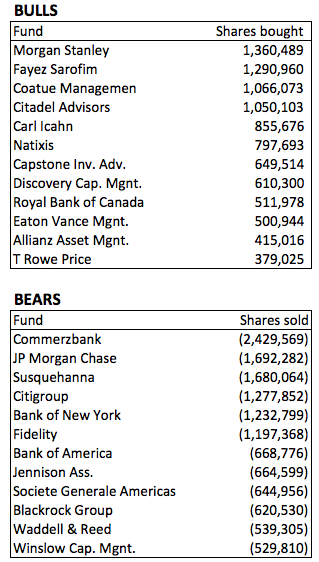

You might not think a stock outperforming the market and considered to have good future prospects would pose a problem for investors, but Reuters reports that it can prove challenging for fund managers.

The issue is that most diversified funds have rules or guidelines that state they shouldn’t hold more than 5-10% of their funds in any one stock. This, fund managers say, can pose three problems. First, there’s the obvious one: they may want to buy more of it than their own rules allow …

Expand

Expanding

Close

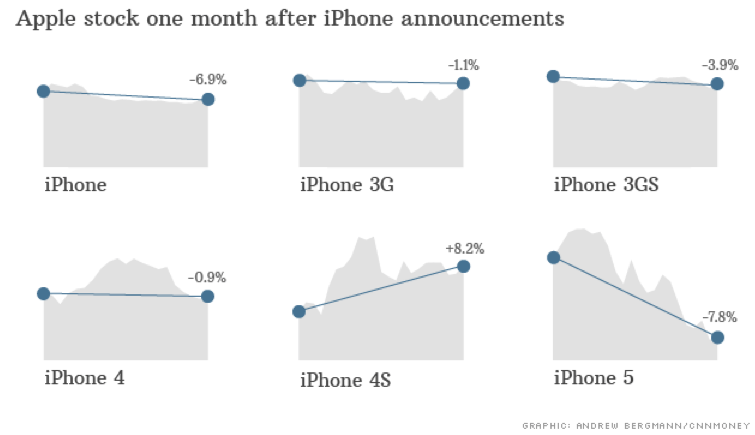

Downgrading AAPL from a buy to a hold, Reitzes said that while he was excited by the

Downgrading AAPL from a buy to a hold, Reitzes said that while he was excited by the