Apple Pay is secure, but weak ID checks by partner banks create vulnerability, claims report

While Apple Pay is the gold standard for safe card transactions, some partner banks are leaving customers vulnerable to fraud via identity theft thanks to weak checks when cards are added to Apple Pay, according to mobile commerce consultants Drop Labs. Some partner banks are consequently seeing fraud rates six times higher than with physical cards.

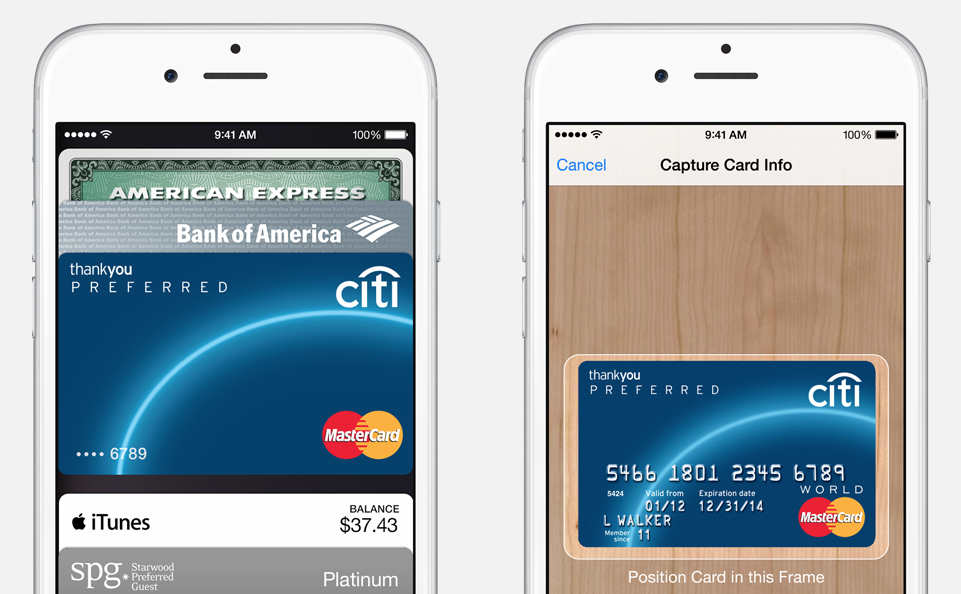

For consumers, Apple Pay is extremely safe, thanks to the use of Touch ID fingerprint verification and single-use code transmission rather than sharing full card details. Drop Labs claims that the weak link in the chain is what happens when cards are added to Apple Pay …

Expand

Expanding

Close