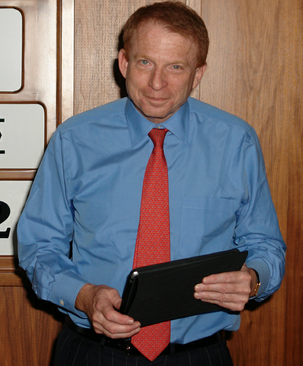

Bob Apfel, the founder of Bondholder Communications Group, told Fortune this morning that he completed the debt restructuring of Greece a couple of weeks ago with the help of an iPad. Well, 100 of them—to be exact.

Greece looked at bankruptcy head-on just a few months ago, but it found mercy through a round of restructuring transactions where the country settled for a smaller percentage of the its bonds’ paper value. Thousands of bondholders needed to first give the go-ahead, but such an endeavor, as Fortune coined it, was a “logistical nightmare.”

At that point, Apfel said he bought 100 iPads equipped with a customized app for debt-restructuring. His team of financial wizards received the tablets and immediately met with investors and other money gurus across the European Union. Of course, the iOS tablet successfully helped Apfel and his firm to close the deal that shrunk Greece’s debt to a more manageable sum.

According to Fortune:

- Toward the end, things got pretty exciting.

- ‘I watched hundreds of millions of bonds being ‘slam dunked’ as these guys were running down the halls,’ says Apfel. ‘Split-second decisions were made that couldn’t have been made without the data platform.’

- When last deal finally closed on April 25, $270 billion of Greek debt had been reduced to $130 billion.

- ‘It was the largest financial transaction in the history of the world,’ says Apfel. ‘And we couldn’t have done it without the iPad.’

Related articles

00