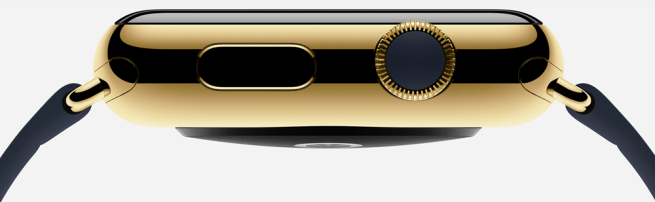

Report claims steel Apple Watch to start at $500, gold model between $4-5K

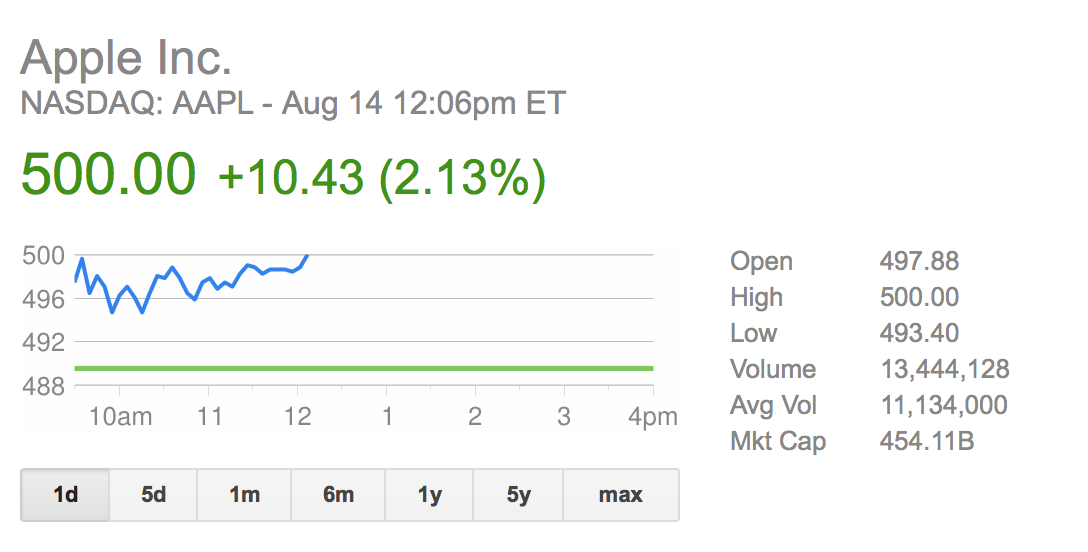

French website iGen.fr, which has provided reliable information in the past, reported on Tuesday that the steel Apple Watch will start at $500 alongside a gold model that will retail for between $4,000 and $5,000. Apple previously claimed at its September event that the Apple Watch would start at $349, but did not disclose further pricing information.

The report claims that the stainless steel Apple Watch in polished steel or black will cost $500, while the gold Apple Watch Edition will be the more expensive version at between $4,000 and $5,000. That price range would be nearly half the estimated $10,000 price that some other reports have suggested.

In December, we heard reports that the Pentagon had

In December, we heard reports that the Pentagon had