PayPal will soon be rolling out new ways for customers and merchants to take advantage of Apple Pay, iPhone, and more. PayPal says it will soon be adopting Apple’s new Tap to Pay on iPhone feature for merchants, as well as adding support for Apple Pay to its branded debit and credit cards and adding Apple Pay as a payment option in checkout flows.

PayPal adopting Apple Pay and more

PayPal made these announcements in an update to investors as part of its Q3 2022 earnings release. As one of its “strategic initiatives and business updates,” the company says it is “working with Apple to enhance our offerings for PayPal and Venmo merchants and consumers.”

We’re very pleased to be working with Apple to enhance our offerings for our PayPal and Venmo merchants and consumers,” PayPal Chief Executive Officer Dan Schulman said in the statement.

There are different components to today’s announcement from PayPal, which also owns the popular peer-to-peer payment platform Venmo. Here they are:

- Leveraging Apple’s Tap to Pay on iPhone technology, US merchant will soon be able to accept contactless debit or credit cards and mobile wallets, including Apple Pay, using an iPhone and the PayPal or Venmo iOS app.

- Adding Apple Pay as a payment option in PayPal’s unbranded checkout flows on merchant platforms, including the PayPal Commerce Platform.

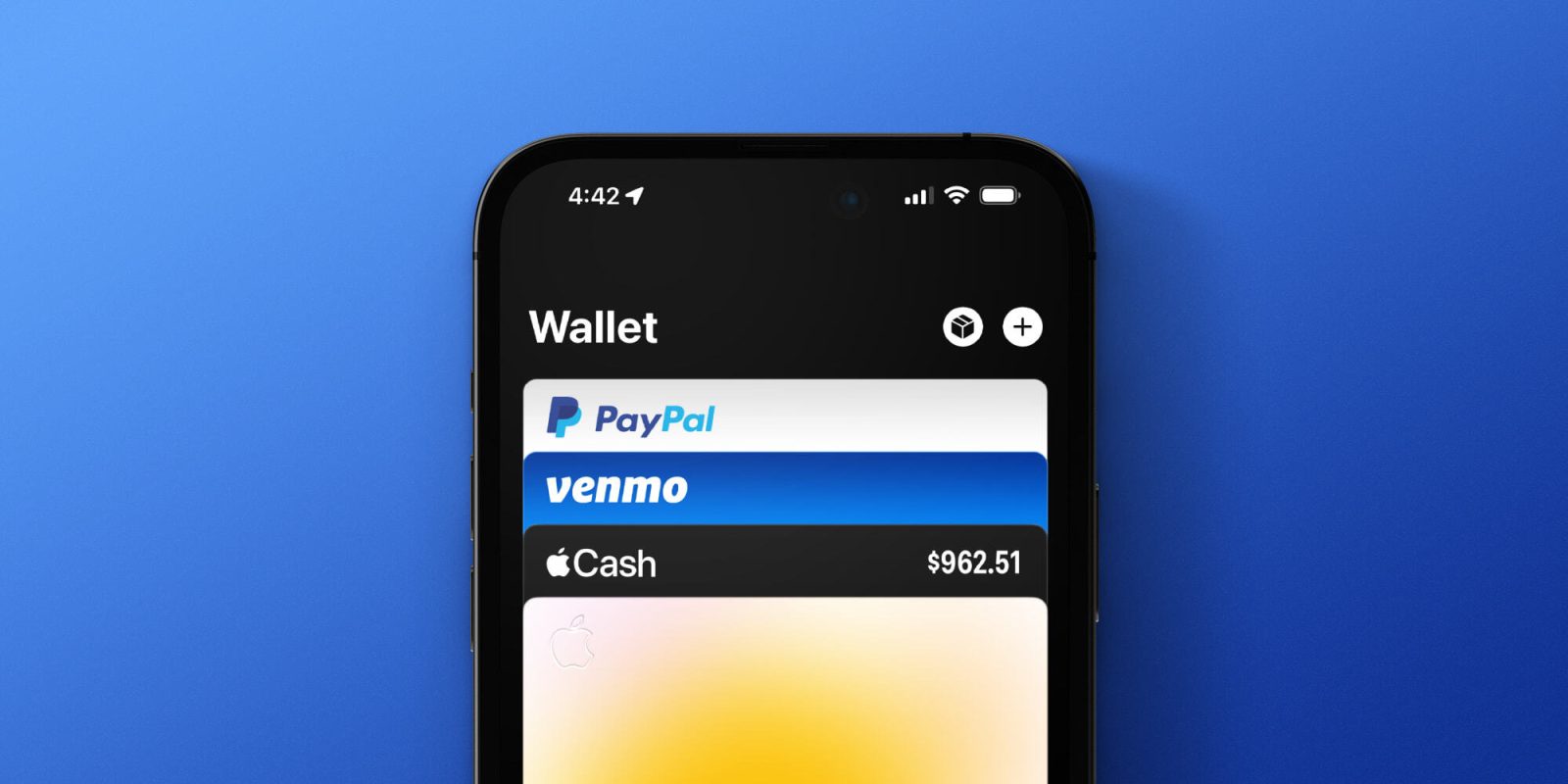

- Next year, US customers will be able to add PayPal and Venmo network-branded credit and debit cards to Apple Wallet and use them anywhere Apple Pay is accepted.

Tap to Pay on iPhone is a new feature launched by Apple earlier this year, currently available in Apple Stores and via Square’s merchant app. Tap to Pay on iPhone works by the merchant prompting the customer to hold their iPhone or Apple Watch near the merchant’s iPhone to pay with Apple Pay, a contactless credit or debit card, or another digital wallet. The payment is then securely completed using NFC technology.

Meanwhile, PayPal’s announcement today also means that you’ll see Apple Pay as a payment option at select online stores that use the company’s unbranded checkout flows. This will increase the availability of Apple pay for purchases on the web, but it sounds like the implementation will be somewhat limited.

Finally, PayPal also says that consumers will be able to add their PayPal and Venmo-branded debit and credit cards to Apple Wallet and Apple Pay next year.

FTC: We use income earning auto affiliate links. More.

Comments