Back in January, we learned that Apple Card has been responsible for more than a billion dollars in losses for Goldman Sachs in recent years. Now amid rumors that Apple is looking to leave Goldman for Amex, the former has reported its Q2 earnings and the results aren’t pretty.

The exact amount of losses Goldman Sachs has seen with its Apple partnership isn’t quite clear, but since 2020 it’s somewhere in the ballpark of $1-3 billion.

Earlier this year we learned those consumer banking losses have come mostly from Apple Card and a Goldman acquisition called GreenSky.

As for why Goldman is seeing such a tough time with its nascent consumer banking offerings, the company says the primary cause is loan-loss provisions which are when a bank has to compensate for greater than expected unpaid credit card balances and loans.

More than another half billion loss

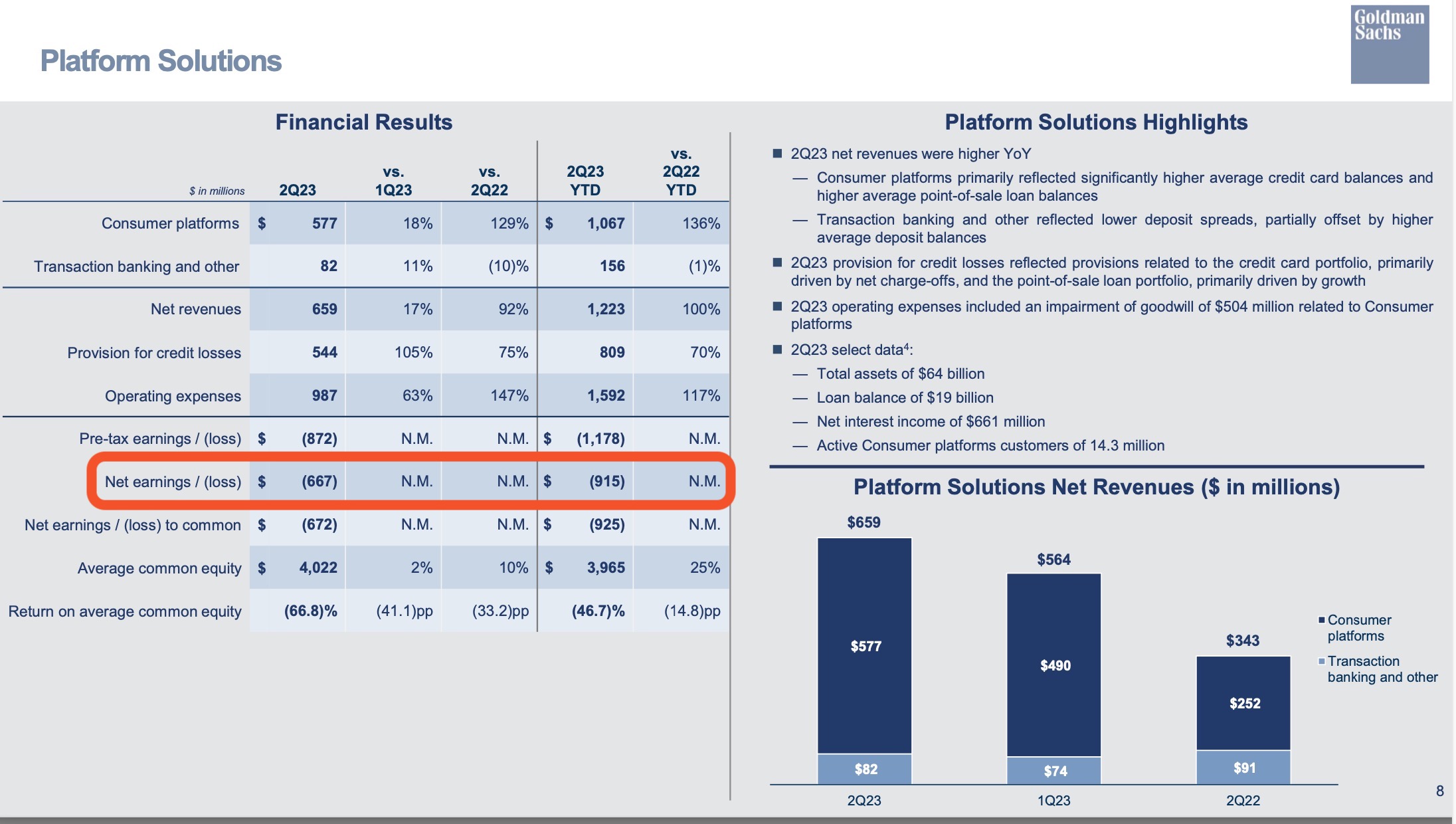

Now Goldman has shared its Q2 2023 earnings and the results show continued trouble for Apple Card and Goldman’s other consumer products.

“Platform Solutions” is the name of the division that includes Apple Card, several General Motors credit cards, and Goldman’s other consumer banking services.

In the June quarter alone, the bank saw a net loss of $667 million ($872 million pre-tax loss). While the division saw an increase in revenue, the provision for credit losses was very high.

Quickly eating away all of the $659 million in quarterly revenue and more, Goldman had $544 million in credit losses and $987 million for operating expenses.

We don’t know how much of the losses were from Apple Card, but it’s likely a good chunk. And put together Goldman’s Q1 $248 million loss for this division with its Q2 results and it’s already $915 million in the red for 2023.

Goldman CEO’s thoughts

At the end of June, Goldman Sachs CEO David Solomon admitted in an interview with CNBC that “we did not execute well” regarding its consumer banking offerings.

There are a number of interesting factors as to why the banking giant hasn’t been able to compete in the consumer market, but a couple include not having staff with decades of experience in consumer services and underestimating the competition in the space.

Top comment by Inkling

And as for Apple Card expanding beyond the US. A new bank partner could be just what it needs to launch the product in new countries.

Yes, Apple could sign up banks around the world so they too lose billions. What I can't understood is why they would want to do that.

Check out CNBC’s full 10-minute video on why Goldman’s consumer efforts have failed.

Future of Apple Card

With Goldman’s consumer banking losses almost at a billion for the first half of 2023 alone, it would probably like to get out of its Apple Card partnership as much or more than Apple.

We’ll have to wait and see if Amex is interested and able to become Apple’s new partner but one thing is for sure, Goldman’s plan to break even with its consumer banking division by 2025 is looking unlikely, to say the least.

And as for Apple Card expanding beyond the US. A new bank partner could be just what it needs to launch the product in new countries.

FTC: We use income earning auto affiliate links. More.

Comments