Apple today announced that its high-interest savings account for Apple Card has topped over $10 billion in deposits. Early indicators suggested that the savings account was a hit, and today Apple has given us firm official numbers to back that up.

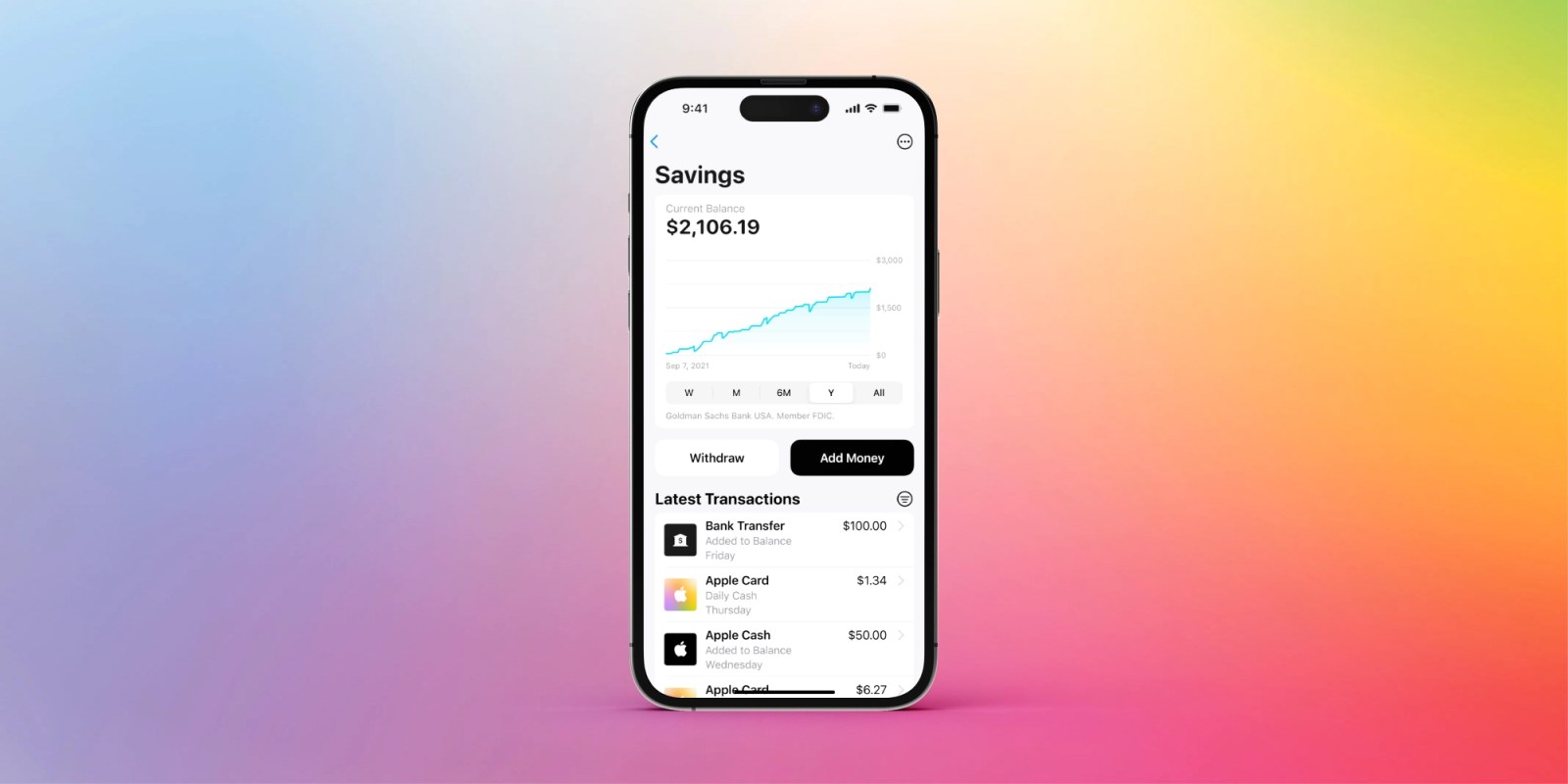

The savings account launched in April, available to all Apple Card customers in the United States, in partnership with Goldman Sachs. The account offers a highly-competitive 4.15% interest rate.

Apple Card launched in 2019 as a way to offer a simple, financially responsible, and private, credit card. Unlike most other credit cards on the market, Apple Card has no membership fees, late fees, or other hidden costs associated with using the account. As long as you pay off your balance each month, you can use the card for free.

The Apple Wallet UI encourages paying off balances in a healthy fashion, and makes the payment calendar clear so users aren’t surprised about upcoming interest charges.

Apple Card pays 1% cashback on purchases made using the physical card, 2% cashback on purchases made using Apple Pay, and 3% cashback on purchases made at select retailers including spending at the Apple Store and on Apple services.

These Daily Cash rewards can automatically be sent to the Savings account to accrue and grow further; Apple says 97% of its users have opted to do this. Customers can additionally move money from other bank accounts into their Savings account. This is where the headline figure comes from. Combined, the total amount held in Apple Card Savings accounts has topped $10 billion.

In the last couple of weeks, some publications have reported that Goldman Sachs is looking to exit the Apple Card arrangement, as part of a strategic shift away from consumer finance.

But at least for now, the Apple and Goldman Sachs partnership remains intact. In a statement, Goldman Sachs said they are very pleased with the response to Apple Card Savings.

“We are very pleased with the success of the Savings account as we continue to deliver seamless, valuable products to Apple Card customers, with a shared focus on creating a best-in-class customer experience that helps consumers lead healthier financial lives,” said Liz Martin, Goldman Sachs’s head of Enterprise Partnerships.

Alongside Savings, the Apple Card product team also launched Apple Pay Later earlier this year, a feature that allows customers to spread a purchase over four separate payments. This feature is currently in pre-release testing with a select group of Apple Card customers, and will roll out more widely in the coming months.

FTC: We use income earning auto affiliate links. More.

Comments