We’ve written a lot about Copilot, the best budgeting app for iPhone and Mac. This week, however, the app has gotten even better. With iOS 17.4, there is now direct integration with Apple Card, Apple Cash, and Apple Card. Read on to learn how it works.

Plus, 9to5Mac readers can use code 9TO5MAC and unlock an extended two-month free trial.

Apple Card, Cash, and Savings in Copilot

iOS 17.4, which is now available to everyone, adds a new FinanceKit feature that makes it incredibly easy to link your account to Copilot. Here’s how it works:

- On your iPhone, open Copilot and go to the “Accounts” tab.

- Choose the “Add” button to “Link an institution” and tap on the “Credit Cards, Checking, and Savings” option.

- Tap the Apple logo and go through the process of linking your accounts.

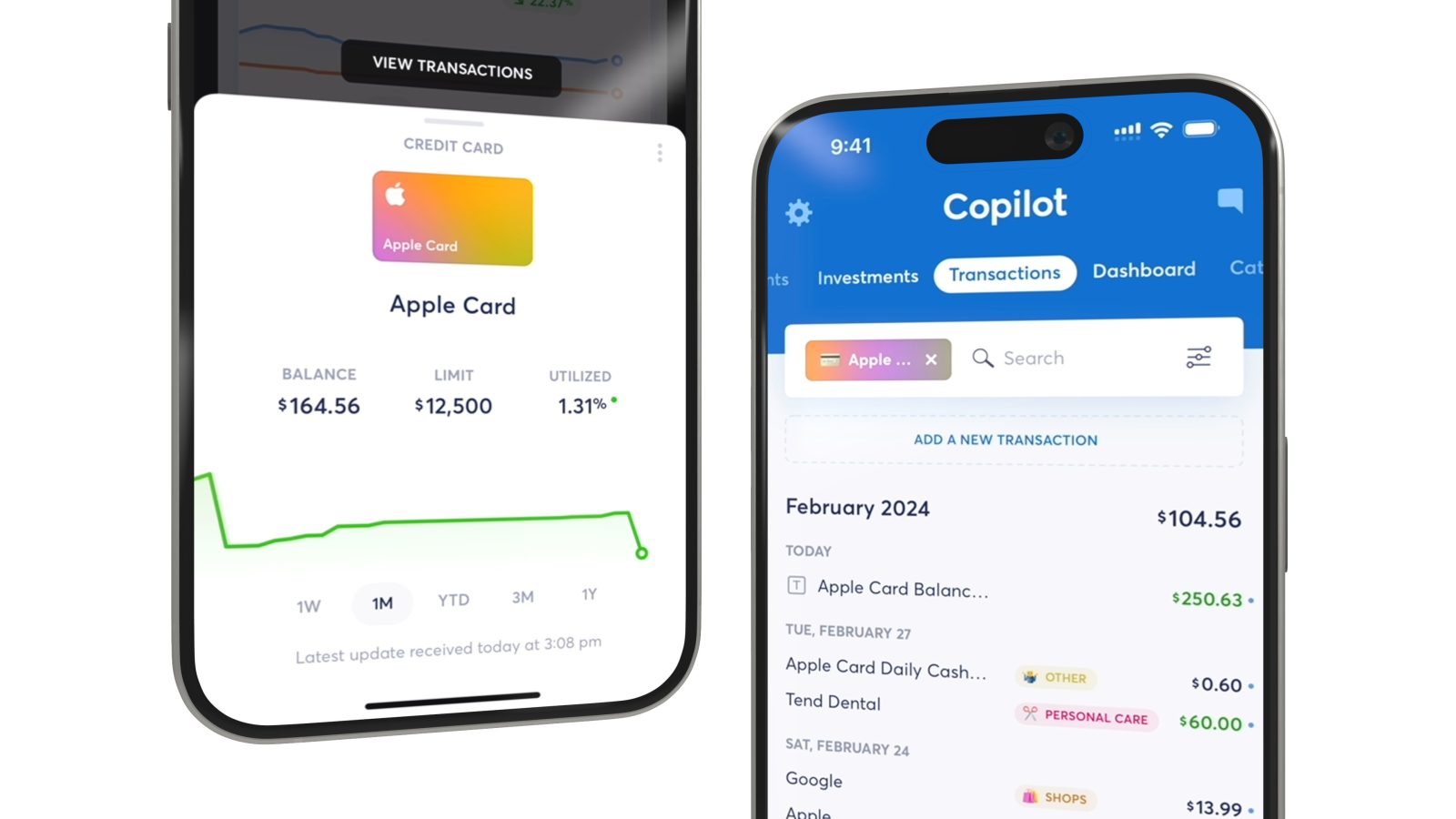

Copilot gives you the option to link all three of Apple’s financial accounts: Apple Card, Apple Cash, and Apple Card Savings Account. You can also choose to share activity over a limited data range or share all data since your account was open.

Once you’ve linked your accounts, you’ll be able to see real-time data from your Apple financial accounts right in Copilot. You can see Apple Card transactions in real-time, monitor your balance, track your savings progress, and more.

In January, I detailed how I use Copilot on iPhone and Mac to live a healthier financial life. This week’s addition of support for Apple Card, Cash, and Savings truly takes things to the next level. I use my Apple Card for all of my Apple purchases, including new hardware and subscriptions. Having this information available in real-time via Copilot is just another way the app makes budgeting as painless as possible.

It also says a lot about Copilot’s focus and attention that they had Apple Card integration ready to go on the same day Apple released iOS 17.4.

Finally, if you already had a manual Apple finance account setup in your Copilot app, the app will present you with the option to seamlessly merge those accounts to maintain your preferences and history.

Privacy

Like always, privacy is at the forefront of this integration as well. Face ID is required during the process of linking your Apple accounts to Copilot. Copilot does not (and never will) sell or share any of your personal information. None of your data ever leaves Copilot’s system, and the app’s infrastructure is built on the same platform used by leading financial companies worldwide.

The company has an in-depth breakdown of its privacy practices on its website with more details.

Still looking for a Mint alternative?

Mint, one of the oldest budgeting platforms, is officially shutting down later this month. The good news, however, is that Copilot recently launched an all-new Mint Importer feature that allows new and existing users to import their historic Mint transactions into Copilot.

This feature, available in Copilot on Mac and iPhone, brings in your transactions from Mint, alongside spending categories and transaction notes.

If you’re still looking for a Mint replacement, Copilot is the way to go – especially now that it has Apple Card, Cash, and Savings integration. The app is feature-rich, it’s native to Apple platforms, it’s far more privacy-friendly, and it’s actively developed with a detailed roadmap of new features to come.

A special offer for 9to5Mac readers

9to5Mac readers can use code 9TO5MAC and unlock an extended two-month free trial of Copilot. The app is available on iPhone and Mac, and a universal subscription unlocks both platforms.

More on Copilot:

- Copilot is the best and smartest budgeting app for iPhone users: Here’s why

- How I use Copilot for iPhone and Mac to live a healthier financial life

FTC: We use income earning auto affiliate links. More.

Comments