Over the last two years, I have become obsessed with the miles and points credit card game. I am always looking for the best way to get the most value out of all the signup bonuses and points I receive through spending with my credit card. I have recently been trying to find ways to leverage these points to, perhaps, get Apple products like an iPhone or iPad. I think I finally figured it out!

Before we start, I want to make a quick disclaimer: I do not advocate getting into credit card debt. The only true way to get value through points is to ALWAYS pay your credit card off in full every month. If not, then all of this is not worth it. So treat your credit card like a debit card and pay it off completely every month. Now, let me show you how to maximize points for Apple products!

How could your MacBook purchase unlock a free iPhone?

Getting a free iPhone by purchasing a MacBook might seem too good to be true, and in most situations like this, it is. However, in addition to your hard-earned money, there’s another type of currency that can be used to score a free iPhone—I’m talking about credit card points.

And more specifically? Chase Ultimate Rewards points.

One of my most recommended credit cards on the market is the Chase Sapphire Preferred Card. It currently has a limited-time offer of 75,000 bonus points after you spend $4,000 in the first three months of opening your account. Normally, this signup bonus is 60,000 points, which can also be enough for free Apple hardware. These signup bonuses are put in place to encourage new customers to actually use their cards and also reward customers for using them. When someone has a large purchase coming up, like a wedding deposit, a new couch, or even a MacBook, I tell them to apply for a card like this so they can instantly meet that minimum spend and receive the signup bonus!

The last time I checked, if you are in the market for a loaded MacBook Pro, it could easily cost over $4000. So, if you applied for the Sapphire Preferred card and then used it to buy the new MacBook, you instantly meet that minimum spend. New computer acquired. And over 75,000 points deposited into your account.

I say over 75,000 points because you’ll also earn points for the money you actually spend in addition to the bonus points that are part of the card’s welcome offer. And with those extra points, you’ll likely have close to 79,000 – 80,000 Chase Ultimate Rewards sitting in your account, so… now what?

Redeeming points for an iPhone or iPad

When you get the Chase Sapphire Preferred Card, you’ll also get a Chase Ultimate Rewards account. This allows you two different ways to use your points for Apple products.

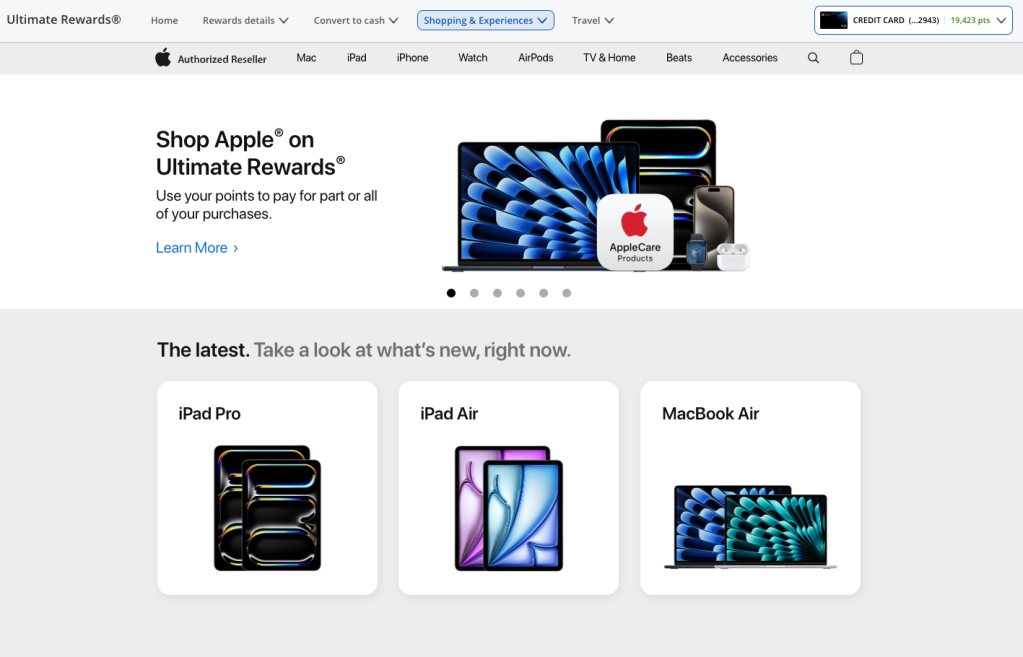

Method 1: Redeem points through the Apple partner portal

Apple and Chase have been partners for years. This means Apple has its own Apple store inside the Chase ultimate reward portal. The store is identical to Apple’s website, but the perk here is that you can purchase a product using Chase points or a combination of points and money.

Here’s how:

- Login to your Chase Ultimate reward portal

- Click on Shopping & Experiences

- Click on Shop Apple

- Select Product

- Checkout using points

So those 79,000 points you earned from buying your MacBook can be used to buy $790 worth of Apple products!

One more consideration

Usually, once a year, Chase will offer a boost on Apple product redemptions through their portal—sometimes, these bonuses are as high as 50%! So, instead of those 79,000 points being worth $790 of Apple products, it is now worth $1,185! This can be an excellent way to get even more value out of your Chase Ultimate Rewards if you’ve got an Apple purchase in mind. Keep your eyes peeled for the next time this offer drops.

Method 2: Cashback

Another perk of the Chase Ultimate reward system is that you can convert your points into cash. Every 100 points is $1, meaning those 79,000 points are actually $790 in cash that can be added right to your checking account.

Here’s how you can do that.

1. Login to your online Chase Ultimate Rewards account

From your rewards homepage, you should see a tab labeled Convert to cash, then Cash back. Select the Cash back option.

2. Figure out how many points you want to redeem for cash back

Remember, you can redeem your points for cash back at a value of 1 cent per point. Fortunately, no minimum redemption is required!

3. Choose between receiving a statement credit or an account deposit

As I said earlier, you can either redeem it for actual cash that can be used later or you can just purchase the product on your card and redeem the points for a statement credit! You should see these credits post to your account within three business days. When they do, your total balance will be reduced based on how many points you choose to redeem for cash back!

With an unlocked iPhone costing around $799, it’s almost like those 79,000 points were earned for this.

Top comment by LeonardoM

I have the feeling that these kind of systems are for the brain the same as gambling.

Better leave all these points and mileage or whatever. Life is too precious to be spent this way.

It really is as easy as that.

Final take

I have been a Chase Ultimate Rewards customer for years. As I said, I usually gravitate towards using points for travel. But sometimes, use cases like these are too good to pass up. So, if you have a big purchase lined up, like a MacBook or a Vision Pro, why not sign up for the Chase Sapphire Preferred and score a free iPhone or iPad or even just pay yourself $790 back to offset the cost of this large purchase?

Let me know what you think! Are you a credit card points user? What are some redemptions you have made? Would you consider trying this? Let’s discuss in the comments below. Also let me know if you like this type of post, I have so many more tips like this!

This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

FTC: We use income earning auto affiliate links. More.

Comments