Managing partner at Short Hills Capital, Steve Weiss, shared in an interview on CNBC that despite being a critic of Apple and Tim Cook in the past, he’s repurchased AAPL and that it’s “one of the bigger positions” for the investment firm. Two of the reasons Weiss is bullish on Apple is he likes that Tim Cook has the ear of President Trump and the company’s more aggressive approach.

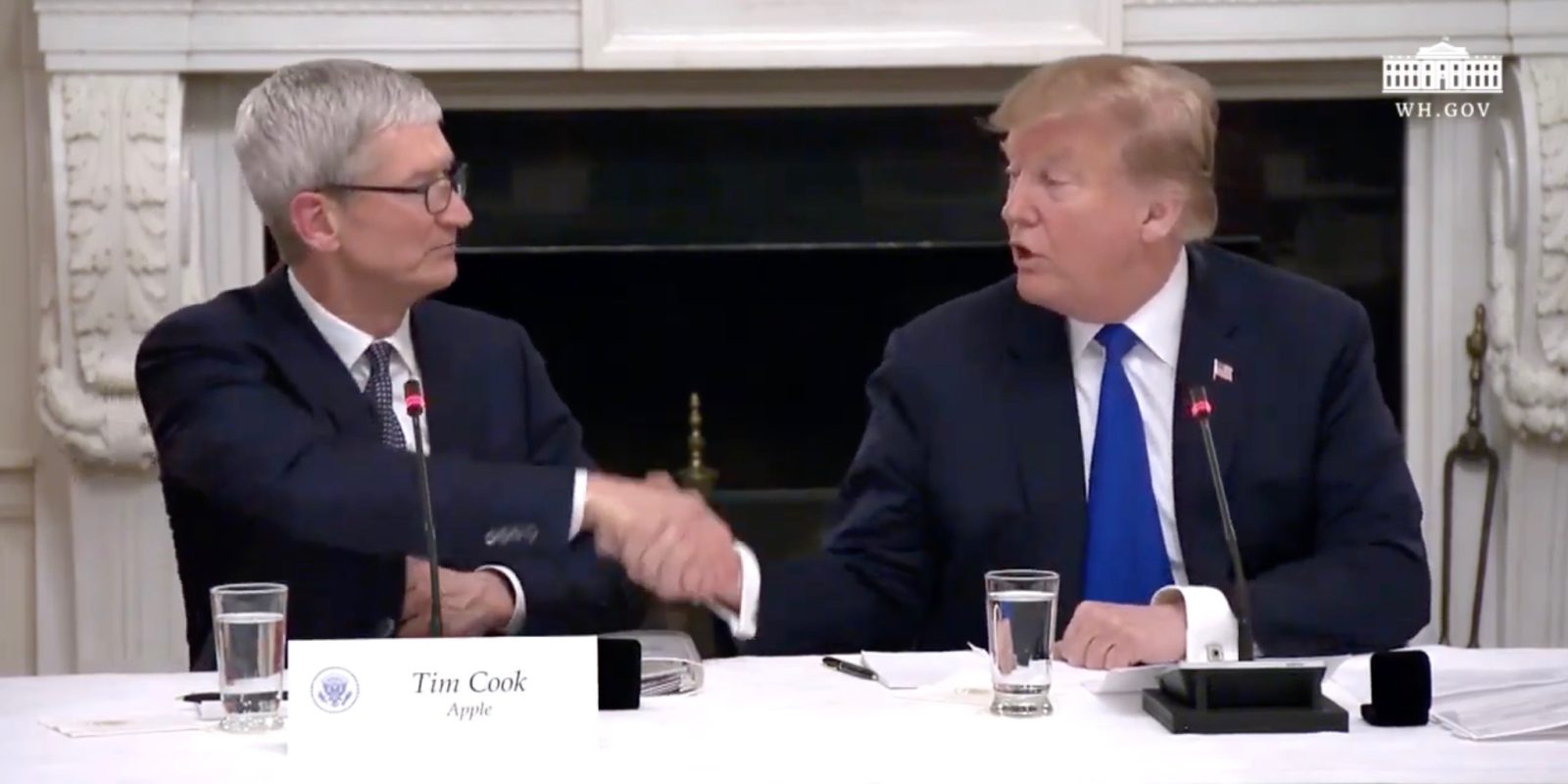

Steve Weiss told CNBC that the first reason he bought back into AAPL was that Tim Cook is unique in being able to have Trump’s ear while also recently moving back some production (Mac Pro) to China. Cook having influence with the President is a reference to the two recently meeting about tariffs and Trump saying “I thought he made a very compelling argument.” While a new round of tariffs due to begin in September was set to hit all Apple products, they have been delayed until December for some products including iPhones and other electronics.

Another reason Weiss invested again in AAPL is that he likes the more aggressive business approach they’ve taken on recently. Previously, one of his criticisms was that Apple relies on its brand power too much as it launches new products. He sees the purchase of Intel’s modem business as a strong and positive move. Weiss believes 5G coming to iPhone in the future will spur a big upgrade cycle in the future.

Further, he sees Apple as a steady investment as it has historically has outperformed the indices and down markets. Notably, AAPL crossed its 2019 closing high during trading today reaching up to $213.02 per share.

Check out the full interview clip below:

Apple shares surging in the past two weeks…prompting @stephenLweiss to "significantly" increase his $AAPL position today. His bull case on the stock 👇 pic.twitter.com/D1yO9G6Rlh

— CNBC Halftime Report (@HalftimeReport) August 20, 2019

FTC: We use income earning auto affiliate links. More.

Comments