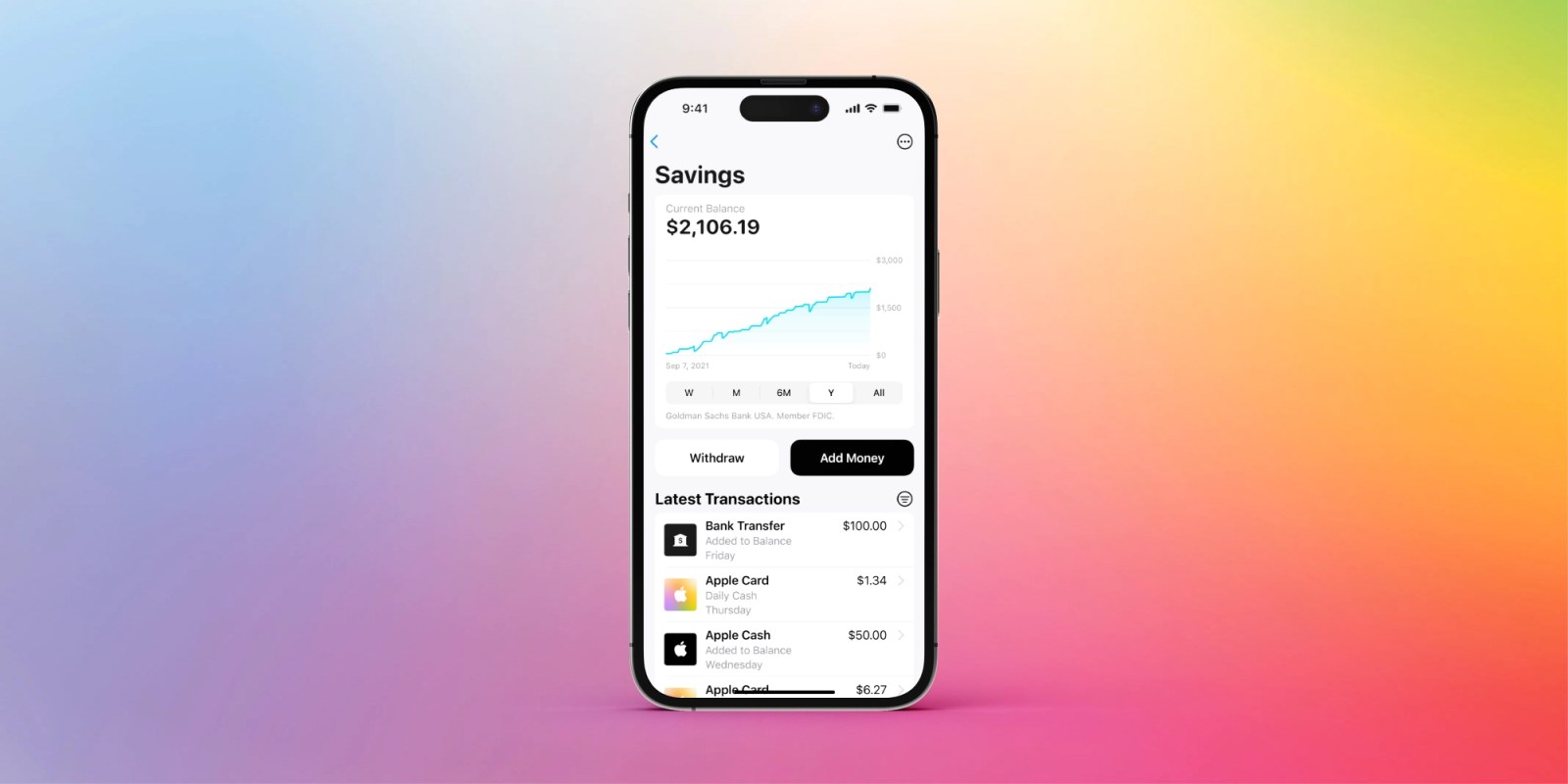

Apple’s first savings product launched last year in the US for Apple Card customers and with 2023 wrapped up, Apple is preparing to send 1099-INT tax forms. Here’s when they’re coming and who should expect one.

Apple Card Savings Accounts started in April 2023 with a 4.15% annual rate. And at the end of December that got bumped to 4.25%.

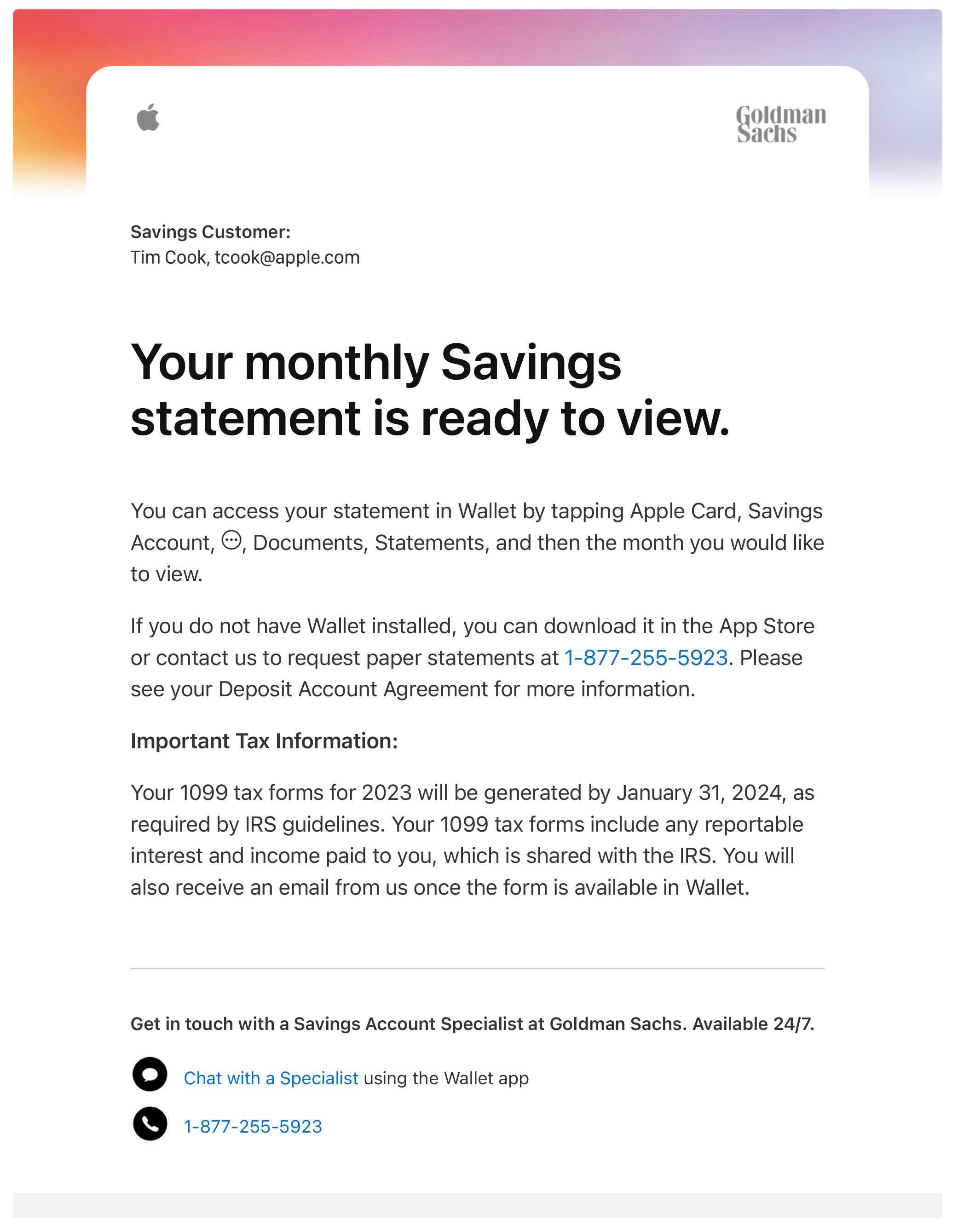

Apple recently started emailing customers letting them know 1099-INT tax forms will arrive by January 31 so they can report the interest when filing taxes:

Your 1099 tax forms for 2023 will be generated by January 31, 2024, as required by IRS guidelines. Your 1099 tax forms include any reportable interest and income paid to you, which is shared with the IRS. You will also receive an email from us once the form is available in Wallet.

Who gets a 1099-INT?

- If you’ve earned more than $10 of interest in 2023 with your Apple Card Savings Account, you’ll get a 1099-INT that the IRS requires you to report on your taxes

- As mentioned above, the tax form will show up in the Wallet app and you’ll get an email when it is ready

- If you somehow don’t have the Wallet app and don’t want it, you can call 1-877-255-5923 to get a paper document

What about Apple Card Daily Cash?

- The IRS considers cash back credit card rewards a rebate – not taxable income, so you won’t see this on your 1099-INT or get a separate one from Apple

Here’s the full email Apple is sending to Apple Card Savings Account customers:

FTC: We use income earning auto affiliate links. More.

Comments