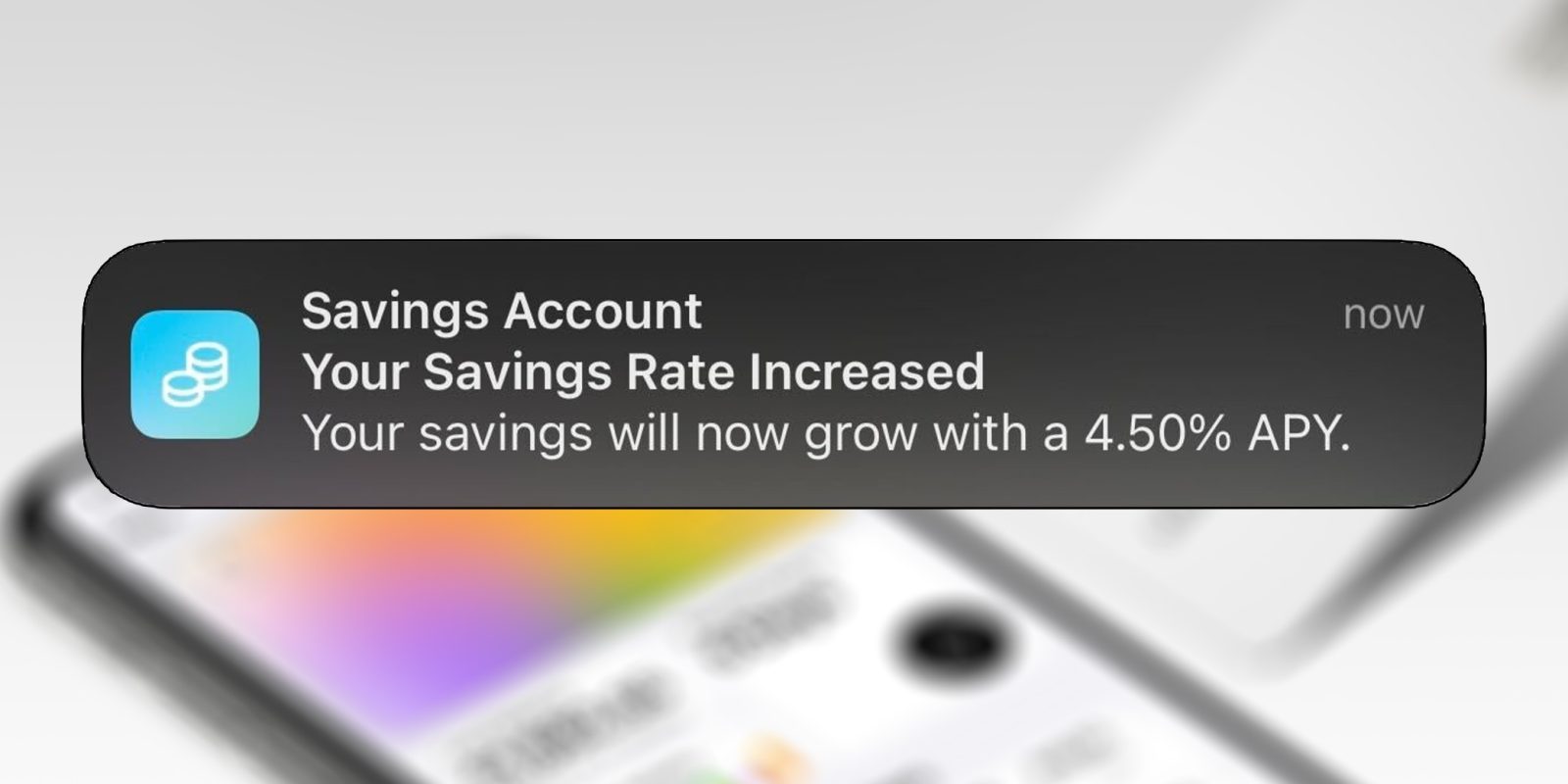

The Apple Card savings account continues to increase its interest rate, making it ever more appealing to customers. On Friday, Apple notified Apple Card users that their money in the savings account are now accruing interest at 4.5%, the second increase in the same month.

The savings rate has gone from 4.25% in December to 4.35% earlier in January, to now 4.5%. For an account with no associated fees, these rises makes the account significantly more competitive with the wider market of high-yield savings accounts.

With a $1000 balance, a 4.5% interest means your money will grow to $1045 after a year of being held in the account.

Since launching savings, Apple has only increased the savings rate. This of course is not guaranteed to continue. The interest rate will rise or fall depending on the actions of the Federal Reserve and the state of the wider economy. Apple Card savings account users are free to move their money elsewhere, at any time.

Like all Apple Card offerings, the savings account is only available in the United States.

Behind the scenes, Apple partners with Goldman Sachs as the participating bank for Apple Card and the savings account. However, Goldman Sachs is looking to exit its consumer finance businesses. Despite having a contractual agreement with Apple that runs through 2029, Apple is said to be proactive and is working on a solution to migrate away from Goldman Sachs within the next year or so.

Prospective Apple Card savings account customers should not worry about the drama of backroom dealings, though. Your money will be safe, regardless of what happens. For additional peace of mind, remember that the Federal Deposit Insurance Corporation ensures account holders for up to $250,000 per depositor.

FTC: We use income earning auto affiliate links. More.

Comments