A day ahead of the Cupertino company disclosing AAPL earnings Q3 2022, analysts are expecting to see an end to the company’s pandemic-fuelled growth.

As is the new normal, the company hasn’t issued any guidance for the fiscal quarter, given continuing supply disruption as China continues its COVID Zero policy …

Background

Apple earnings of late have been a battle between supply and demand. On the supply side, the Cupertino company has faced a whole array of disruption to product production due to COVID lockdowns. Demand, on the other hand, has increased due to a mix of greater spending on tech during the pandemic and a whole new generation of Apple Silicon Macs.

Demand has so far won out, with the company enjoying a series of record quarters. Back in April, for example, Apple reported revenue of $97.3 billion, an increase of 9% year over year. Chief financial officer Luca Maestri said then that the company saw revenue records in almost all product categories.

We are very pleased with our record business results for the March quarter, as we set an all-time revenue record for Services and March quarter revenue records for iPhone, Mac, and Wearables, Home and Accessories.

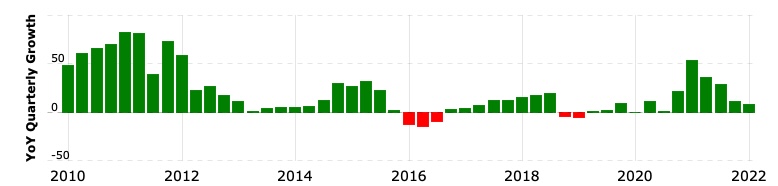

Apple has reported revenue growth in every one of the past dozen quarters, beginning with the second quarter of 2019.

AAPL earnings Q3 2022 will plateau – analysts

Yahoo Finance has its usual roundup of analyst expectations. The range of predicted revenue for fiscal Q3 is huge, from $79.26B at the low end to $88.41B at the high end.

The average across 26 analysts, however, is $82.81B – which would represent year-on-year growth of just 1%, which is essentially flat.

The site says that the strong dollar and loss of Russian sales are other factors at play.

Apple expects COVID-induced supply chain disruptions and industry-wide silicon shortages to hurt the top line by $4-$8 billion, much higher than what it witnessed in second-quarter fiscal 2022. Unfavorable forex is also expected to hurt revenues by 300 basis points (bps). The absence of Russian revenues will hurt the top line by 150 bps [1.5%].

A strong dollar means that Apple must either increase prices of products in other countries, or take a hit to its margin.

The fact that Apple openly discounted iPhones in China – a first for the company – just a couple of days before its earnings call suggests that it may be trying to generate some iPhone growth news to compensate for lack of same in the previous quarter.

Seeking Alpha notes that someone is betting big on Apple’s share price to fall after tomorrow’s earnings announcement, and the technicals do support this contention.

The stock has been trading as if all is well, and nothing can go wrong when the company reports results […]

A trader is betting that Apple will trade lower following results. On July 25, the open interest for the July 29, $140 puts rose by around 16,600 contracts [This] would imply that the stock will be trading below $139.55 by the expiration date at the end of this week. Given this trade’s short time frame, this is a reasonably large wager, with the trader paying around $800,000 in premiums to make the bearish bet […]

Apple’s technical chart does suggest the shares can fall after hitting technical resistance at $156.65. The RSI has been trending lower for some time, making a series of lower highs and lower lows. It would suggest that momentum is very bearish. If the stock should fall below support at $152, then there is a chance the stock could fall back to $139.60.

If AAPL earnings fall short of expectations, that could mean traders get nervous about the tech sector as a whole, driving the NASDAQ down.

Photo: Adam Nowakowski/Unsplash

FTC: We use income earning auto affiliate links. More.

Comments