AAPL investors need to see inside the company’s “$70 billion black box,” say analysts – a reference to Apple lumping together all its Services revenue into one figure, despite the fact that it effectively covers ten different businesses with the company.

The issue is vital to understanding the level of the threat posed to Apple by antitrust regulations in respect of the App Store, they say …

Apple’s more secretive finances

Apple used to be relatively open about its sources of income, including reporting individual sales figures for iPhone, iPad, and Mac.

That changed in 2018, when the company announced that it would cease to report sales numbers, and would instead reveal only the revenue stream for each product line. Given the range of retail prices for different models, that made it much harder to get a sense of how well particular product lines were selling.

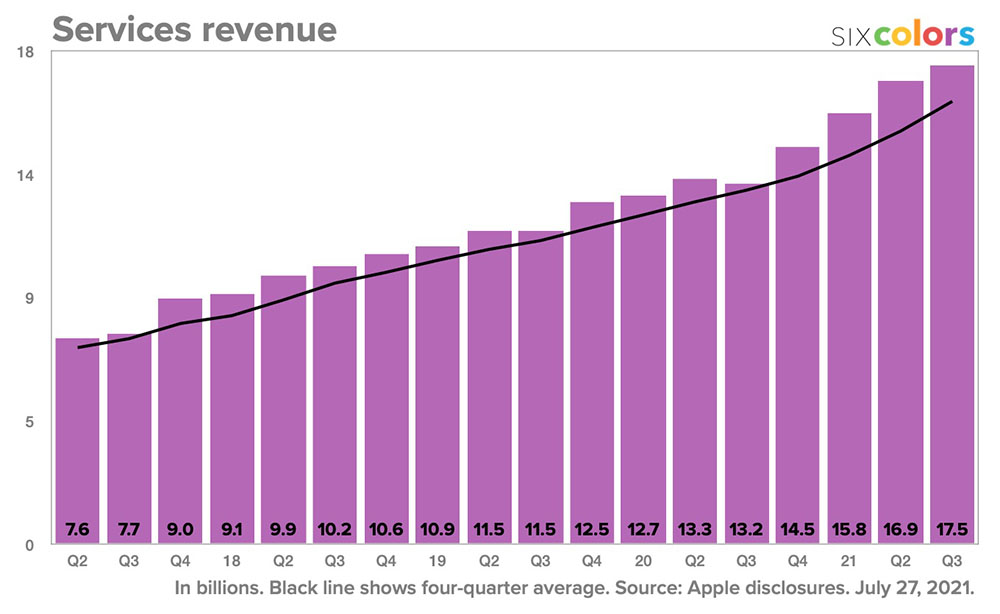

Apple reporting Services income as a single figure didn’t used to be much of an issue back in the days when we knew it was the App Store plus much smaller miscellaneous income for other things.

But things are very different today. Services is a huge element of the company’s earnings. The business is worth way more than Mac and iPad put together, and it’s getting close to the combined totals of Mac + iPad + AirPods + Apple Watch. Heck, as of the most recent numbers it’s almost half as big as iPhone revenue!

- iPhone: $40.67 billion

- Mac: $7.38 billion

- iPad: $7.22 billion

- Wearables: $8.08 billion

- Services: $19.60 billion

Service is also the only part of Apple’s business where revenue (almost) only moves in one direction – up.

AAPL investors need to see the App Store slice

Analysts say they need to see a breakdown of this revenue to properly understand the company’s future prospects. Bloomberg reports.

Consider the quarter ended in June [where] Services’ 12% growth rate was meaningfully slower than the 25% that the segment averaged over the previous four quarters […]

Apple conspicuously didn’t include the App Store as one of several businesses driving growth in services, as it has done for several years. Instead, Apple said services growth was “due primarily to higher net sales from advertising, cloud services and AppleCare.”

What’s going on? Could regulatory and legal pressures on App Store practices and fees be having an impact? We don’t know, and that’s the point […]

Arete Research analyst Richard Kramer, who has pointed out Apple’s steady reduction in disclosure, last March described services “as a $70 billion black box amalgamation of 10 different businesses.” That seems about right.

The App Store is the big unknown here; the consensus view is that it remains the biggest slice of Services revenue, and has a profit margin estimated at 80%. That means it contributes most of Apple’s Services profit. So if antitrust measures hurt that revenue, it’s a very big deal.

Apple faces massive antitrust pressures around the world, with the App Store the primary focus. In the US, for example, the Open App Markets Act – which is close to a vote – would require big changes to the App Store business model, including allowing third-party app stores. How much impact that would have on the company’s revenue and profit is something AAPL investors would very much like to know – and right now they don’t even know how much cash is at stake.

Photo: Milad Fakurian/Unsplash

FTC: We use income earning auto affiliate links. More.

Comments