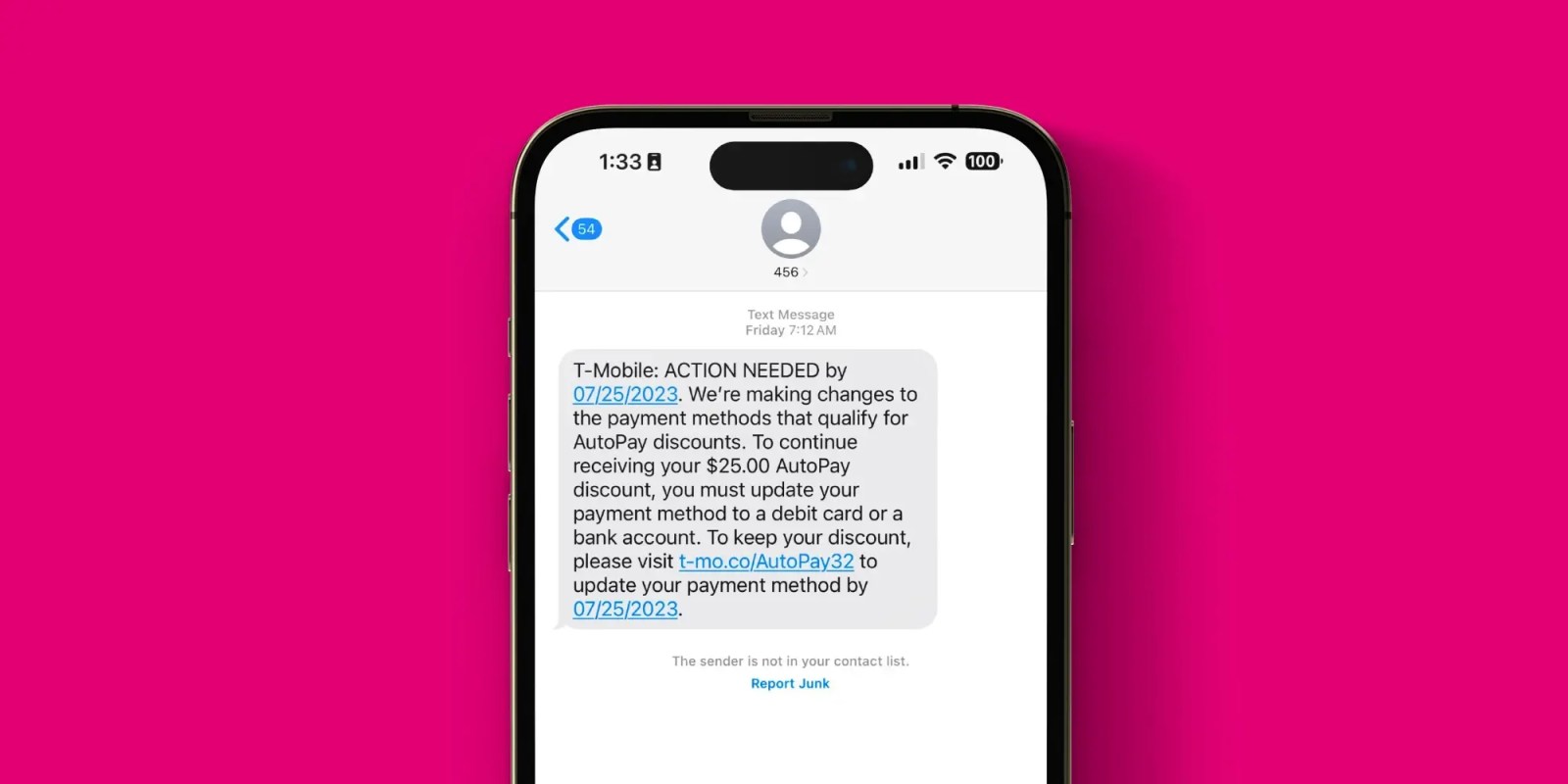

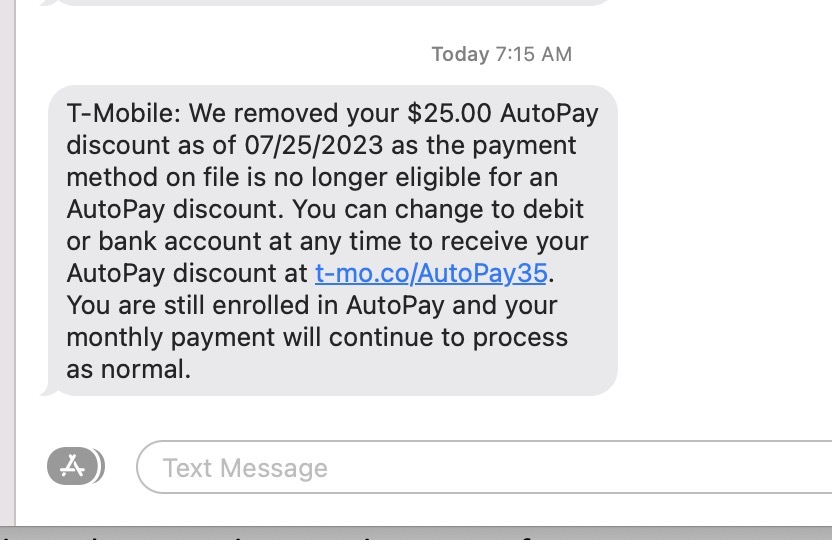

T-Mobile’s long-feared and unpopular change to AutoPay is officially starting to go into effect. With this change, T-Mobile will no longer accept credit cards, Apple Pay, or Google Pay for AutoPay. This means that if you want to secure the $5 per line discount for using AutoPay, you’ll have to update your payment method to use either a bank account transfer or a debit card.

This story is supported by Mosyle, the only Apple Unified Platform. Mosyle is the only solution that fully integrates five different applications on a single Apple-only platform, allowing businesses and schools to easily and automatically deploy, manage, and protect all their Apple devices. Over 38,000 organizations leverage Mosyle solutions to automate the deployment, management, and security of millions of Apple devices daily. Request a FREE account today and discover how you can put your Apple fleet on auto-pilot at a price point that is hard to believe.

This change has been in the works at T-Mobile for months and is finally going into effect on July 25. T-Mobile’s reasoning is: It pays higher processing fees on credit card transactions, so it saves a few bucks on each transaction by limiting AutoPay to debit and bank payments only. But that doesn’t mean T-Mobile users aren’t upset about the change, and rightfully so.

Many credit cards offer phone insurance at no extra charge, so long as users pay their phone bill every month with that credit card. Additionally, some credit card companies – like American Express – also offer a statement credit every month for cell phone bills.

The change is also a double-whammy for Apple Card users. When buying with Apple Pay, Apple Card customers can lock in 3% Daily Cash on their purchase. Now that T-Mobile is removing Apple Pay as an AutoPay option, however, that 3% kickback is also gone.

Another complaint many T-Mobile users have voiced is that they aren’t keen on giving their banking information or debit card information to a company that’s had more than its fair share of data breaches in recent years. Credit cards offer protection against unauthorized purchases, while Apple Pay keeps your card information entirely secure. That’s not the case for debit and bank transfer purchases.

Top comment by Josh Rocker

For a company with such a problematic history of data breeches, this seems like an unwise move. Maybe they should prove they can go a few years without a data breech and then ask for this kind of sensitive information.

One workaround (though this doesn’t address the security concerns) is to set your AutoPay details to a bank or debit account, as required. Then, manually use the T-Mobile app every month to pre-pay your bill before the scheduled AutoPay transfer. It’s not ideal, but it’s an option.

T-Mobile doesn’t seem keen on listening to this feedback, so you’ll have until July 25 to update your AutoPay information to be a debit card or bank account.

Thanks, Michael!

Follow Chance: Twitter, Instagram, and Mastodon

FTC: We use income earning auto affiliate links. More.

Comments