The Apple Card has been out since August 2019, meaning I have had this card for almost four years now. The Apple Card was one of the first credit cards that I was ever approved for. I remember really wanting it purely for the titanium and the cool Apple Wallet integration (which goes to show how much I knew about credit cards back then). But in those four years, I have used it in various settings for different categories and gotten some great value from it. But in 2023, the credit card scene has become extremely competitive, so how does the Apple Card hold up as a zero annual fee card compared to the competition? And is it still worth it to get?

Apple Card – the surface details

On the surface, as a zero-fee card, the Apple Card is sort of a middle-of-the-road card. It gives you some good value, but there might be other zero-fee cards out there that others would and should consider.

The specs:

- Zero-dollar annual fee

- $75 sign-up bonus (as of July 2023)

- No fees at all – hidden, late, foreign transaction, or anything

- 3% cashback on anything Apple related, including hardware, software, services, app store purchases, and even in-app purchases

- 2% cashback on any Apple Pay transaction including online retailers

- 1% cash back when you physically use the card on anything else

- Cashback is rewarded on a daily basis

- Access to new Apple Savings account with 4.15% APY (as of July 2023)

- Cool titanium card that makes a fun clank noise when you drop it

So as you can see it has some decent value for a zero-fee card. There are also some other merchants that have partnered with Apple like Nike, Panera, T-mobile, and others, that also give you that 3% cashback. So if you regularly buy at those stores, then that adds even more value.

There are other cards in this category like the Wells Fargo Active cash card that gives you 2% back on everything, or the Sofi Credit card that gives you 3% cash back on everything for the first year and then 2% after that (love this card). You then have Chase Freedom which gives you 1.5% cashback on everything with some 3% categories. So there are plenty of options in this zero-fee, cash back category for someone to decide on. So that begs the question, is the Apple Card worth it in 2023?

Why I think it is still worth it in 2023

I do want to mention that this is not financial advice, and I am just going off of my experience with the Apple card. I also like to mention that I usually prefer to use credit cards that earn miles and points for travel hacking. But as a cashback card, in the US, I think this card is still top tier.

As a big Apple user, I can use the card to not only get 3% cashback on hardware like iPads and Macbooks, but I also have the ability to finance the hardware with zero interest over 12 months. There is no other card on the market that does that for Apple. Apple products are pricey, so being able to get a $1000 MacBook Air and pay $80 a month for it is a big benefit for some.

2% cashback on Apple Pay

This category could be a bit deceiving because it’s 2% cashback, but only if you use Apple Pay. When this card first came out I didn’t think this was great because their adoption of Apple Pay wasn’t a lot. But as of this year, in the US, 85% of merchants take Apple Pay. Not only that, but if you are shopping online and you see the Apple Pay button, that also counts as 2% cashback. So this category is actually much more robust.

For instance, my grocery store, gas station, mall stores, and coffee shop all take Apple pay. It is very rare that I use a physical credit card nowadays.

Apple Wallet updates

Since the Apple Card is an Apple product, just like any of their products, it tends to improve over time with feature updates with each iOS iteration. Since the Apple Card has been out, we have seen some great improvements and added features for Apple Card Users.

Apple Savings

This new account is available to all Apple Card users and gives you 4.15% APY on your money. What is great about this is that you can have your cashback automatically deposited into this account, so your cashback earns even more money for you. There are other accounts that offer some higher APYs like Sofi’s 4.4% or Ally Bank has 4.3%, but the Apple integration is the selling point for most.

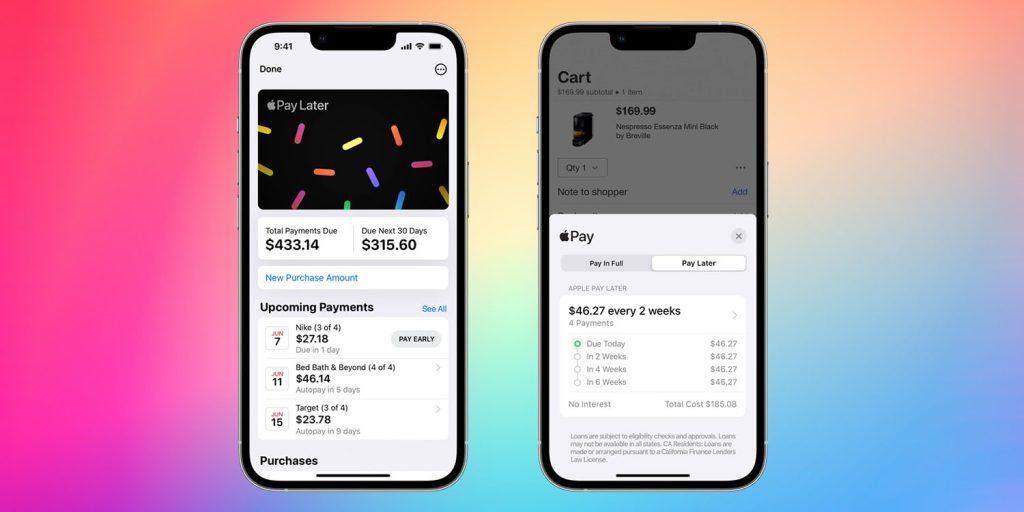

Buy Now, Pay Later

Apple is also rolling out its Buy Now, Pay Later feature. Now I am personally not a fan of these features because it encourages short-term debt, but for some, it can be needed and useful. It basically allows users to pay for a product that is between $50-$1000 in weekly increments. So if you want to buy a $400 desk, you can pay in four payments of $100 over six weeks. The UI is easy to use and it’s well-built, and if you pay on time there are no issues at all. But just be careful not to miss payments because interest and credit impact will occur!

Final thoughts

So again, as a cashback category card, I think the Apple Card is still a great choice. The 2% cashback on Apple Pay is a category that is forever growing and becoming more and more relevant. I would argue that in 2023 the Apple Card is now even more worth it because of Apple Pay adoption. The Wallet App will also continue to evolve and add features as time goes on. So if you are in the market for a cashback card, the Apple Card could be a good option for you!

What do you think about the Apple Card? Do you own one? Do you want one? If you have one, what do you use it for? Let’s discuss all things Apple Card in the comments below!

FTC: We use income earning auto affiliate links. More.

Comments