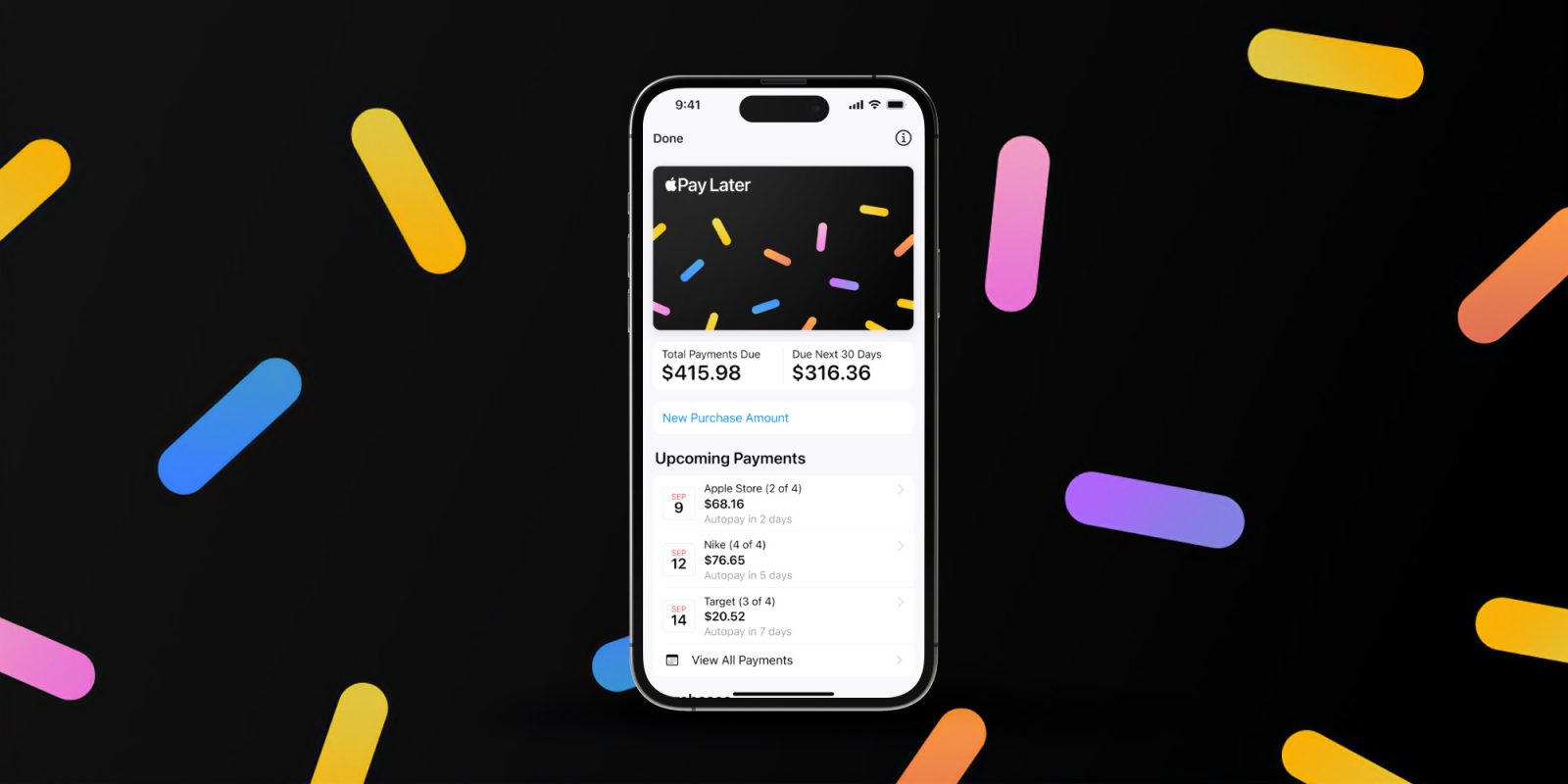

Apple Pay Later, the feature where you can spread an Apple Pay purchase across four equal installments with zero interest, is leading the way when it comes to consumer credit transparency.

Experian and Apple announced today they are working together to include Apple Pay Later pay-in-4 loans in a consumer credit report. Apple is the first major BNPL provider to provide loan and payment history directly to a credit reporting agency.

Apple Pay Later loans borrowed starting today will appear on Experian credit reports, beginning March 1. Apple Pay Later loan signals will not be used to compute the traditional credit score, but may in the future.

As other buy-now-pay-later providers work with Experian, lenders who request a credit report will be able to see a full history of a consumer’s loan history. This will help them make more accurate lending decisions.

In a statement, the vice president of Apple Pay Jennifer Bailey said this change helps improve transparency for both buyer and lender, and helps users improve their credit history:

“We designed Apple Pay Later with our users’ financial health in mind, and an important part of this is ensuring that their loans are reflected in their overall financial profiles,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “By reporting Apple Pay Later loans to Experian, we aim to help promote greater transparency and responsible lending for both the borrower and the lender, while providing users with the opportunity to further build their credit.”

Apple Pay Later is available to eligible Apple customers in the United States. You can choose to pay later directly inside the Apple Pay payment sheet. Using Apple Pay Later, the purchase is spread over four equal repayments with no interest, essentially giving a free six weeks window of credit lending.

FTC: We use income earning auto affiliate links. More.

Comments