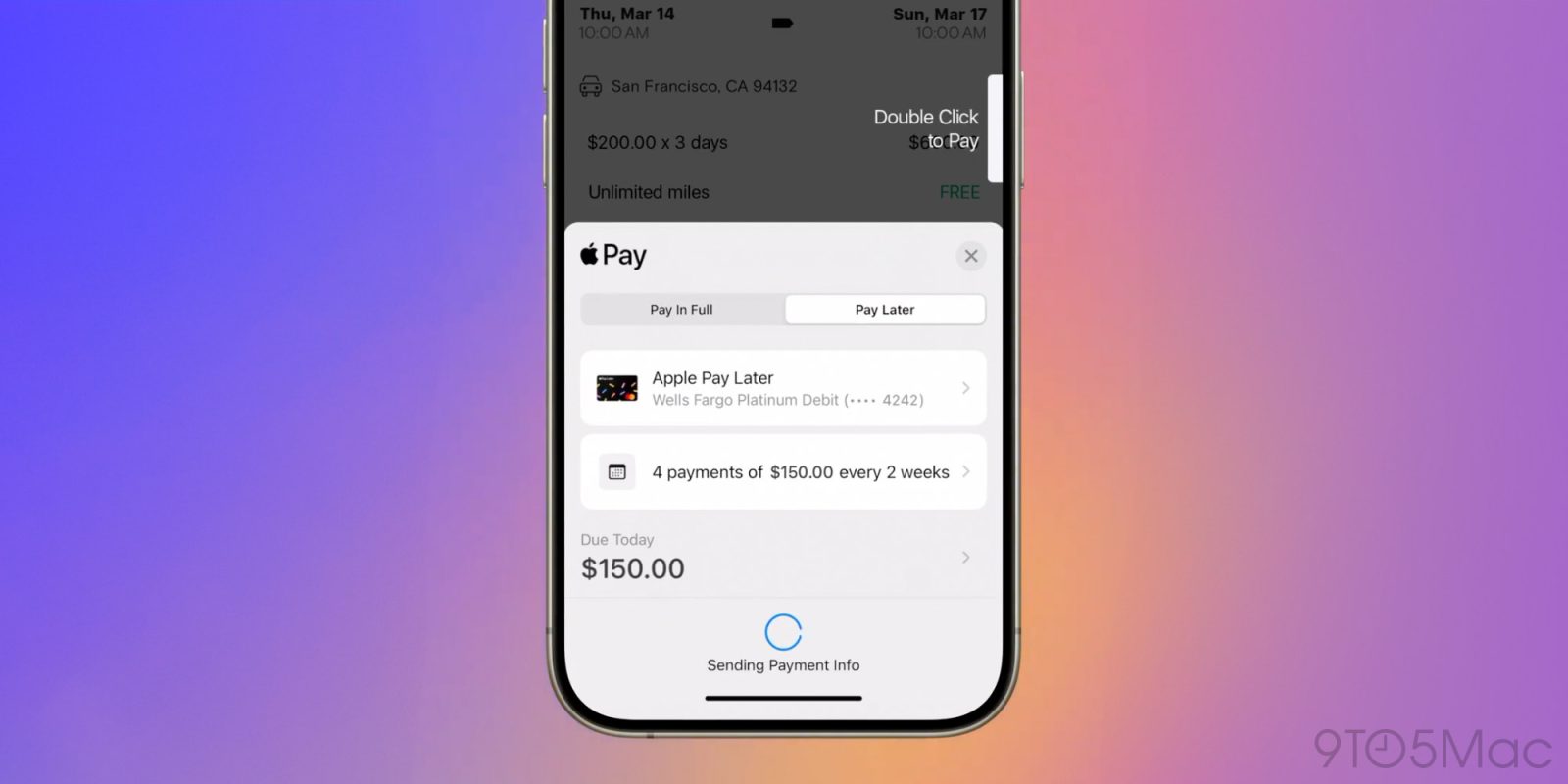

Apple Pay Later officially started rolling out a year ago. The feature gives users a way to easily split in-app and online Apple Pay purchases into four equal payments across six weeks, with no fees or interest.

While Apple Pay Later has broadly been available at a lot of retailers since last year, Stripe this week announced that Apple Pay Later is now enabled by default for all merchants who accept Apple Pay.

Stripe has supported Apple Pay Later for most merchants since last March, but the feature is officially rolling out to everyone this week. Most notably, the option is now turned on by default for all Stripe merchants who accept Apple Pay, the company explains.

This means that when you check out online or in-app with a merchant that uses Stripe for payment processing, Apple Pay Later will now be an option almost everywhere. Using the Apple Pay payment sheet, you can choose between paying in full and paying in installments. Apple Pay Later is an option for purchases ranging from $75 to $1,000 when using Stripe.

Stripe says:

Apple Pay Later is a buy now, pay later feature of Apple Pay that allows customers in the United States to split purchases into multiple equal installments across six weeks. Apple backs and manages payments, and businesses are paid the full amount in the same manner as with Apple Pay.

The Apple Pay Later process begins with a user applying for a loan, which can be done directly during the checkout flow or in the Wallet app at any time. This will have “no impact to their credit,” Apple says, but loan and payment history may be reported to credit bureaus. In fact, Apple and Experian officially launched their partnership this month to report Apple Pay Later on Experian credit reports.

Stripe has more details on the feature for merchants, including how to opt-out, on its website.

Follow Chance: Threads, Twitter, Instagram, and Mastodon.

FTC: We use income earning auto affiliate links. More.

Comments