More Apple Pay installment options, and PayPal balance will be visible in Apple Wallet

We speculated at the time that the decision to withdraw Apple Pay Later was probably driven by a desire to get ahead of upcoming legislation, and a piece today suggests that it’s actually a new interpretation of a very old law.

The Truth in Lending Act was passed in 1968, and grants consumers a number of protections when it comes to credit cards – and Apple Pay Later seemed set to fall within scope …

Expand Expanding Close

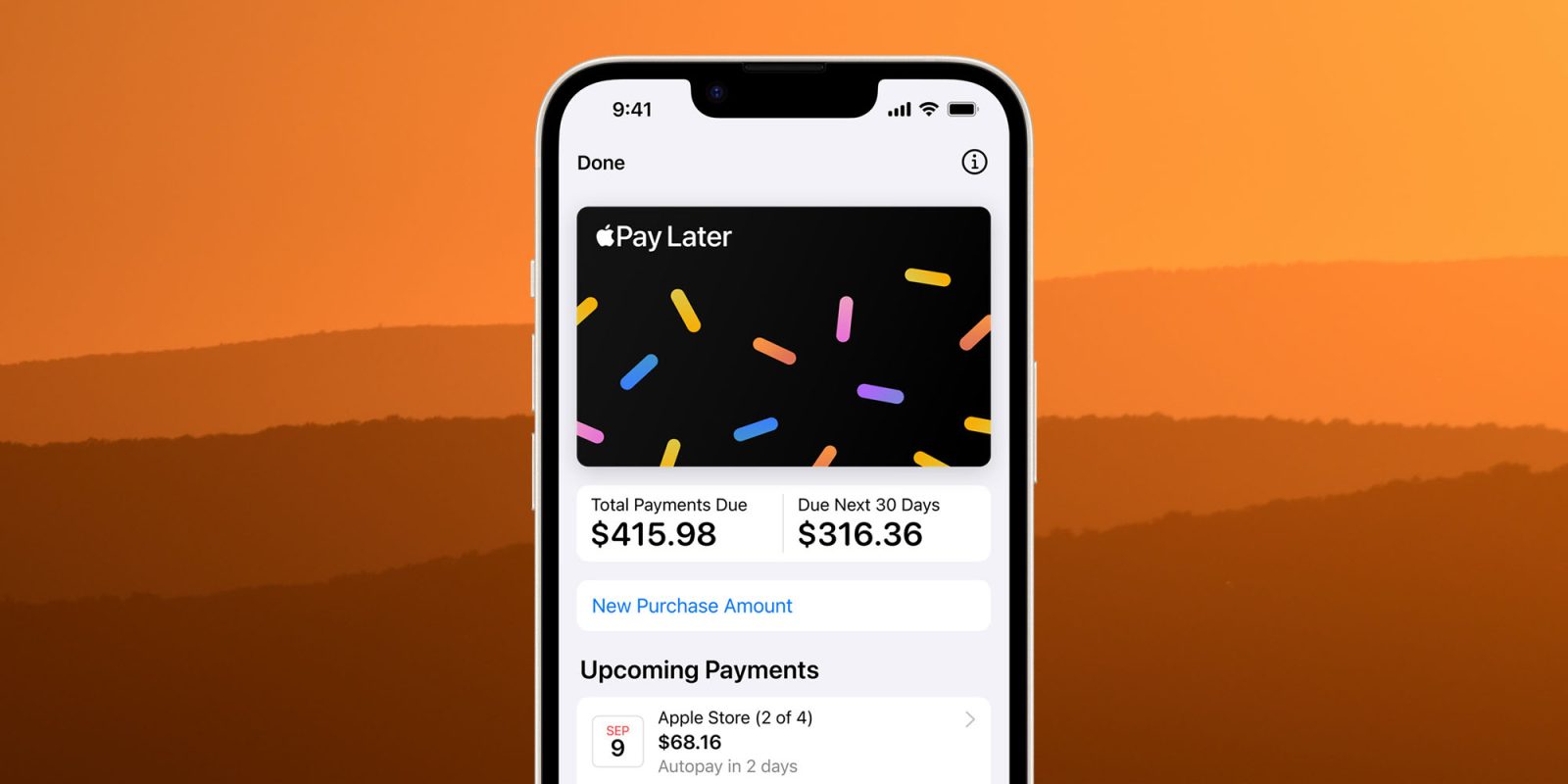

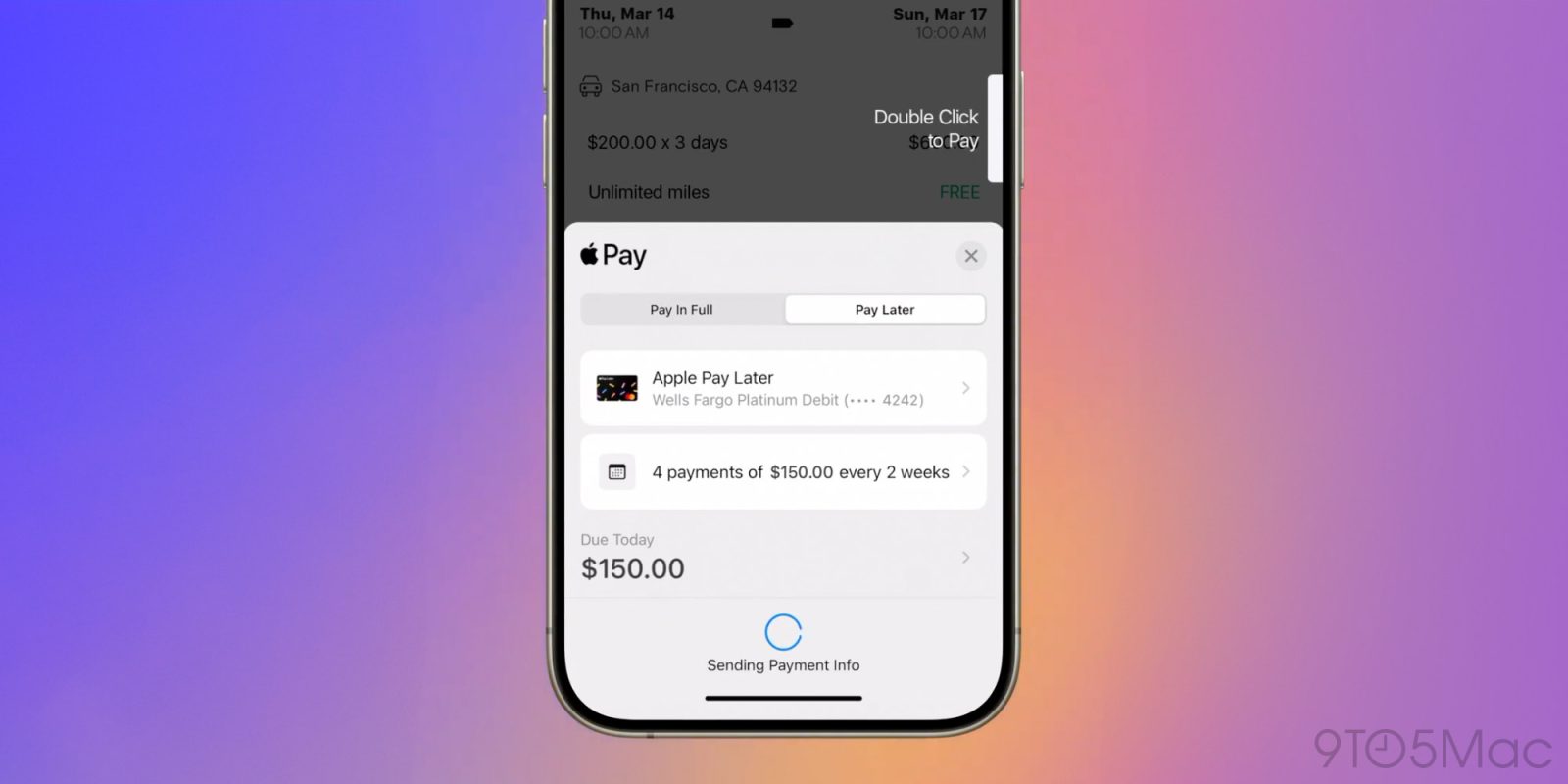

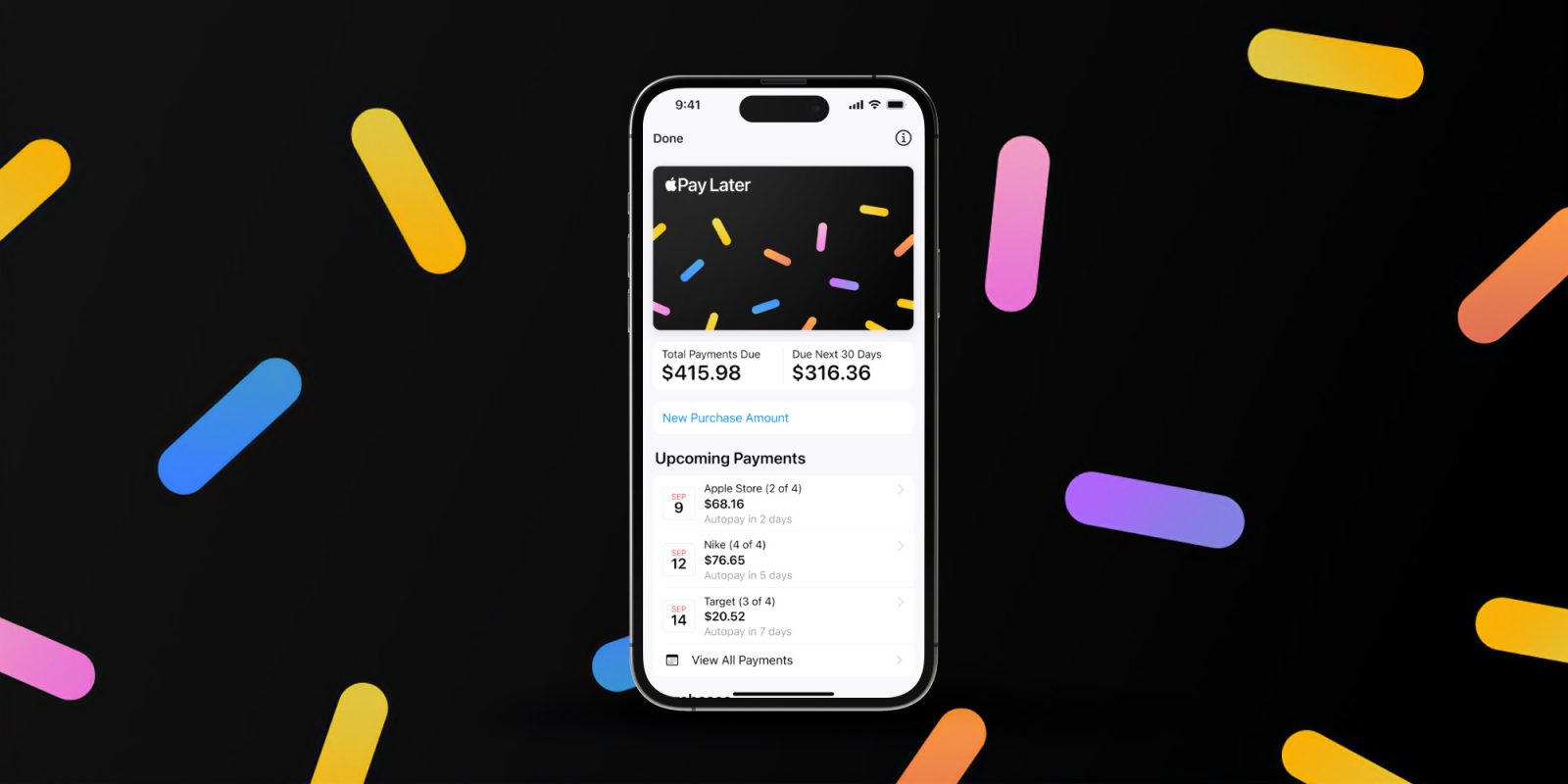

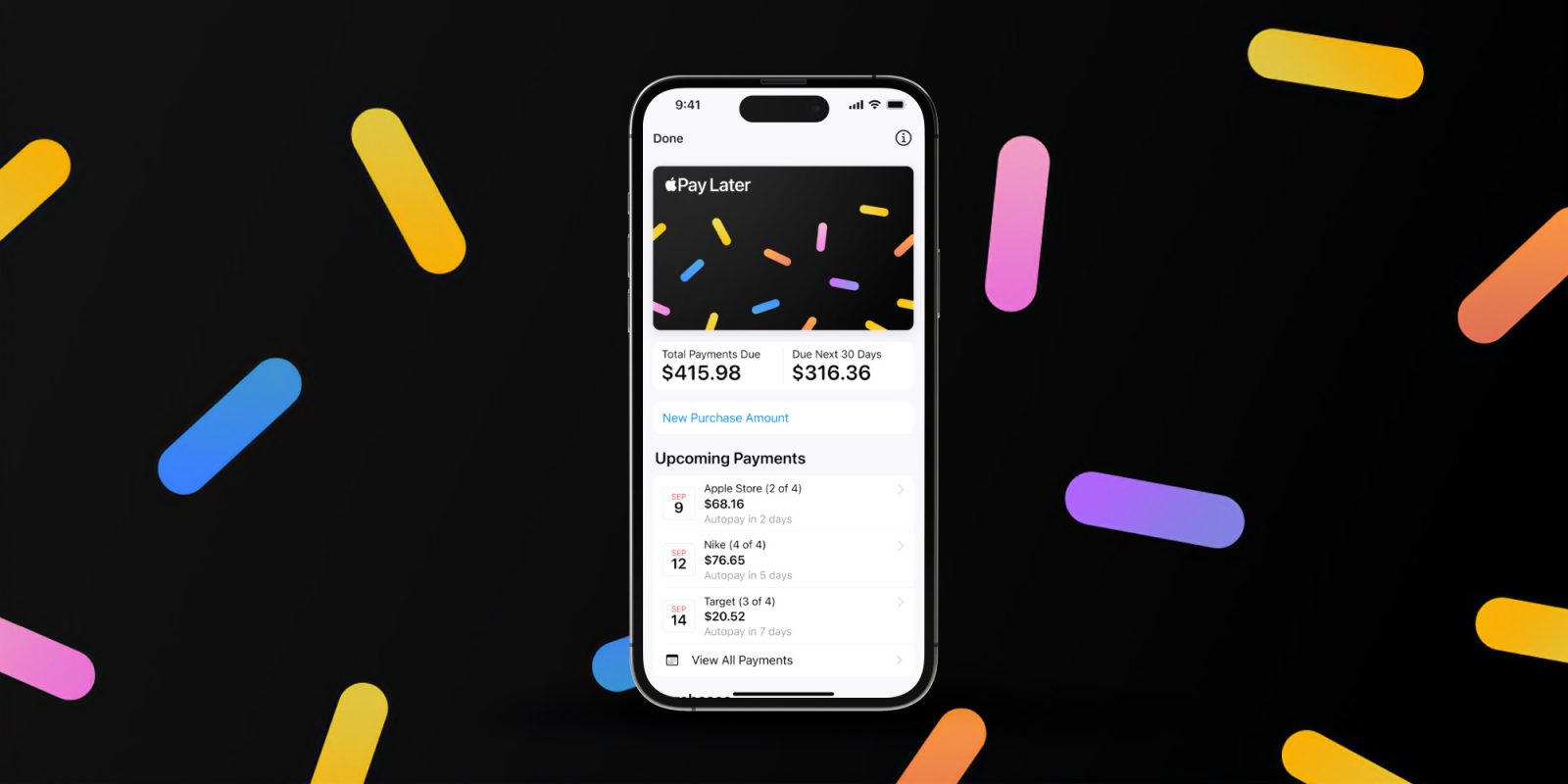

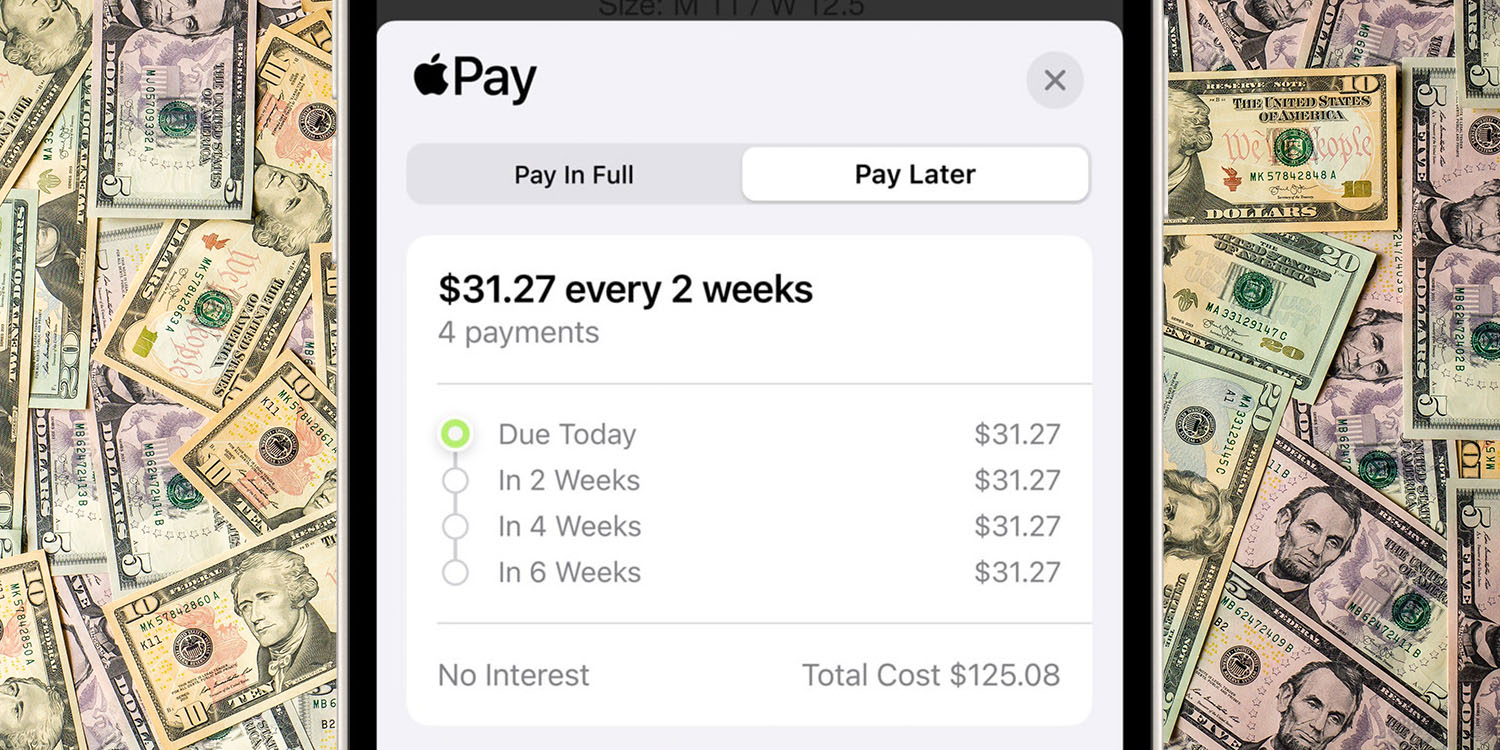

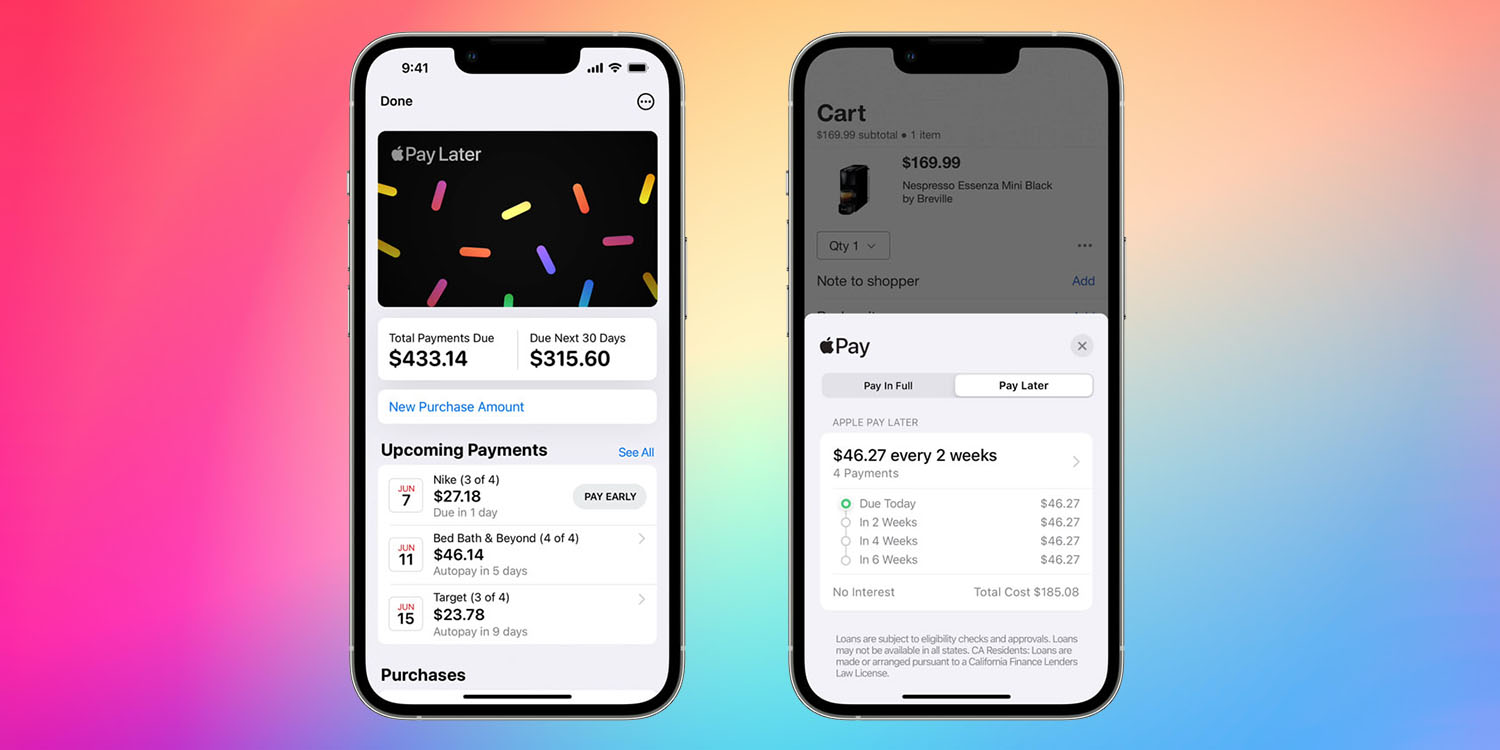

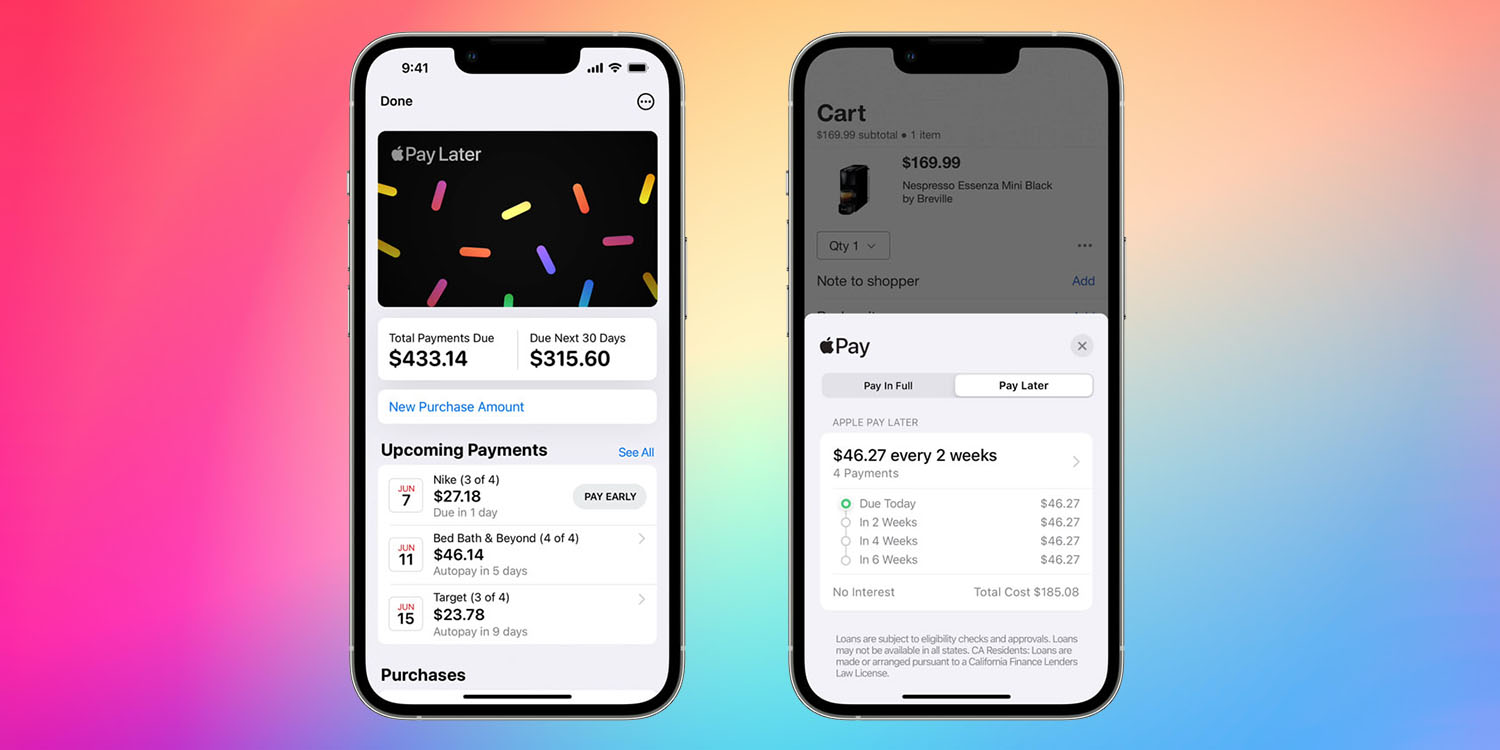

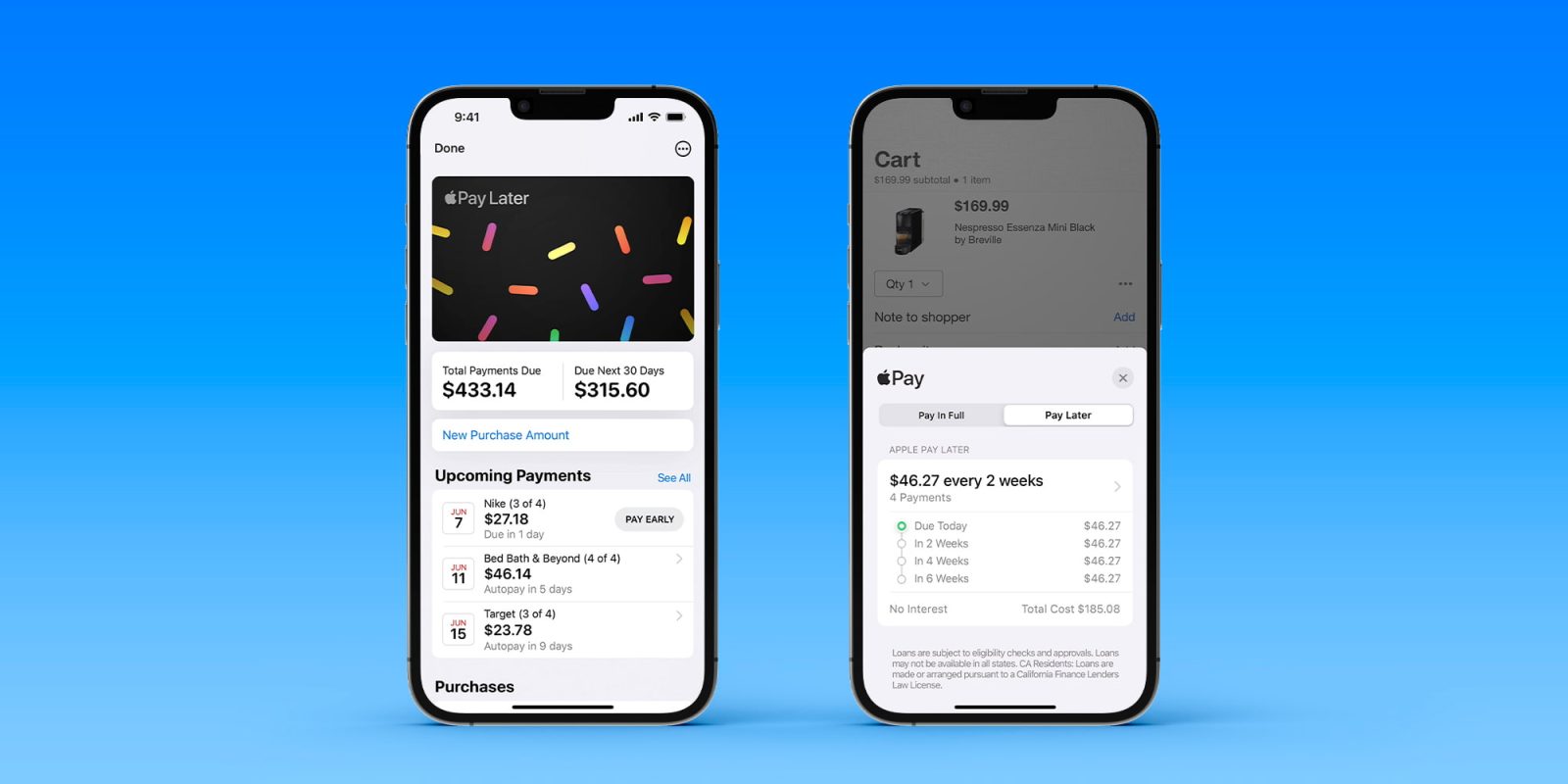

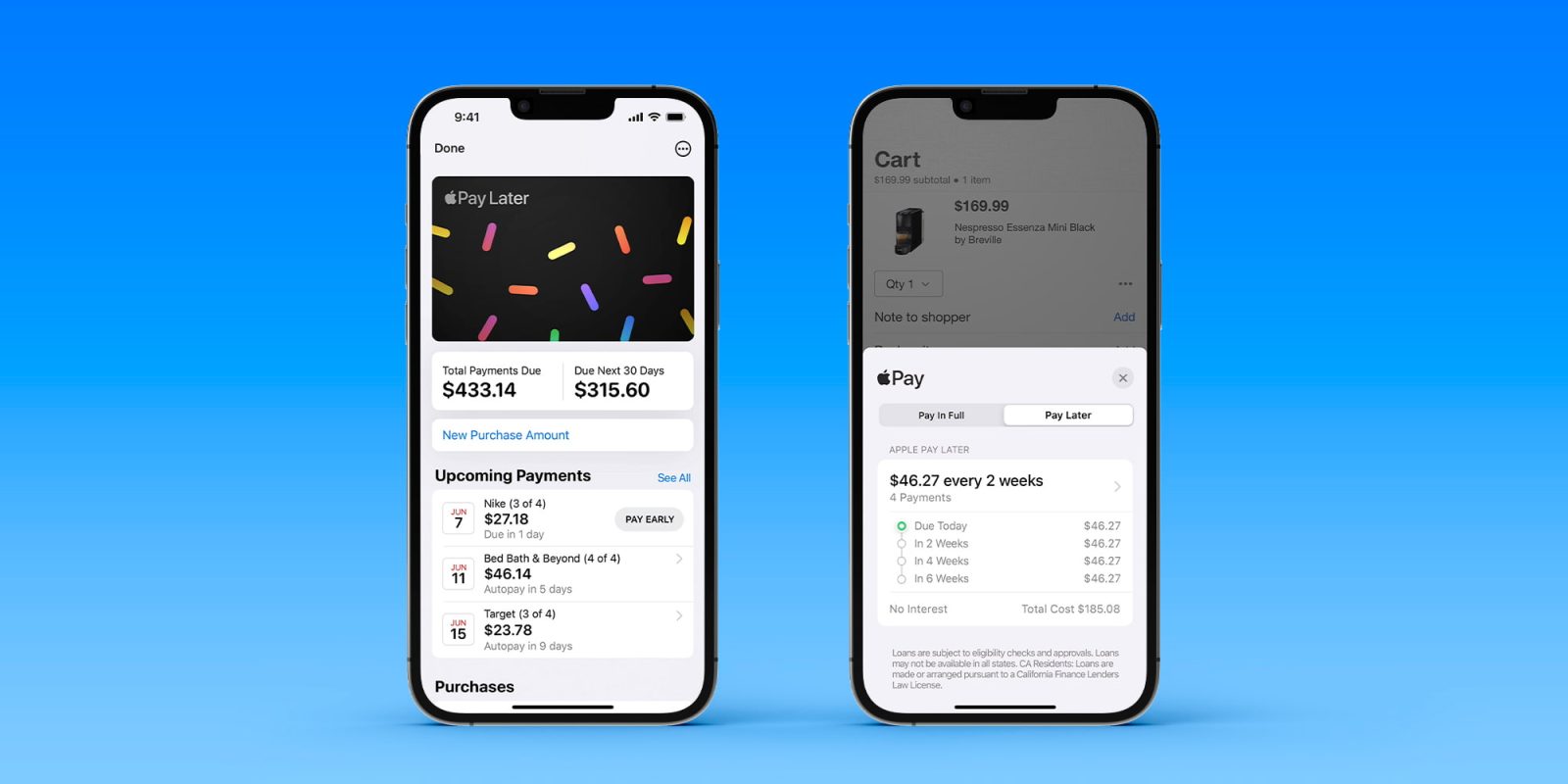

Apple Pay Later officially started rolling out a year ago. The feature gives users a way to easily split in-app and online Apple Pay purchases into four equal payments across six weeks, with no fees or interest.

While Apple Pay Later has broadly been available at a lot of retailers since last year, Stripe this week announced that Apple Pay Later is now enabled by default for all merchants who accept Apple Pay.

Expand Expanding Close

Remember Apple Pay Later, the belatedly released iOS 16 service? It’s now available for all iPhone users in the United States.

Expand Expanding Close

Apple Pay Later has been rolling out since March, but it’s still not available to everyone. Despite the limited availability, a new survey today suggests that Apple is already taking business from other buy-now-pay-later services like Paypal, Afterpay, and more.

Expand Expanding Close

It’s almost a decade since I first suggested that we might one day see an Apple Bank. Given that not even Apple Pay existed back then, I’ll be the first to admit that it seemed a pretty out-there idea at the time.

By 2015, it seemed significantly less of a stretch, and yesterday’s billion dollar news brought us even closer …

Expand Expanding Close

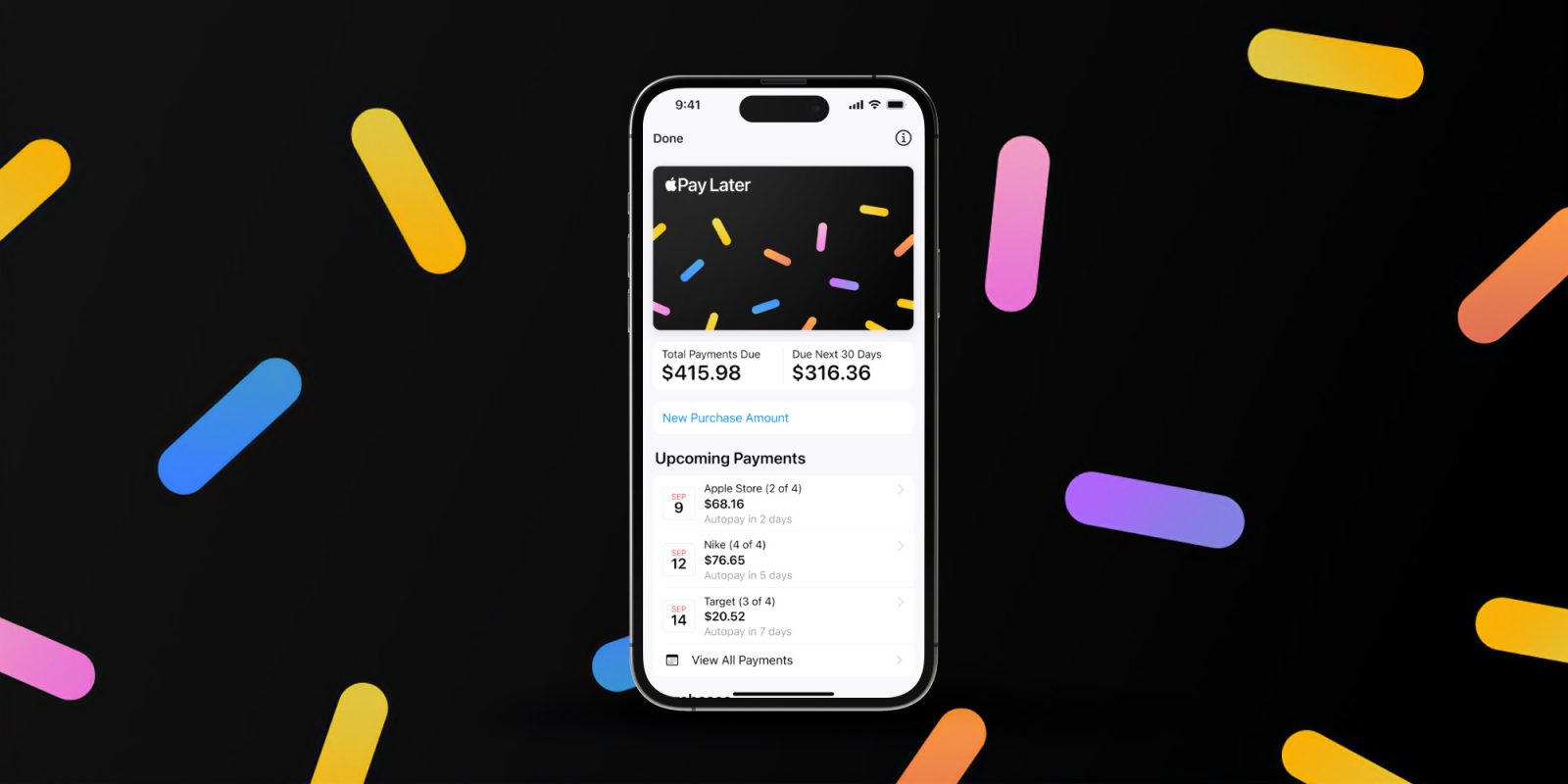

Last week, Apple announced that it was beginning to roll out its new Apple Pay Later financing service to the first customers. This rollout appears to be progressing incredibly slowly, and only today have we received our first reader report of someone actually being invited to try Apple Pay Later…

Expand Expanding Close

Some people can already use Apple Pay Later, with the company promising that it will come to “all eligible users” in the next few months. But while you will be able to use it soon, the question is: Should you?

On the surface, it seems like a decent option. It’s interest-free, there’s no application form to fill out, there’s no impact on your credit rating, and you’re dealing with Apple rather than a bank or finance company. But there are a few things to consider …

Expand Expanding Close

Apple has announced that its long-awaited Apple Pay Later financing service will begin rolling out today. At launch, Apple says that it will “begin inviting select users to access a prerelease version of Apple Pay Later.” It will launch to “all eligible users in the coming months” in the United States.

Expand Expanding Close

Apple Pay Later was announced at WWDC 2022 as a feature of iOS 16. With this feature, customers will be able to pay in installments simply by choosing the option in the Wallet app when purchasing something with Apple Pay. First expected to be introduced in late 2022, the feature was delayed – and now Apple CEO Tim Cook has confirmed that Apple Pay Later will be “launching soon.”

Expand Expanding Close

Apple financial services – like Apple Card and the new savings account – are mostly limited to the US at present, but the UK regulator is already launching an inquiry into potential antitrust concerns.

Amazon, Google, and Meta are also facing scrutiny over their own moves into the financial services arena …

Expand Expanding Close

Apple Pay Later was announced during the WWDC 2022 keynote. It will be a way to let customers pay in installments simply by choosing the option in the Wallet app when they make payments. Originally rumored to be introduced this year, it seems this service could be delayed to Spring 2023 with iOS 16.4.

Expand Expanding Close

The announcement of an Apple buy now, pay later feature, Apple Pay Later, has drawn the attention of the US consumer finance regulator, the Consumer Financial Protection Bureau (CFPB).

CFPB director Rohit Chopra said that Apple Pay Later raised “a host of issues,” with antitrust concerns one of those …

Expand Expanding Close

The announcement of Apple Pay Later has made waves in the Buy Now Pay Later world, with some suggesting that existing companies like Affirm are going to be hard hit. But some are fighting back …

Expand Expanding Close

The Apple BNPL (Buy Now, Pay Later) scheme will use your Apple ID history as one form of fraud prevention, says a new report today.

The report also notes how Apple Pay Later addresses one of the key issues to becoming a credit provider: reputational risk …

Expand Expanding Close

Apple on Monday announced the new “Apple Pay Later” service, which will let iOS users pay in installments through an option in the Wallet app. Now, according to a Bloomberg report, Apple will handle the lending on its own without a partner bank.

Expand Expanding Close

We first learned about plans for Apple Pay Later almost a year before the company announced the new installment payment plan at WWDC. While no interest or fees are charged, a report today says that Apple will still make money from the service.

A business school academic has also warned consumers to be cautious about using the option …

Expand Expanding Close

Among today’s iOS 16 announcements is Apple Pay Later, a way to let you pay in installments simply by choosing the option in the Wallet app when you make payment.

You can pay in four equal installments, and get up to six weeks interest-free …

Expand Expanding Close