From the outside, it might seem like Apple Services has been going crazy with growing paid customers quarter after quarter. And it has been increasing revenue impressively with Services now being the second biggest category behind iPhone. However, a new study reveals Apple may have a lot more room to grow when it comes to getting hardware customers to pick up a paid Apple subscription.

At the end of October, Apple shared an update that it had 900 million paid subscribers with its Services revenue growing 5% YoY to $19.19 billion for its fiscal fourth quarter. To put that in perspective, that’s almost half of the $42.63 billion Apple generated from iPhone, its number one driver of sales. Over the last five years, Apple has been growing Services revenue tremendously.

But a new report from CIRP released today suggests that Apple could have a lot more opportunity to increase Services further. That is if it can convince a greater percentage of iPhone, iPad, and Mac owners to pick up or increase their paid subscriptions.

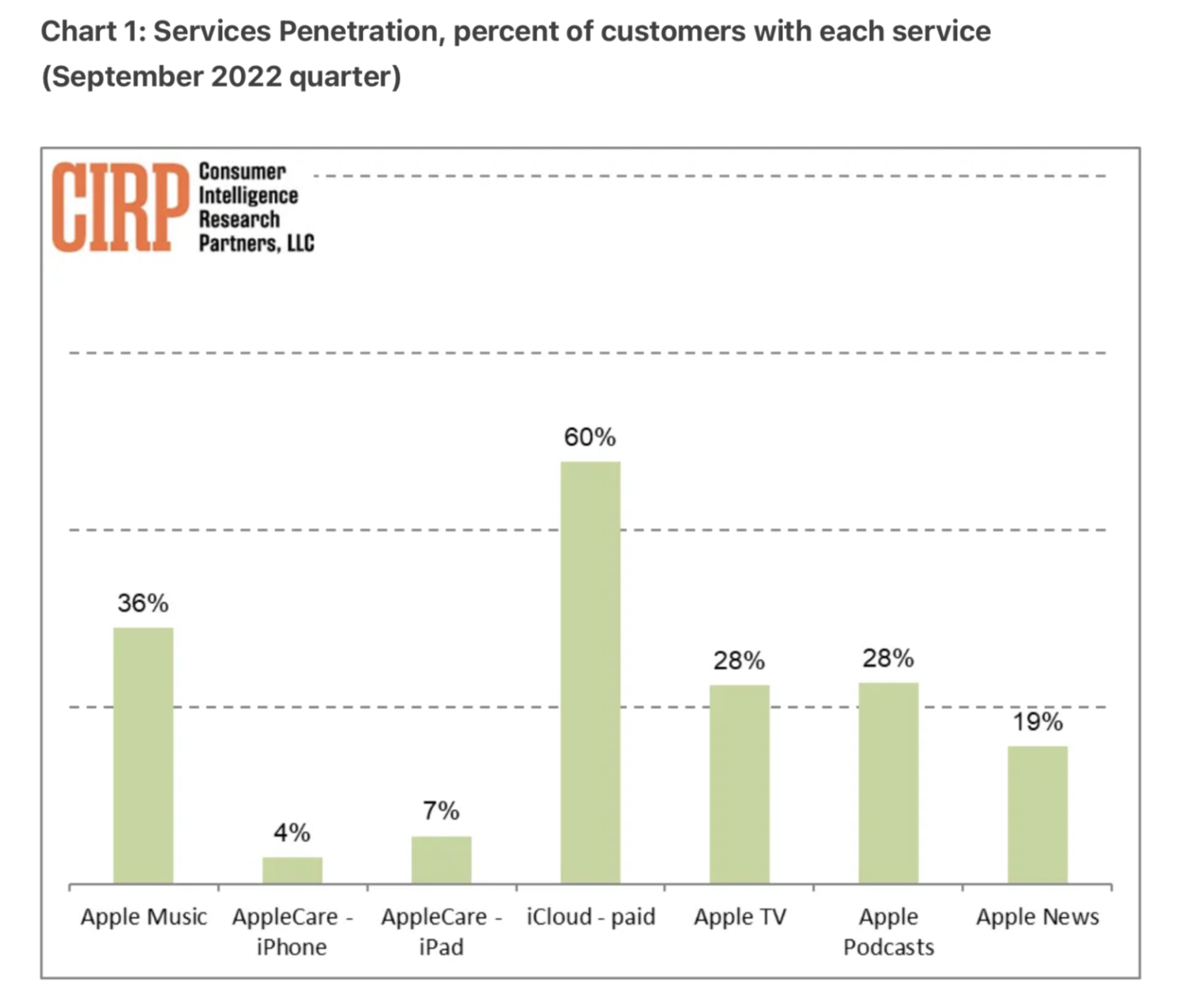

According to CIRP’s latest data, iCloud subscriptions are the most common for Apple customers with 60% of those surveyed saying they pay for extra storage.

Next is Apple Music with 36% of customers, followed by 28% saying they have both Apple TV and Apple Podcasts.

AppleCare for iPhone and iPad is in the single digits with 4 and 7% respectively. CIRP notes a lot of competition in the extended warranty space plus the challenge that almost 70% of iPhones are sold through a carrier or online.

9to5Mac’s Take

A couple of things to keep in mind when looking at these results. First, consumers might not always be aware of what they pay for when it comes to Apple Services. For example, people may remember they have the Apple TV app or Apple News app on their iPhone and think they pay for it, but it’s actually just the included free app, not Apple TV+/Apple News+.

Second, CIRP didn’t share what sample it used for the survey, but it’s possible we’re talking about thousands of people out of almost a billion paid subscribers.

28% of Apple customers being paid Apple TV+ subscribers seems high compared to 36% for Apple Music. And we’ve seen previous studies that show an Apple TV+ overall market share of 6% (note, that’s not a direct metric comparison but could be a clue).

In any case, Apple certainly has a lot more opportunity to make its Services more compelling for the owners of 1.8 billion+ active Apple devices. A lot of that may come down to whether it can convince customers to leave competitors like Spotify, Netflix, etc., and switch to its offerings like Apple Music and TV+.

Notably, another challenge is a reorganization of the company’s Services division as its VP Peter Stern is expected to leave his role at the end of January.

FTC: We use income earning auto affiliate links. More.

Comments