Apple CEO Tim Cook last week pointed to emerging markets like India as the solution to flattening growth rates in mature markets like the US and Europe. One way of kick-starting growth in new markets, suggests Bloomberg’s Mark Gurman, would be for Apple to sell an older iPhone SE for the local equivalent of $199.

This would effectively be following in the footsteps of the $199 Apple Watch Series 3, which Apple retained on sale long beyond the point at which it made sense to buy one …

Flattening growth in mature iPhone markets

The global smartphone market has been declining for more than a year now. That’s likely a temporary effect of high inflation and low job security, but even before this, the growth curve was becoming flatter and flatter.

It used to be common for keener smartphone users to upgrade every year, while many upgraded every two years. That upgrade cycle has gradually slowed to the point where the average person keeps their smartphone for either three or four years.

There’s a certain inevitability to that. While market leaders Apple and Samsung keep trying to come up with new features, the basic form factor of an iPhone hasn’t changed too much since the iPhone X. The smartphone market is – at least until some as-yet unpredictable breakthrough – evolutionary rather than revolutionary in nature.

If Apple wants to return to the days of significant year-on-year growth in iPhone sales, emerging markets will be the places where this happens.

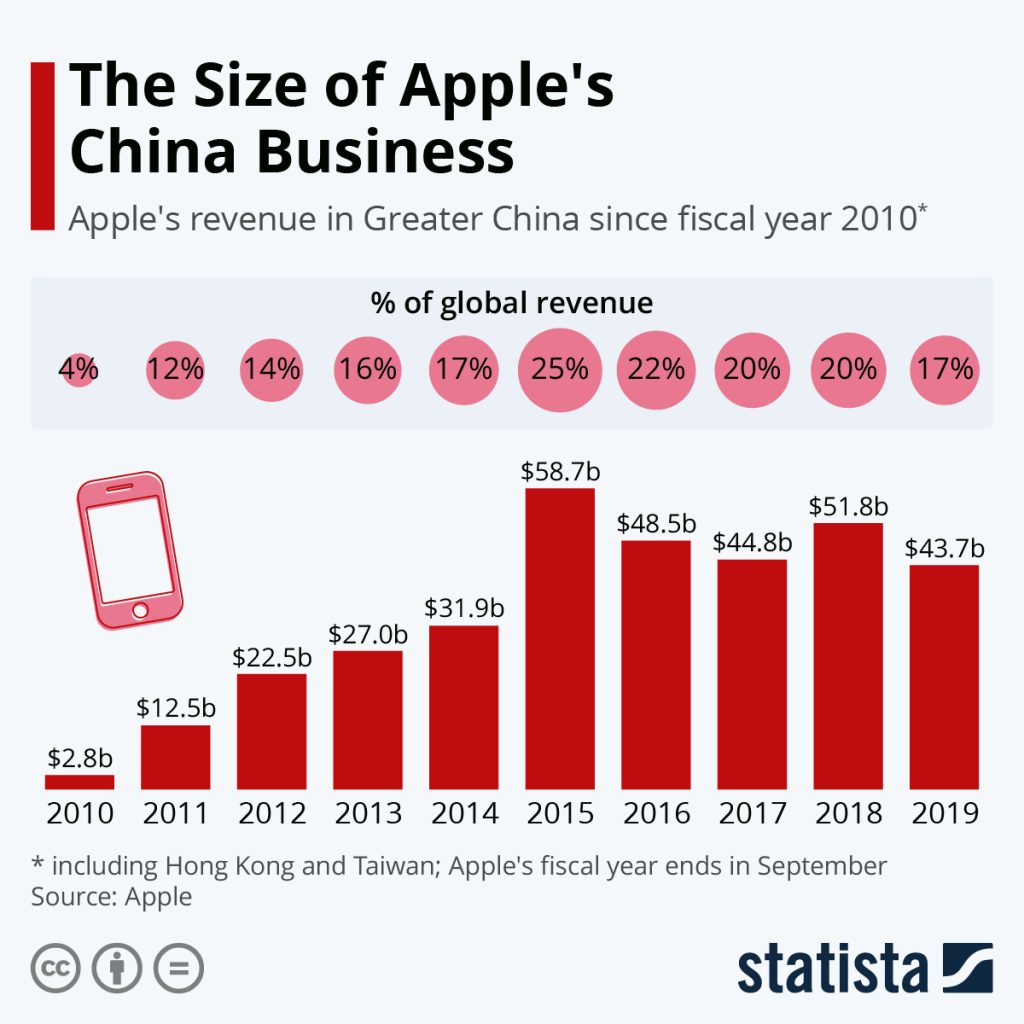

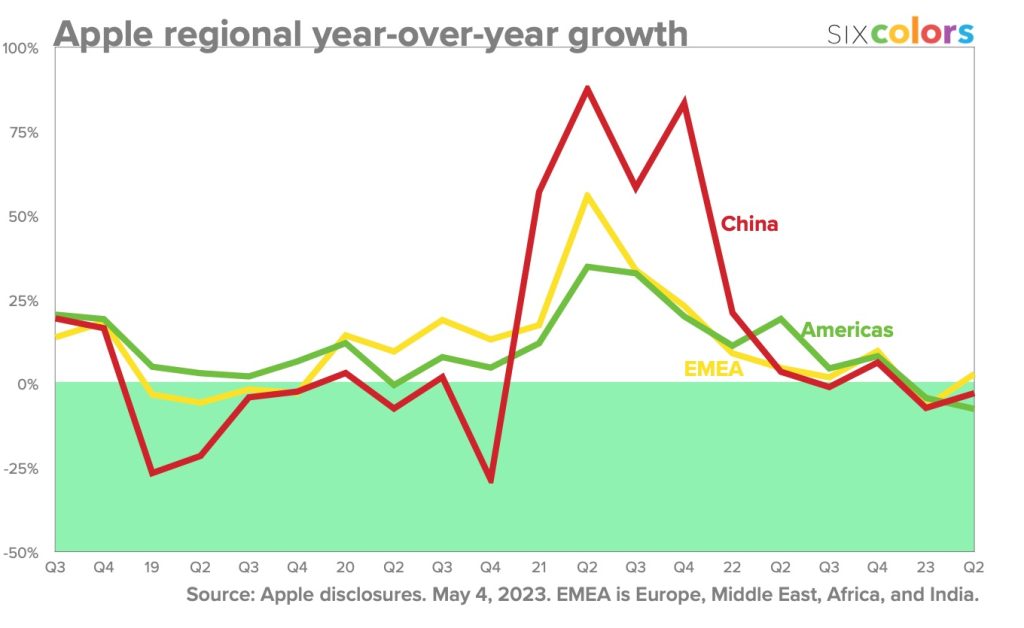

China was once Apple’s growth engine, but no more

China played a massive role in iPhone growth, generating ever-growing revenue for Apple for the first six years. That growth reached its peak in 2015, thanks to the late-2014 launch of the iPhone 6 in a region that had huge pent-up demand for a larger-screen iPhone.

Since then, however, that upward trajectory has been lost, as the above Statista and below sixcolors charts show.

India is Apple’s next big opportunity

India is undoubtedly Apple’s next major opportunity for growth. While much of the population still lives in poverty, the picture is different in major cities like Mumbai and Delhi, where there is a rapidly growing middle class.

CEO Tim Cook and CFO Luca Maestri mentioned India no fewer than 19 times in last week’s earnings call. It was, for example, one of three countries to enjoy a doubling of iPhone revenue.

We set March quarter records in several developed and emerging markets, with India, Indonesia, Turkey, and the UAE doubling on a year-over-year basis

Cook said he believed India is at a tipping point, where it’s about to become a major market for premium consumer products like iPhone.

India is an incredibly exciting market. It’s a major focus for us. I was just there. And the dynamism in the market, the vibrancy is unbelievable. Over time, we’ve been expanding our operations there to serve more customers. And three years ago, we launched the Apple Store Online. And then, as you just mentioned, we launched two stores just a few weeks ago, and they’re off to a great start, one in Mumbai and one in Delhi. We’ve got a number of channel partners in the country as well that we’re partnering with, and we’re very happy with how that’s going.

Overall, I couldn’t be more delighted and excited by the enthusiasm I’m seeing for the brand there. There are a lot of people coming into the middle class, and I really feel that India is at a tipping point, and it’s great to be there.

Selling an older iPhone SE for $199 would make sense

Clearly incomes are rising in India, but the higher the cost of entry to the Apple ecosystem, the slower Apple’s growth will be.

Bloomberg’s Mark Gurman first suggested more than a year ago that Apple should sell an older iPhone SE in emerging markets for the equivalent of $199.

For years, the technology industry has been clamoring for a low-cost iPhone aimed at emerging markets.

A device priced at $200 could make inroads in regions like Africa, South America and parts of Asia that are currently Android strongholds. That would let Apple Inc. sign up more customers for services, potentially making a low-end iPhone quite lucrative for Apple in the long run.

He doubled down on this in yesterday’s newsletter, saying that if emerging markets are indeed where Apple’s future growth is to be found, “it might just have to do” this.

I agree

Of course, a brand-new iPhone bought from Apple isn’t the only budget entry path into the ecosystem. There are refurbished devices available at lower costs, as well as a more general market for used devices.

But at the same time, it’s undeniable that the status symbol of a “new” iPhone does have particular value in emerging markets, which is why China is still home to a great many counterfeit products, bought by people who want to be seen with Apple devices, but who cannot afford them.

Given the ever-growing importance of Services revenue to Apple, it would make sense to me for Apple to do everything it can to bring new customers on board, even if it makes little from the initial hardware sale. The lifetime value of an Apple customer is huge.

I don’t know for sure how well the $199 Apple Watch Series 3 sold, but the fact that Apple kept selling it for a frankly embarrassingly long time does suggest it was an extremely successful strategy. A $199 iPhone would likely do every bit as well in emerging markets.

So yep, I agree with Gurman – how about you? Please take our poll, and share your thoughts in the comments.

FTC: We use income earning auto affiliate links. More.

Comments