Regain clarity with CleanMyPhone by MacPaw — the new AI-powered cleaning app that quickly identifies and removes blurred images, screenshots, and other clutter from your device. Download it now with a free trial.

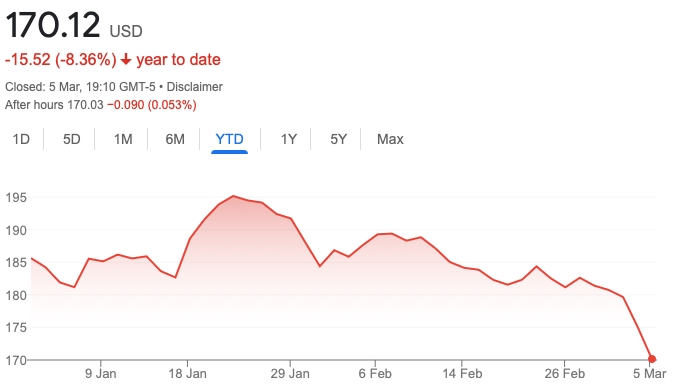

Apple’s stock price has been taking a beating in the last few weeks, hitting a low for the year today, closing at $170.12.

Investors are pessimistic on the company’s outlook for a variety of reasons. Following a year of negative revenue growth in 2023, Apple executives forecast only meek growth guidance at its February earnings call. In the key Chinese market, there were more indications today that a recent streak of hot iPhone sales has come to an end. And investors are reeling from the EU’s $2bn fine for ‘illegal’ App Store policies, which threatens future Services revenue growth.

During its February earnings call, Apple’s China sales missed analyst estimated by more than $3 billion. The China news from today suggests iPhone sales are down 24% in the first six weeks of 2024, compared to a year ago. The report has scared investors into believing there will be sustained iPhone sales weakness throughout this year, with local smartphone manufacturers like Huawei becoming increasingly popular in the culture once again.

On Monday, Apple stock plummeted almost 3% following the news of the EU fine. The EU declared Apple’s anti-steering policies as illegal. Investors fear that more App Store policy changes are coming driven by regulation from pressure around the world, and that will cut into Apple’s Services growth trajectory with lower commissions from In-App Purchase.

Overall, AAPL stock is down 8.3% so far this year, and almost 13% off all time highs set at the end of last year.

While is true that many other tech stocks sold off in today’s session amidst a wider market pullback, the general trend for most big tech stocks has been positive with an artificial-intelligence hype train fuelled rally. For instance, Microsoft stock is up 8.5% this year. And the stock of AI chip manufacturer Nvidia has soared 78% in 2024 alone, with its market cap valuation approaching Apple in size.

In contrast, Apple is seen to be somewhat behind the times on AI, having not announced any major generative AI features so far. However, rumors indicate that is set to change at WWDC this June, with iOS 18 featuring deep AI integration across the system.

In a rare move, Apple CEO Tim Cook teased that Apple had major AI announcements in the pipeline during its last quarterly earnings call; these comments were doubled down on at its annual shareholders meeting held last week. The company is clearly conscious of the narrative that it is behind, and is keen to break it.

FTC: We use income earning auto affiliate links. More.

Comments