Hot on the heels of data showing just how dominant the iPhone was in 2022, Canalys is out with its breakdown of the “smart personal audio market” for Q4 of 2022. As you might expect, Apple had a dominant holiday quarter, even though its own shipments and the overall market took a year-over-year tumble.

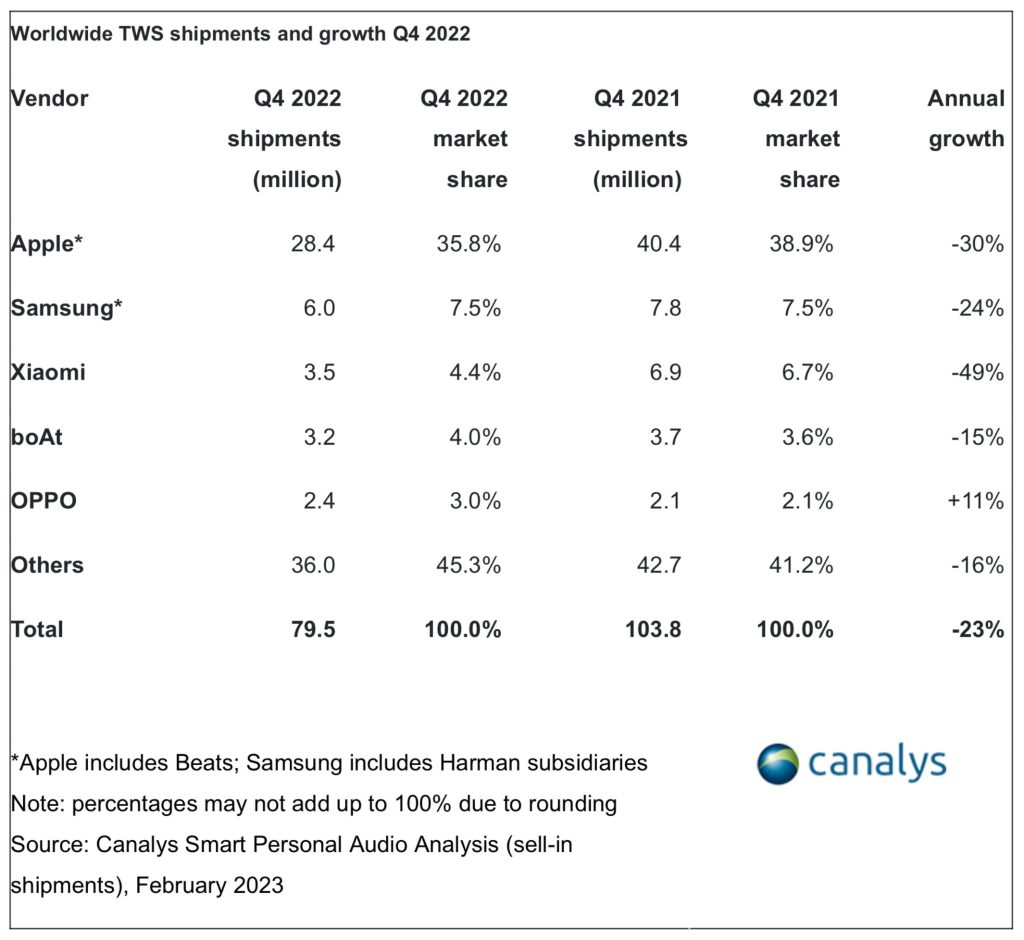

Within the “smart personal audio market,” Canalys has a few different subcategories. This one is specifically focused on true wireless stereo shipments — or TWS shipments — for the holiday shopping season of 2022.

For the quarter, Canalys estimates that overall TWS market shipments fell to 79.5 million units, a decline of 23%. Here’s how that breaks down a little further:

- Wireless earphone shipments fell by 36%

- Wireless headphone shipments fell by 25%

Apple, in particular, saw a 30% year-over-year decline, which Canalys says can be attributed to the release of third-generation AirPods boosted shipments for Q4 2021. Still, however, Apple dominated the overall industry in Q4 2022, despite that year-over-year decline.

- AirPods Pro 2 accounted for 63% of all AirPods shipments in Q4 2022. This makes them the overall most popular AirPods during the holiday shopping quarter.

- AirPods Pro 2 drove a 44% shipment increase in the $200-$299 price category.

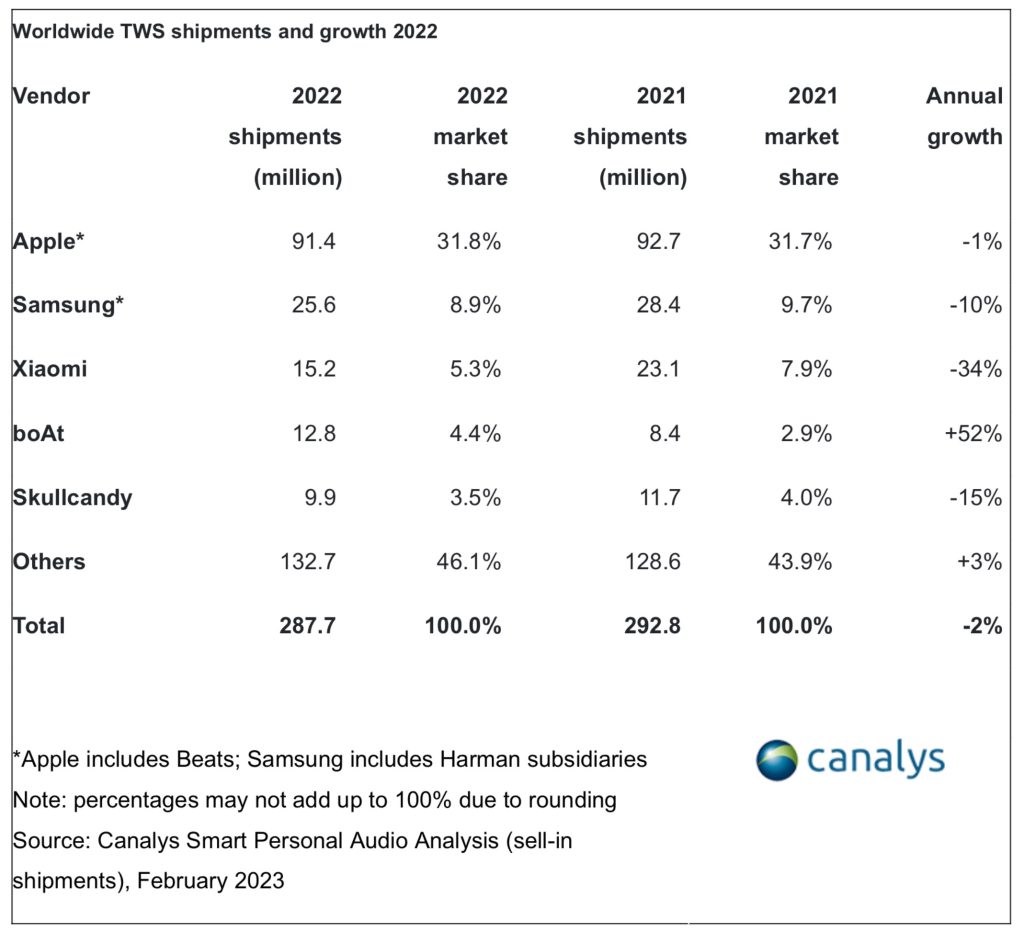

Zooming out and looking at the entire year of 2022, Apple accounted for 32.8% of the overall TWS market with shipments of 91.4 million units (down 1% compared to shipments in 2021). Samsung came in as the runner-up with 25.6 million shipments, followed by Xiaomi, boAt, and Skullcandy.

Interestingly, Canalys also says that AirPods 3 shipments have slowed — referencing the “weaker market performance” of the product.

According to Canalys Analyst Cynthia Chen, price band shifting trends were evident in Q4, with the sub-US$100 band taking up 55% market share, compared to 48% a year ago. “The US$200-299 price band saw an increase of shipments driven by Apple’s second-generation AirPods Pro. Apart from the weaker market performance of the third-gen AirPods, the downgrading of consumption happening on a global level contributed to the shrinking of the US$100-199 price band. Smartphone vendors, whose scales are often larger, felt the most significant impact as they saw their market shares shrink.”

One thing to note is that Apple is boosted by Beats — so this means Apple’s shipment numbers include not only AirPods but also all of the different variations of Beats headphones.

The full report can be found on the Canalys website.

FTC: We use income earning auto affiliate links. More.

Comments