Apple’s Japanese bond sale will raise more than expected, at $2B

Apple’s first ever Japanese bond sale will raise more than had been previously estimated. An SEC filing reveals that the sale will raise ¥250B ($2B), more than the ¥200 billion ($1.6B) which had been reported earlier.

Apple is selling the bonds in Japanese yen due to the extremely low interest rates in the country, with Apple offering a rate of just 0.35%, paid twice a year in June and December. Goldman Sachs, one of the two underwriters of the bond issue, said that the market would welcome the offering.

“It’s Apple’s first time issuing in yen. Their ratings, credit fundamentals and familiarity within the Japanese market are very high,” said a Goldman Sachs banker. “The outcome proves how much the market welcomed seeing this issuer come up.”

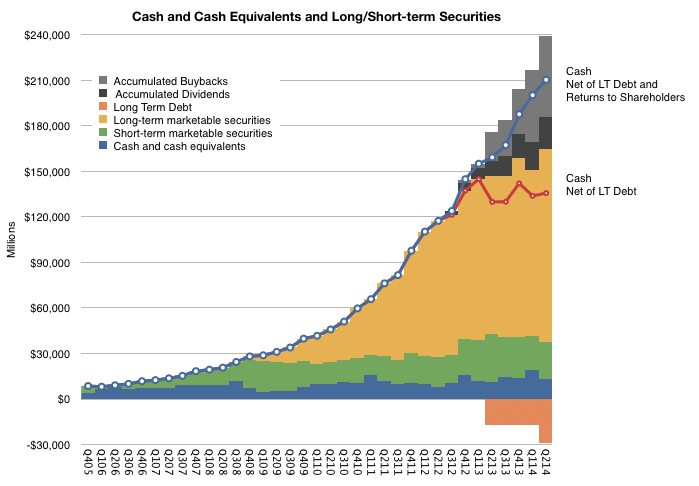

Although Apple has huge cash reserves, the majority of this is held overseas and cannot be repatriated back to the U.S. without large tax liabilities. It is cheaper for the company to borrow money to fund its stock buyback program and to fund dividend payments. Apple announced in April that it will spend $200B by the end of March 2017 on a mix of share repurchases and dividend payments.

Photo: randomwire.com