A class action Apple Pay lawsuit has been filed by Hagens Berman, the law firm that previously won two high-profile antitrust cases against Apple.

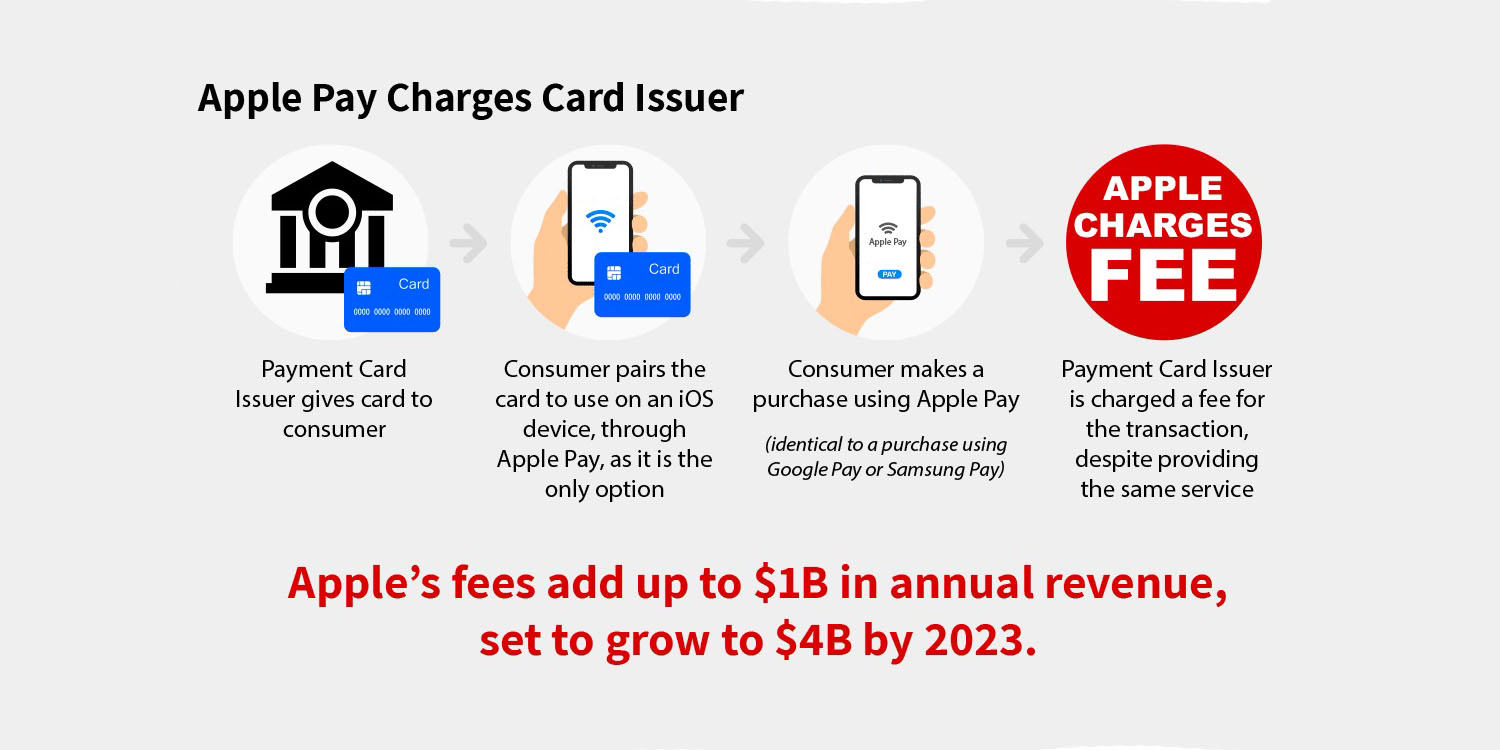

The lawsuit accuses Apple of making a billion dollars a year in fees to card companies by forcing them to sign up for Apple Pay as the only way to let their customers make payments from iPhones and Apple Watches.

How Apple Pay works

Apple Pay, Google Pay, and Samsung Pay are all based on the same technology, known as EVM. The acronym isn’t particularly informative, as it just stands for the names of the three companies who developed the payment tech: Europay, Mastercard, and Visa.

When you present your phone or watch to a payment terminal, it doesn’t send your actual card number but instead a single-use token, valid only for that specific transaction. The token is passed wirelessly by the NFC (Near-Field Communication) chip in the phone.

What all the fuss is about

Google and Samsung allow any bank or card company’s app to use the NFC chip for their own mobile wallet apps. That means there is no cost to the card issuer.

Apple, in contrast, does not allow third-party mobile wallet apps to access the NFC chip in iPhones or Apple Watches. If a bank or finance company wants to offer mobile wallet services, it must sign-up for Apple Pay. All payments are then made through Apple’s own Wallet app.

For every Apple Pay transaction, Apple charges card companies a fee. For credit card transactions, it’s 0.15%; for debit cards, it’s half a cent. While these are individually small amounts, they add up. The lawsuit alleges that Apple makes a billion dollars a year from these fees and that forcing card companies to sign-up for Apple Pay is an antitrust violation.

The European Union has already reached a preliminary conclusion that Apple Pay is indeed anticompetitive, and a lawsuit has now been filed in the US.

Apple Pay lawsuit

Law firm Hagens Berman has filed the antitrust suit on behalf of one card issuer, Affinity Credit, but the lawyers are inviting all other card issuers with Apple Pay agreements to join a class action suit.

The lawsuit seeks to represent a class of U.S. credit unions and financial institutions that issue payment cards enabled for use in Apple Pay. The class action was filed in the U.S. District Court for the Northern District of California and accuses Apple of denying rivals access to the technology needed to develop a competing mobile wallet.

On iOS devices, Apple has ensured that only its mobile wallet, Apple Pay, can make contactless payments at the point of sale. Having secured a monopoly for Apple Pay in this fashion, Apple charges card issuers who use Apple Pay supracompetitive fees for a service that is available on Android devices for free, according to the lawsuit […]

“When you compare the functionality of Apple Pay to mobile wallets available on Android devices – Google Pay, Samsung Pay – you’re essentially holding up a mirror; they are essentially identical,” said Steve Berman, Hagens Berman co-founder and managing partner. “And yet, the same service on Android that card issuers pay absolutely nothing for costs them a collective $1 billion annually through Apple Pay.”

“The reason for this is simple,” Berman added. “There is competition on Android devices, with multiple wallets offering contactless payments, whereas Apple has barred all rivals, making Apple Pay the only option.”

The firm has a good track record in antitrust cases against Apple. It’s the company that won the long-running and high-profile ebook case against the iPhone maker. More recently, it achieved a $100M settlement for iOS developers over anticompetitive practices in the App Store.

The company now said it’s going for the hat trick.

“As a firm with a long history of antitrust successes, we’re no stranger to Apple’s monopolistic behavior,” Berman said. “We’re hoping for a hat-trick and we believe the economic evidence our team has amassed against Apple in this case is frankly undeniable. We look forward to fighting for this case.”

The lawsuit is seeking compensation for the fees charged to card companies and calling for the NFC chip to be opened up to third-party mobile wallet apps.

9to5Mac’s Take on the Apple Pay lawsuit

Apple claims that the reason only its own Wallet app is allowed to use the NFC chip for payments is security. This is not a claim it is likely to be able to defend because the security is provided by the EMV system, which was not developed by Apple and can be used by any card issuer.

Additionally, Apple could, if it wished, still oblige card companies to sign up to Apple Pay without charging any fees in the same way that Google Pay and Samsung Pay do. It’s clear that Apple’s motivation for its current policy is financial, with the fees expected to add up to $4 billion a year by 2023.

There is no direct claim on behalf of consumers: Apple Pay terms and conditions forbid companies from passing on the fee to cardholders. However, all costs have to be recouped somehow, so ultimately consumers pay for all the fees involved through higher card fees or interest rates.

It should be noted that, even if Apple were forced to open up the NFC chip to third-party companies (i.e., card issuers), iPhone owners would still have the option of storing all their cards in the Wallet app, and it’s likely that most would do so for the convenience of having everything in one place.

Apple has a track record of fighting hard against all antitrust lawsuits and rulings, but in this one, it is up against the same firm that has twice won against the company – a judgment in the ebook case, and a settlement in the App Store one. With the European Union also finding Apple Pay terms to be in breach of antitrust regulations, this is going to be an interesting fight.

FTC: We use income earning auto affiliate links. More.

Comments