Premium smartphone sales reached a new record high in 2021, according to a new report today, with Apple taking the top slot in each of the six global regions covered.

The iPhone maker is also said to be best-placed to take advantage of Huawei’s effective demise …

Counterpoint Research says that growth in the premium segment (defined as >$400 wholesale price) is far out-stripping the market as a whole.

The global premium smartphone market sales grew 24% YoY in 2021 to reach their highest ever level, according to Counterpoint Research’s Market Pulse Service. The growth in the premium segment outpaced the 7% YoY growth in the overall global smartphone sales in 2021. The premium segment alone contributed to 27% of the global smartphone sales, its highest ever share.

The firm believes that a range of factors are behind this. Demand for 5G phones is an obvious one. The pandemic pushed some planned 2020 launches into 2021, and the global chip shortage meant that companies like Apple couldn’t keep up with demand, delaying what would normally have been 2020 purchases into early 2021. Additionally, smartphone companies have prioritized the premium segment at a time of component shortages, because it makes sense to apply limited resources to the most profitable product lines.

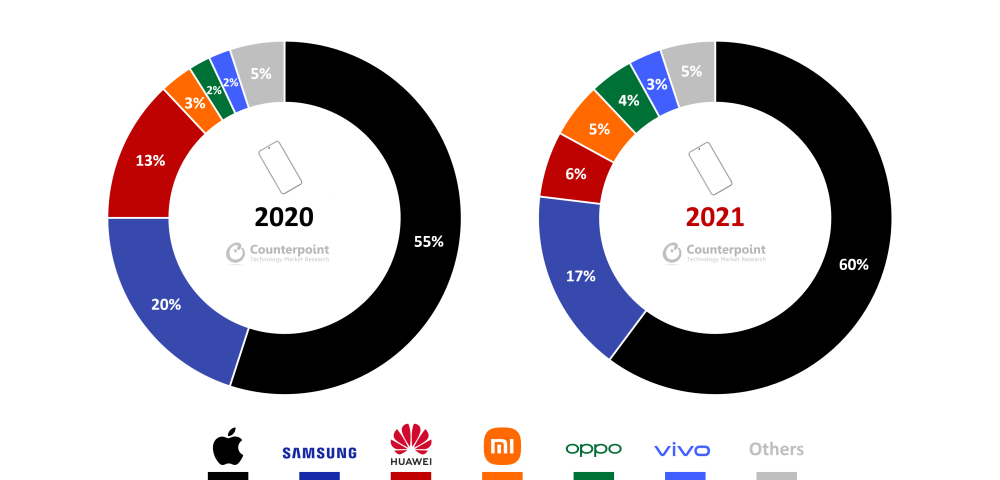

Apple achieved its highest share of the premium market since the launch of the iPhone X in 2017.

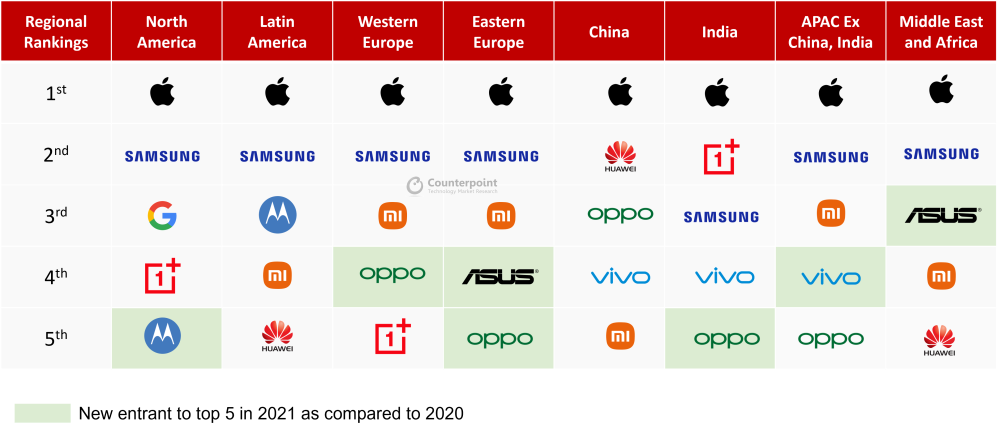

In terms of OEMs, Apple continued to lead the market, reaching the 60% sales share mark for the first time since 2017 driven by strong 5G upgrades for the iPhone 12 and iPhone 13 series. The delayed launch of Apple devices in 2020 also pushed demand to 2021. Apple, with its strong brand power, is in the best position to gain Huawei’s premium smartphone users. This is also indicated by Apple’s growth in China, where the brand reached its highest ever market share in Q4 2021. Apple was the top OEM in the premium segment in every region in 2021.

Samsung sales growth lagged behind the premium market as a whole.

Samsung’s sales grew 6% YoY in the segment, but the OEM lost share. The S21 performed better than the pandemic-hit S20. The Galaxy Z Fold and the Flip series, which were launched in H2 2021, also performed well, especially in South Korea, North America and Western Europe. However, these gains were somewhat traded off due to the lack of a new Note series and an FE series refresh in 2021. Component shortages also affected the brand’s supply.

Photo: Thai Nguyen/Unsplash

FTC: We use income earning auto affiliate links. More.

Comments