A series of recent reports have all pointed to relatively strong Chinese iPhone sales within an overall declining market. The latest one echoes this, stating that Apple’s most expensive models have achieved the greatest growth, up 147% year-on-year.

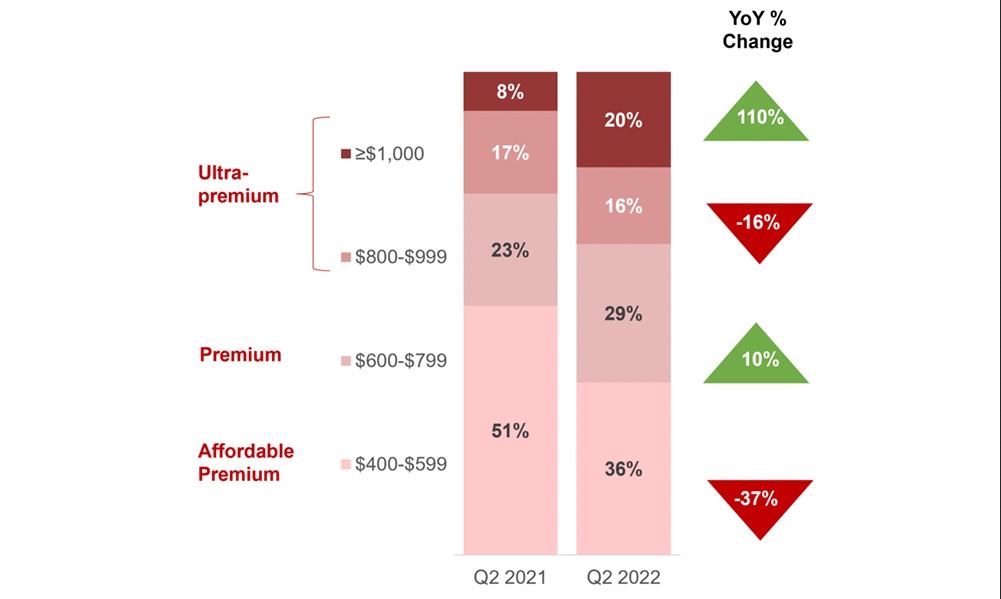

The market intelligence data shows an interesting split in sales by price level …

A declining market

Smartphone sales in China have been declining for some time, with a recent official government report predicting that shipments would this year fall to the lowest level in a decade.

Market saturation, longer waits between upgrades, and increasingly budget-conscious consumers combine for what could prove a prolonged downturn.

In the first half of the year, smartphone shipments in the world’s largest market sank 21.7% on the year to 134 million, according to the China Academy of Information and Communications Technology.

The smartphone market has been badly hit by a combination of supply chain problems, high inflation, and economic uncertainty, leading many consumers to reduce spending on discretionary items like new phones.

The position in China has been worsened by citywide lockdowns as part of the government’s continued insistence that such drastic actions will enable it to completely eradicate COVID-19. This has led to many being unable to work, while others are not allowed to leave their factories.

Chinese iPhone sales

The iPhone has, however, fared better than most. While local brands were struggling, both Apple and Samsung have managed to outperform the market, with the greatest increases seen in the so-called ultra-premium category of phones costing more than USD $1,000.

In the first quarter of the year, this segment saw year-on-year growth of 176%, and Counterpoint Research says that while Q2 wasn’t quite that dramatic, both Apple and Samsung enjoyed three-digit growth in $1,000+ sales.

The $600-$799 (premium) and $1,000 and above (ultra-premium) segments recorded increases in Q2 2022 […]

Apple did well in the $1,000 and above segment, recording 147% YoY increase, while Samsung also grew 133% YoY. Both these brands benefitted from Huawei’s decline and the shift in purchase trends towards premium phones in China.

Samsung has long boosted sales of its flagship models by offering significant discounts in China, while Apple has mostly kept discounting to a more modest level, and offered nothing on its official website. This changed for the first time last month.

It’s very clear that the ultra-premium category is where most of the growth can be found.

Next month’s launch of the iPhone 14 lineup should further boost Apple’s growth in the country in the current quarter, especially if rumors of an early launch turn out to be correct.

FTC: We use income earning auto affiliate links. More.

Comments