Morgan Stanley predicts AAPL will see its first ever drop in iPhone sales next year [Updated]

Update: Fortune reports that in a conference call, Huberty said her forecast was in part based on an estimated 10% drop in component orders. She noted that this could be due to robust inventories rather than weak demand, and that the numbers in the note were a ‘worst-case’ scenario. Huberty emphasized that she remains upbeat on Apple, citing a strong brand, loyal customers, R&D investment and other revenue streams compensating for weaker predicted iPhone sales.

[tweet https://twitter.com/philiped/status/676410189852078080 align=’center’]

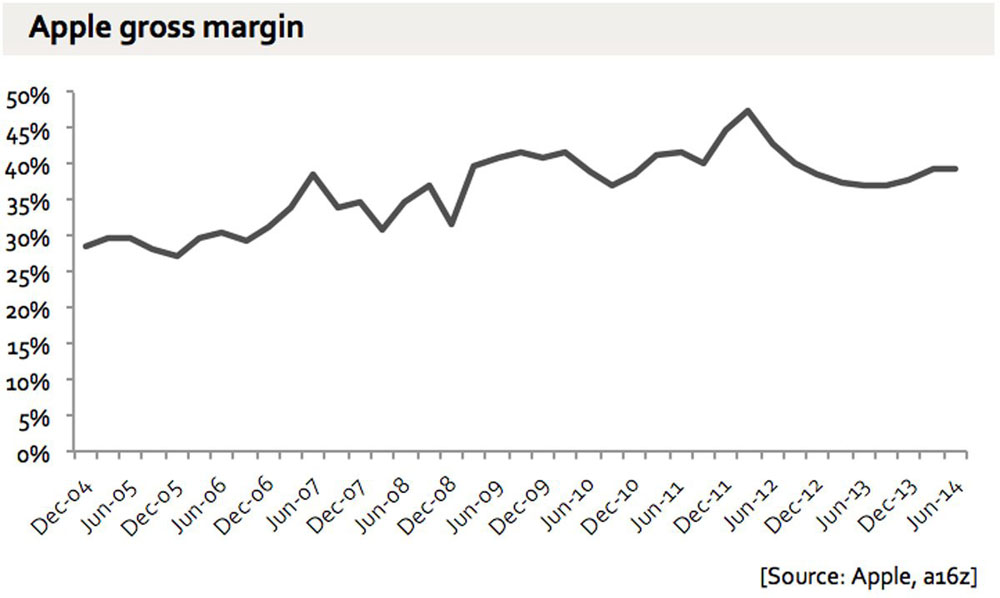

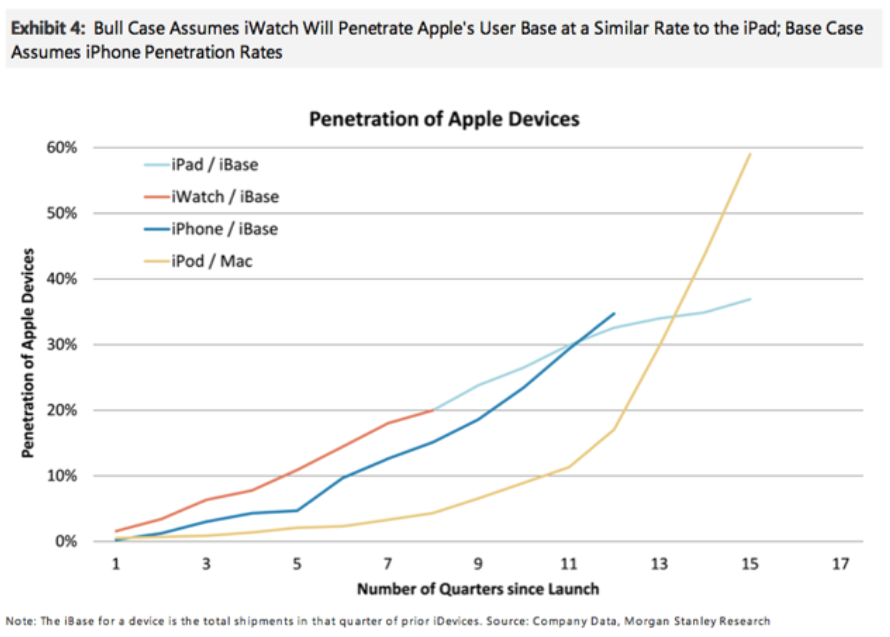

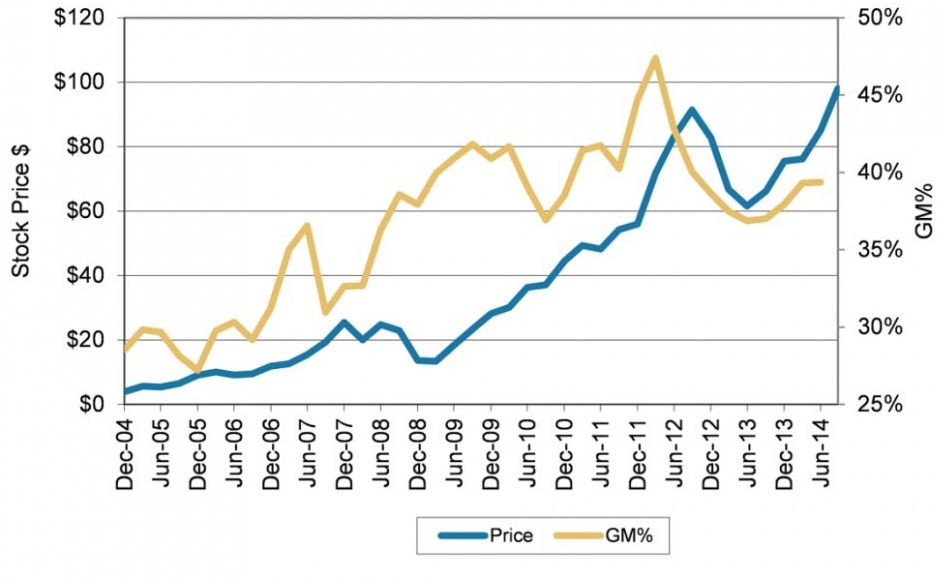

The brand is strong. Customers are loyal. Gross margins are stable. R&D is going full tilt. And revenue streams from new products (Watch, Apple TV), apps, and media could start to make up for slowing iPhone growth.

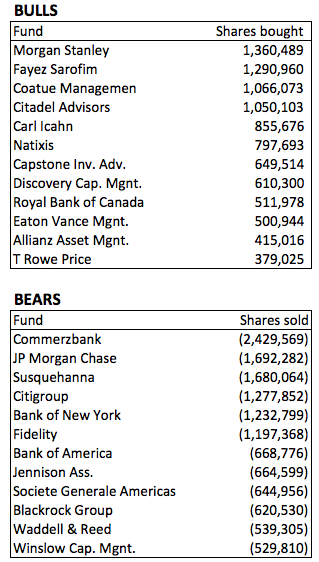

An investment note by Morgan Stanley Katy Huberty predicts that Apple will see its iPhone sales fall by 5.7% in Apple’s 2016 financial year, reports Business Insider. The prediction is significant for two reasons: if realised, it would be the first time since the launch of the iPhone that sales have fallen year-on-year – and the forecast is made by a noted Apple bull.

Morgan Stanley thinks that Financial Year 2016 iPhones sales will be 218 million – a 5.7% drop — while Calendar Year 2016 sales will be 224,000 — a 2.9% drop. These predictions are significantly below Huberty’s previous estimates, of 247 million for FY2016 and 252 CY2016.

One of the reasons given isn’t new – high smartphone penetration in developed markets – but Huberty says there is a second reason …

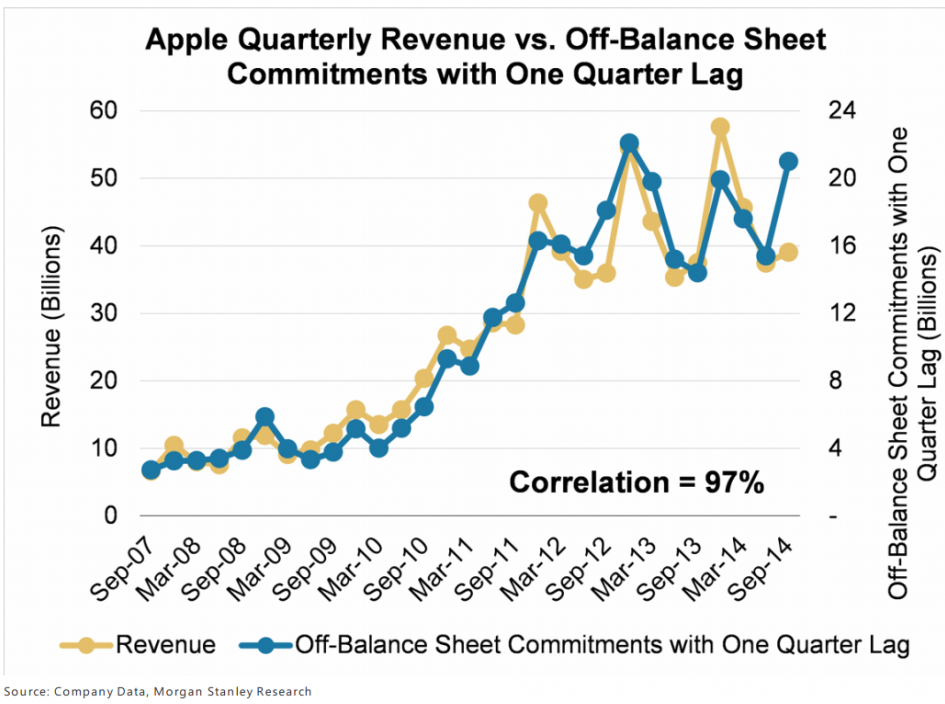

Morgan Stanley’s Katy Huberty says that an analysis of Apple’s recent

Morgan Stanley’s Katy Huberty says that an analysis of Apple’s recent