Photo: readwrite.com

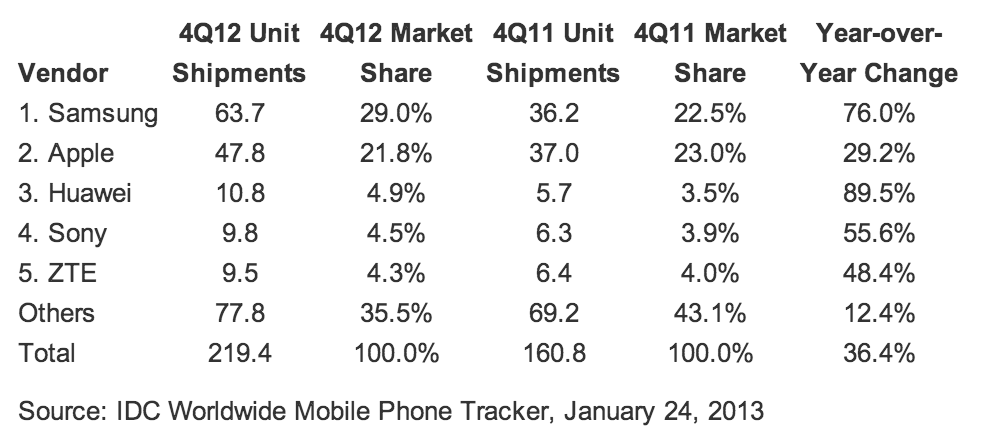

While smartphone growth is slowing in China, Apple managed to increase its market share from 6 to 7 percent in the final quarter of 2013, even before the China Mobile deal was struck. IDC figures reported by the WSJ show that Apple is now the fifth largest smartphone seller in the country, behind Samsung, Lenovo, Coolpad and Huawei. Xiaomi sits just behind Apple at 6 percent.

Apple’s share is likely to increase significantly in the current quarter, thanks to finally being sold through China’s largest carrier, China Mobile. The carrier has more than 760M subscribers, and analysts have estimated that the deal will generate between 15M and 30M additional iPhone sales in the course of 2014.

iPhone sales in Russia, meantime, doubled to 1.57M units with a total value of $1B, reports Bloomberg. Apple had struggled to persuade Russian carriers to sell the iPhone due to its high price and laws that forbid carriers from discounting up-front prices in return for signing up to lengthy contracts. After selling through electronics stores, however, three Russian carriers resumed selling iPhones within the past few months.

The so-called BRIC markets – Brazil, Russia, India and China – are of huge importance to Apple now that the U.S. and Europe have reached saturation point. While Apple will never compete in market share with the low-end Android handsets available in these markets, there is still significant growth potential at the high end. In an earlier WSJ interview, Tim Cook said:

I look at the mobile phone market as having three kinds of phones: feature phones, smartphones that function as or are used as feature phones, and real smartphones. I do care about the market share of the last category and you want to be relevant.

The importance of the BRIC markets was illustrated when it was revealed that Apple’s Asian sales had outstripped those of Europe even by Q1 of last year. Next quarter’s China numbers are going to make very interesting reading.