As rumored leading up to today’s event, Apple announced today that it has struck a deal with NTT DOCOMO to bring its new iPhone lineup to Japan’s largest carrier when the device launches in multiple countries later this month. On September 20th the iPhone will launch on the carrier for the first time and Apple will also launch a single model of the iPhone 5c and iPhone 5s in Japan for KDDI and Softbank. Thanks to an increase to 13 LTE bands with the new iPhone 5s and 5c— which Apple says is more than any other smartphone– it will also be able to consolidate various models of iPhones for multiple carriers in other countries.

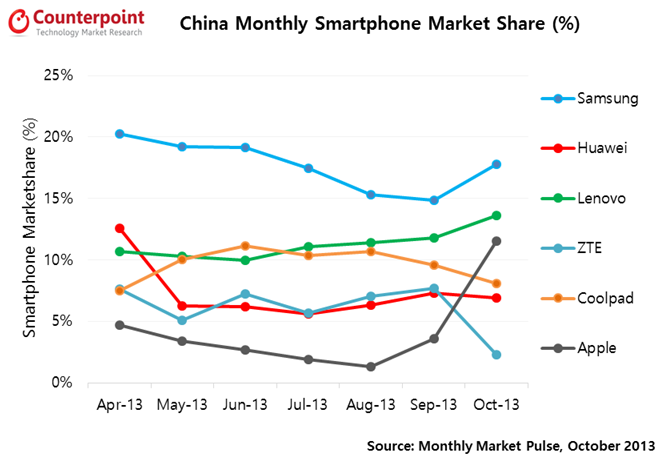

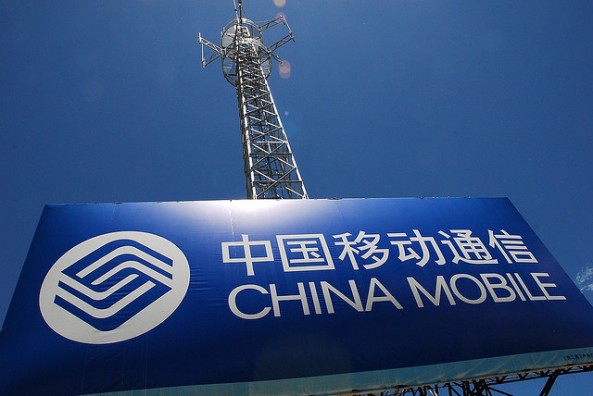

More LTE bands means that Apple will now be offering a single iPhone 5s and 5c model for AT&T and Verizon in the US (Sprint will still get its own model), while customers in the UK will be able to use a single iPhone model for EE, Vodafone, and Three’s upcoming LTE network. Apple will also have an TD-LTE compatible version of the new iPhones, but rumors of a deal with the world’s largest telecom, China Mobile, have not yet been confirmed.

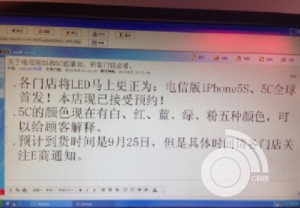

Apple does plan to launch the new iPhones in China on September 20th alongside launches in the US, Australia, Canada, Germany, France, Singapore, UK, and Japan.

NTT DOCOMO & Apple Team Up to Offer iPhone in Japan on Friday, September 20

TOKYO and CUPERTINO, California—September 10, 2013—NTT DOCOMO and Apple® today announced that iPhone® 5s, the most forward-thinking smartphone in the world, and iPhone 5c, the most colorful iPhone yet, will be available on the DOCOMO network beginning on Friday, September 20. iPhone 5s features an all-new A7 chip, making iPhone 5s the world’s first smartphone with 64-bit desktop-class architecture for blazing fast performance, an all-new 8 megapixel iSight® camera and introduces Touch ID™, an innovative way to simply and securely unlock your iPhone. iPhone 5c features an all-new design, packed with incredible features that people know and love, in five gorgeous colors—blue, green, pink, yellow and white.

“We’re thrilled to offer the incredible new iPhone 5s and iPhone 5c to our customers,” said Kaoru Kato, President and CEO of NTT DOCOMO, Inc. “We know our customers will enjoy the amazing experience of iPhone on DOCOMO’s high-quality network.”

“NTT DOCOMO has built an impressive network, the largest in the nation with over 60 million customers,” said Tim Cook, Apple’s CEO. “We’ve enjoyed tremendous success with iPhone in Japan, in fact it’s the top selling smartphone in the country, and we look forward to delivering iPhone into even more customers’ hands through NTT DOCOMO.”

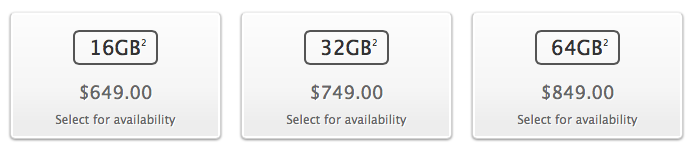

With the launch of the new iPhone 5s, iPhone 5c and iOS 7, Apple is ushering in the next generation of mobile computing, delivering an incredible new hardware and software experience that only Apple could create. iPhone 5s redefines the best smartphone experience in the world with amazing new features all packed into a remarkable thin and light design, including the Apple-designed A7 64-bit chip, all-new 8 megapixel iSight camera with True Tone flash and introducing Touch ID, an innovative way to simply and securely unlock your phone with just the touch of a finger. iPhone 5c features an all new-design, packed with features people know and love like the beautiful 4-inch Retina® display, blazing fast performance of the A6 chip, and the 8 megapixel iSight camera—all while delivering great battery life.¹ iPhone 5s and iPhone 5c both offer more LTE bands² than any other smartphone in the world and include all-new FaceTime® HD cameras.

iPhone 5s and iPhone 5c feature iOS 7, the most significant iOS update since the original iPhone, featuring a stunning new user interface, completely redesigned with an elegant color palette, distinct, functional layers and subtle motion that make it feel more alive. iOS 7 has hundreds of great new features, including Control Center, Notification Center, improved Multitasking, AirDrop®, enhanced Photos, Safari®, Siri® and introduces iTunes Radio℠, a free Internet radio service based on the music you listen to on iTunes.³

Beginning on Friday, September 13, customers can pre-order iPhone 5c at DOCOMO dealers⁴ and the first 30,000 docomo Premier Club Premier Stage⁵ customers can pre-order from DOCOMO’s website.⁶

January File Photo

January File Photo