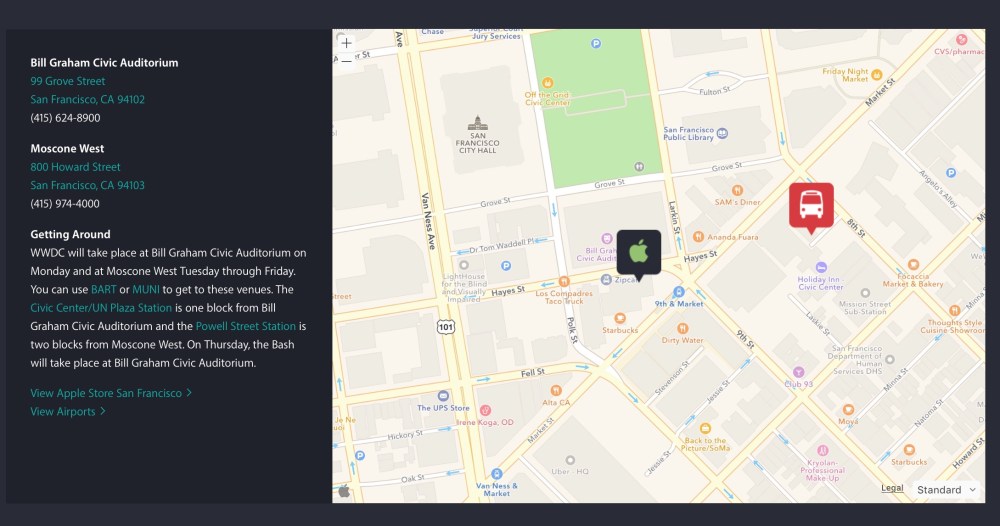

Embedded Apple Map on WWDC site suggests official public MapKit web API coming soon

Apple seems to be preparing to announce a web version of its MapKit framework, allowing anyone to embed an Apple Map view into a web page. On the WWDC microsite, Apple has embedded its own map object in the page to show attendees how to get between Moscone West and the Bill Civic auditorium, where the Monday keynote will be held. Looking at the code, it appears Apple wants to make this embeddable map a public API in the (near?) future so anyone could add an Apple Map to their website.

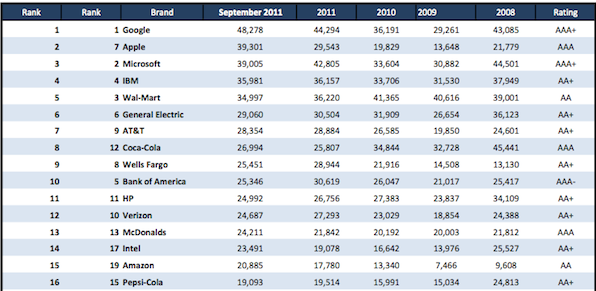

The map allows user interaction like you might expect with panning, zooming and such. Behind the scenes, the Apple map uses a HTML5 <canvas> element to render the custom cartography. Right now, MapKit is exclusive to iOS and Mac apps, ostensibly funded by the revenue Apple brings in from the sale of App Store apps.

From a business perspective, it is unclear why Apple would want to open up its API to web developers. Today, most developers use embedded Google Maps to display maps on their websites due to its ubiquity. Although other mapping options exist, a high-profile entrance of Apple into the space would provide strong competition to Google’s offering.

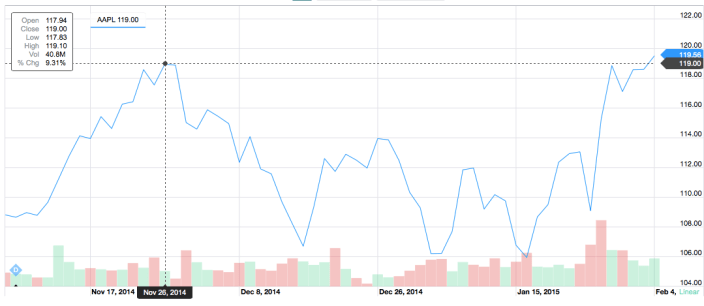

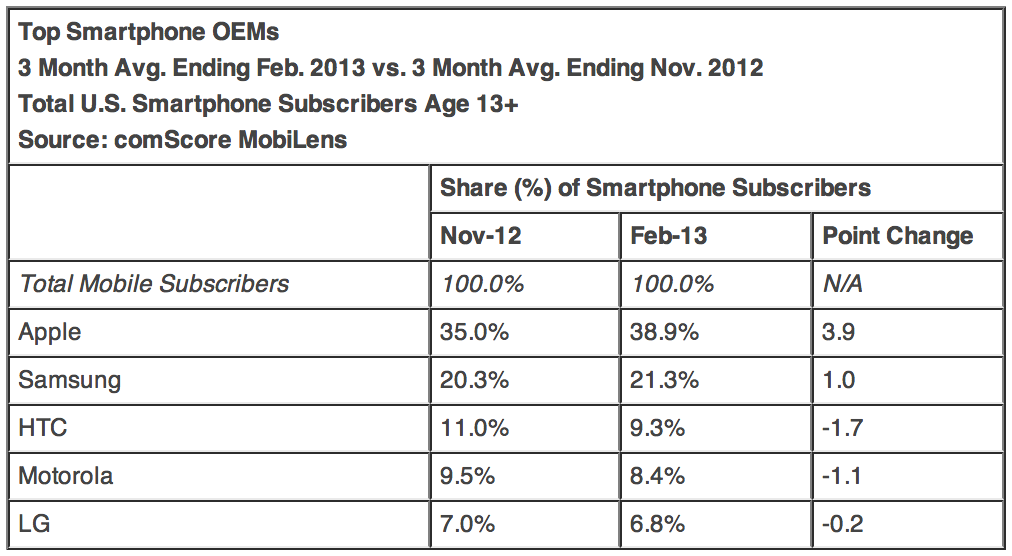

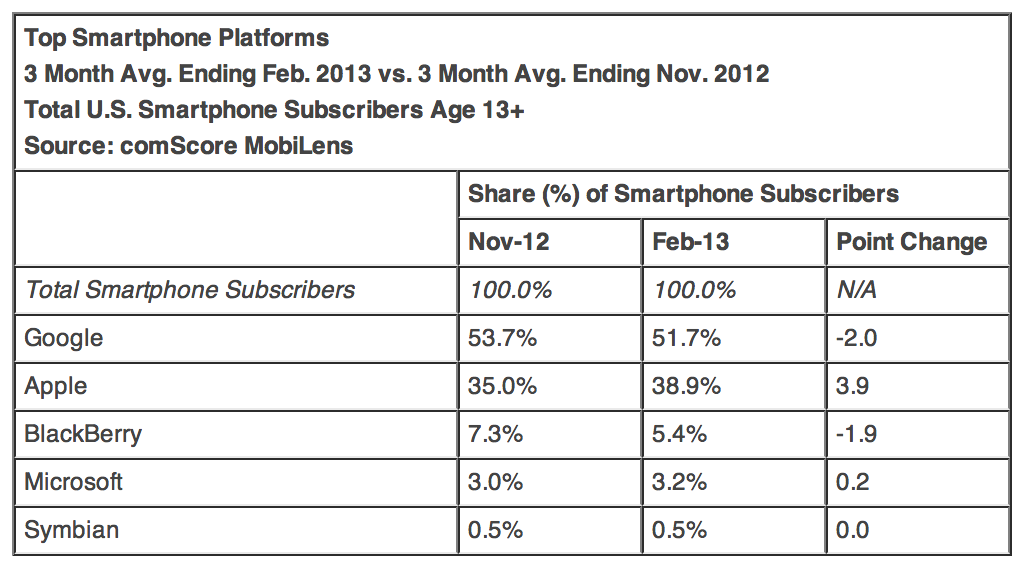

It’s important to point out that the shipped vs. sold argument doesn’t apply to comScore’s results, as its data comes from surveys tracking smartphone subscribers and usage and not sales or units shipped. Google grabs the spot as top smartphone platform at the end of February, but Apple continues to close the gap capturing 38.9-percent of the market (up from 35 percent) compared to Google’s 51.7-percent (down from 53.7-percent):

It’s important to point out that the shipped vs. sold argument doesn’t apply to comScore’s results, as its data comes from surveys tracking smartphone subscribers and usage and not sales or units shipped. Google grabs the spot as top smartphone platform at the end of February, but Apple continues to close the gap capturing 38.9-percent of the market (up from 35 percent) compared to Google’s 51.7-percent (down from 53.7-percent):