Apple holds 3rd place in smartphone market share, position looks safe for now

Apple isn’t the only smartphone manufacturer seeing falling sales. New figures from Strategy Analytics show what the global smartphone market saw its first-ever year-on-year drop on sales, down 3%.

Linda Sui, Director at Strategy Analytics, said, “Global smartphone shipments fell 3 percent annually from 345.0 million units in Q1 2015 to 334.6 million in Q1 2016. It is the first time ever since the modern smartphone market began in 1996 that global shipments have shrunk on an annualized basis. Smartphone growth is slowing due to increasing penetration maturity in major markets like China and consumer caution about the future of the world economy.”

Apple’s fall was of course far more dramatic, iPhone sales down 18% year-on-year, with CEO Tim Cook blaming economic ‘headwinds’ – and Strategy Analytics’ numbers show that strong competition from Chinese brands forms a large part of those …

According to the latest U.S. smartphone market share numbers from Parks Associates, Apple is still well in the lead compared to competing manufacturers, holding a beefy 40% of the smartphone market. But the latest figures also show that Android OEMs are gaining ground on the dominant Cupertino, California-based iPhone maker. Now, Samsung holds around 31% of the market and LG is next in line with 10%…

We learned this week that Apple shipped 74.8 million iPhones globally during the recent holiday quarter, which is just slightly up from the 74.4 million shipped during the same quarter the year prior and just under the 75 million that analysts expected.

Today Strategy Analytics has released new data showing how Apple’s last two years of shipments compare to competitors like Samsung and Huawei. The data also breaks down how Apple’s global smartphone marketshare stacks up to those same competitors.

New data from research firm Strategy Analytics shows that Apple’s introduction into the smartwatch market made a dramatic shift in both the overall size of the market and which companies are on top.

According to the firm’s data, Apple claimed a massive 75.5% of the global smartwatch marketshare in Q2 2015 with the launch of the Apple Watch in late April. It also shows that Apple’s entrance stole a huge portion of Samsung’s marketshare as the previous smartwatch market leader dropped 66 points from 73.6% marketshare to a single digit 7.5% …

Expand

Expanding

Close

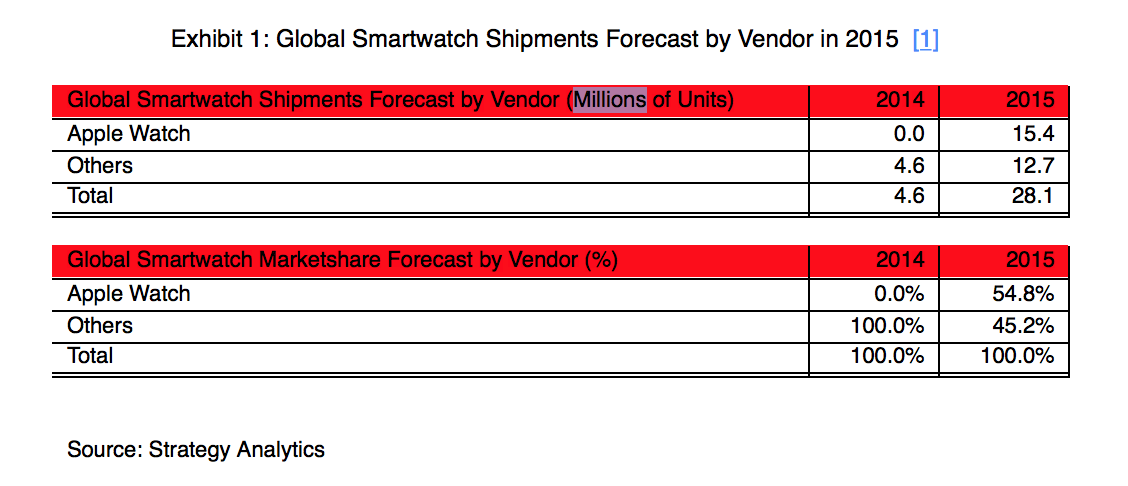

Research firm Strategy Analytics released its latest report today forecasting global Apple Watch sales and smartwatch marketshare for 2015. The firm’s predictions put Apple’s anticipated global smartwatch marketshare at more than half with 54.8% reached in 2015. Notably, that forecasted percentage is versus all other smartwatches combined competing with the Apple Watch.

While the report predicts that Apple will take the overwhelming majority of smartwatch sales this year, it predicts a relatively conservative number of units shipped globally in 2015 at 15.4 million. That forecast still beats the collective “other” group with a 12.7 million units shipped globally predicted.

To be clear, the firm is predicting that the as-of-yet unreleased Apple Watch will outsell the existing smartwatch market in 2015…

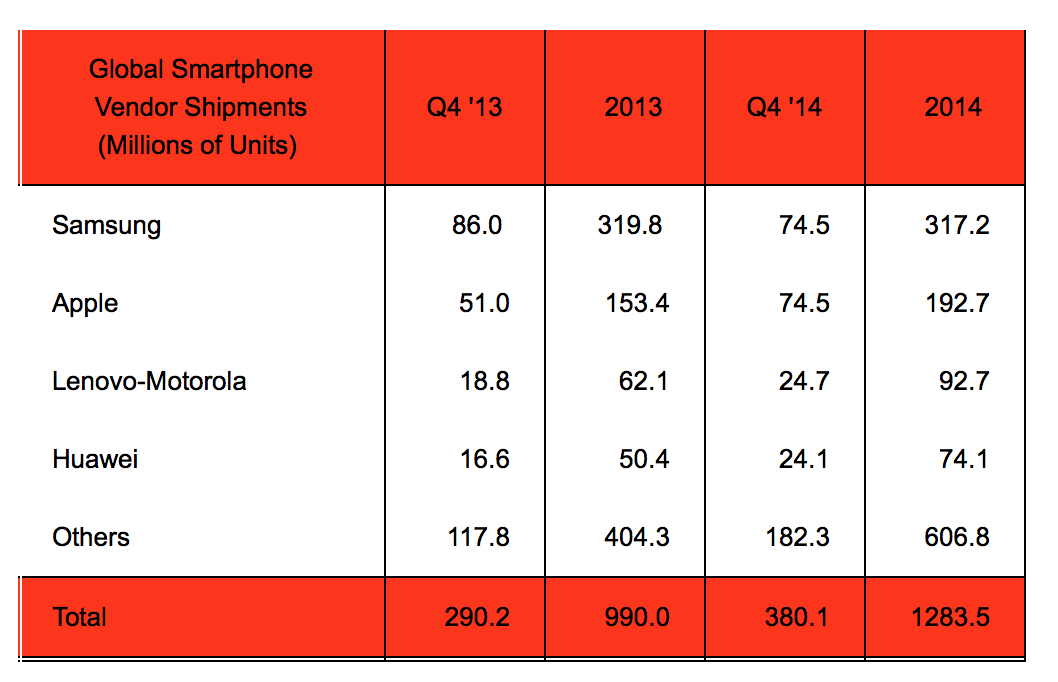

Following on the heels of a record-breaking quarter for Apple, Strategy Analytics has crunched the numbers and crowned Apple the king of the smartphone vendors for Q4 2014—or rather, one of the kings. It seems the Cupertino company managed to tie rival Samsung for the title.

Both companies shipped 74.5 million handsets during the quarter, though Samsung still outsold Apple in terms of the annual total by a hefty margin. Those quarterly sales gave both companies an equal marketshare of 19.6%.

Both Samsung and Apple have slipped in smartphone marketshare globally during the first quarter of 2014 according to the latest numbers from research firm Strategy Analytics. While global smartphone shipments grew 33 percent to 285 million units in Q1 compared to 213.9 million in the same quarter last year, Apple and Samsung collectively dropped from over 50 percent of the market to 47 percent. The report cites strong growth of “second-tier smartphone brands” such as Huwaei and Lenovo and lack of entry-level devices in markets abroad from Apple as the main contributors to slowed growth for Samsung and Apple. As for Apple on its own:

Expand

Expanding

Close

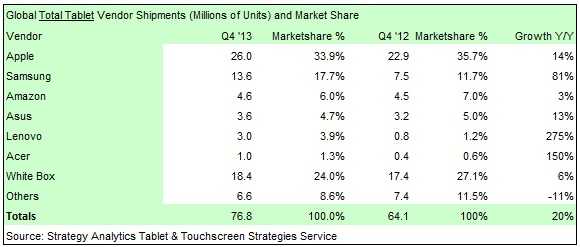

Strategy Analytics reported its tablet figures for 2013 and unsurprisingly, iPad remains in first place with 33.9% marketshare. Marketshare growth has dipped slightly, however, year-on-year as iPad accounted for 35.7% of tablet sales in Q4 2012.

In terms of unit growth, Apple rose 14% compared with the year-ago quarter. The second-place position goes to Samsung, with 17.7% marketshare (although this means annual growth was more than 80%). Apple sold just under double Samsung’s shipments for the period, so even though Apple’s growth has slowed, there is still a significant gap between first and second place.

The latest numbers from IDC, ABI and Strategy Analytics (the latter not yet online) paint an interesting picture of where the smartphone business currently stands, and where the iPhone sits within it.

The overall picture for smartphones is, of course, strong. IDC reports:

In the worldwide smartphone market, vendors shipped 237.9 million units in 2Q13 compared to the 156.2 million units shipped in 2Q12. This represents 52.3% year-over-year-growth, the highest annual growth rate in five quarters. Second quarter shipments were up 10.0% when compared to the 216.3 million units shipped in 1Q13.

While ABI pegged the year-on-year growth at a significantly lower 44 percent, it’s clear that much of the traditional featurephone market is switching to smartphones.

The high-end also remains strong, with both the iPhone and Samsung S4 outpacing the smartphone market as a whole, though both sets of figures show iPhone growth at a long-time low …

Expand

Expanding

Close

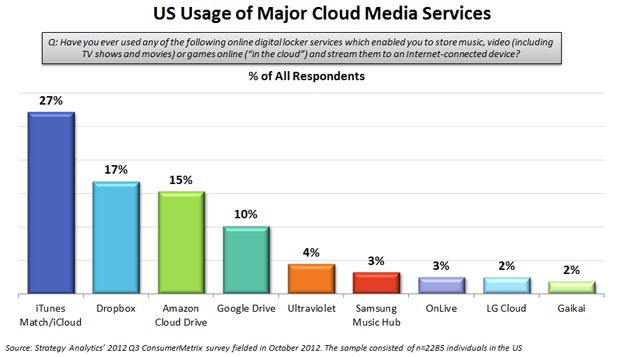

According to a recent survey by research firm Strategy Analytics (via Engadget), Apple is dominating the cloud storage space with 27 percent of respondents picking iTunes Match and iCloud as their go-to service. Closely behind is Dropbox at 17 percent, Amazon Cloud Drive at 15 percent and Google Drive at 10 percent. The report is quick to point out that Dropbox is the one major player that has gained its share of the market without actually selling content associated with its service. It might not be entirely accurate of usage worldwide, as the survey included around 2,300 people only in the United States.

Usage of cloud storage is heavily skewed towards younger people, in particular 20-24 year olds, whilst Apple’s service is the only one with more female than male users. Amongst the big four, Google’s is the one most heavily skewed towards males.

Cloud storage is overwhelmingly dominated by music; around 90% of Apple, Amazon and Google’s cloud users store music. Even Dropbox – which has no associated content ecosystem – sees around 45% of its users storing music files. Dropbox’s recent acquisition of Audiogalaxy will add a much needed native music player to the platform in the coming months.

Update: While it’s hard to read too much into these reports, Foxconn told The Wall Street Journal the freeze on hiring is a result of “a high employee return rate following the Lunar New Year holiday.”

According to the report from Financial Times, Apple’s major assembly partner Foxconn has halted new hiring at its facilities due to a slow down in production for the iPhone 5:

The suspension in hiring by China’s largest private sector employer and the biggest assembler of Apple products, is the first such countrywide move since the 2009 downturn, prompted by the financial crisis. It underscores the weakening demand for some Apple products, which has put pressure on the US company’s battered share price.

Foxconn confirmed it is not currently hiring in its plants located in mainland China, and FT reported the company’s employees were informed that hiring would stop until at least the end of March “in response to reduced orders for the iPhone 5.” While the iPhone 5 doesn’t seem to be experiencing a slow down, according to the latest numbers from Strategy Analytics, the March time frame would line up nicely with rumors of iPhone 5S production beginning in March. Many analysts are calling for a June or July launch of the next-generation iPhone, and Apple could begin initial production as early as next month if true. The decreased production at Foxconn is likely thanks to the expected falloff in new sales in the months following the busy holiday season. Less likely is speculation that Apple could be switching manufacturers.

Recruiters in China told FT that Foxconn has stopped hiring specifically for the iPhone and iPad production lines in many of its factories:

Following a report from Strategy Analytics earlier this month that had Apple as the No.1 mobile phone vendor in the United States for the first time, research firm comScore is out today with its stats for the three-month period ending in December 2012. ComScore looked at the top smartphone subscribers by OEM and the top smartphone platforms, which doesn’t include mobile phones other than smartphones like Strategy Analytics’ report.

According to the report, Apple was able to increase its share from 34.4-percent in the September quarter to 36.3-percent last quarter. Samsung also increased its share—although was significantly behind Apple but still up from 18.7-percent in the quarter before—to 21 percent of the market. HTC, Motorola, and LG rounded out the last three spots in the category with 10.2-percent, 9.1-percent, and 7.1-percent of the U.S. market in December. While Apple was able to grab the top smartphone vendor position, Android maintained its lead over iOS as the top smartphone platform during the quarter.

Google captured 53.4-percent of smartphone subscribers with Android in Q4, up from 52.5-percent in September. In comparison, Apple came in at 36.3-percent and posted a slightly larger increase than Android with two points from 34.3-percent the quarter before. Growth for iOS and Android, like in previous months, comes at the expense of declines for BlackBerry and Microsoft.

Canalys also released a report today that tracked worldwide PC shipments in the fourth quarter—a category that also includes iPads. According to the report, Apple continued its lead in the PC market by hitting over 20 percent for the first time with over 27 million units shipped. Macs accounted for 4 million of those units, while the report estimated iPad mini made up about half of the remaining 23 million iPads:

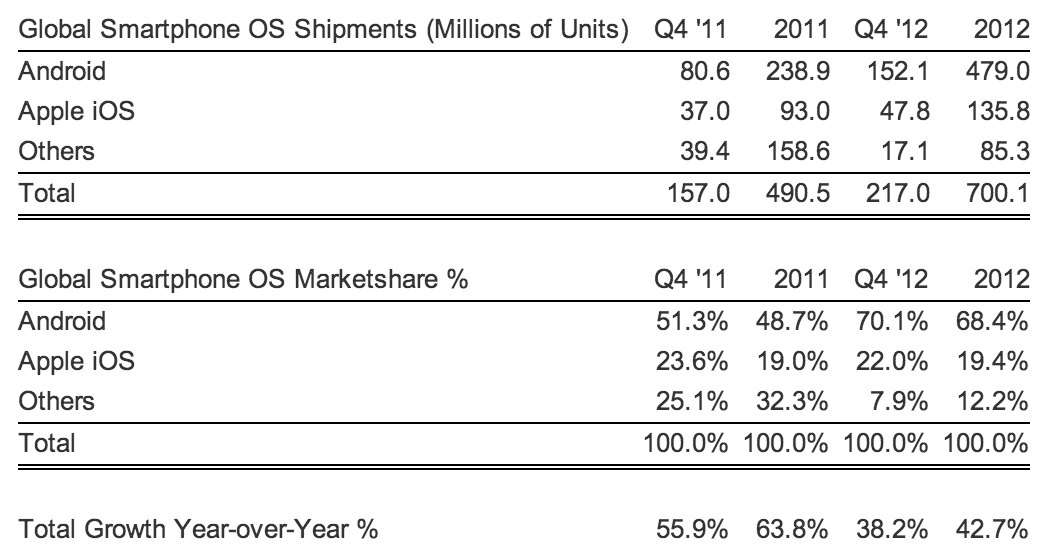

According to the latest numbers from Strategy Analytics that measure global smartphone operating system shipments and marketshare for the fourth quarter of 2012, iOS and Android together accounted for 92 percent of all shipments. Both iOS and Android were able to significantly increase market share over Q3, while global smartphone shipments over the entire year reached a record 700.1 million units.

As for iOS, Apple grew 29 percent annually by selling 135.8 million iPhones throughout the year. The company captured 22 percent of the market in Q4, down from the 24 percent it held in the year-ago quarter, and its share of the smartphone market for the year comes in at 19.4-percent. According to Strategy Analytics, that is up slightly from the 19 percent it took during 2011.

With the “others” category shrinking from 32.3-percent of the market in 2011 to just 12.2-percent in 2012, Android was able to post the largest gains jumping to 70.1-percent of the global market during the fourth quarter from 51.3-percent a year ago. The other category of course includes other platforms, such as BlackBerry, Symbian, Bada, and Windows, all of which together only grabbed 7.9-percent of the market in Q4 2012. That’s down from 25.1-percent in Q4 2011. Android’s gains are clearly at the expense of the “others,” as Apple continues to slowly gain marketshare as well.

Q4 2012 estimates from Strategy Analytics

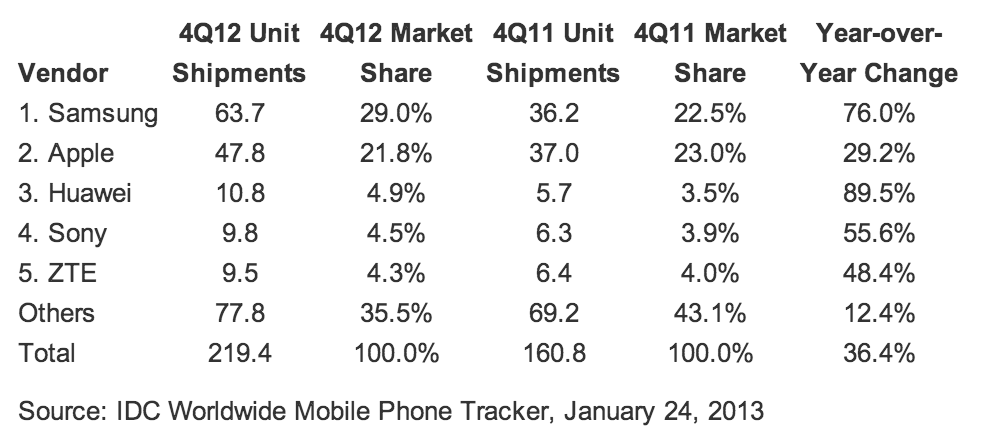

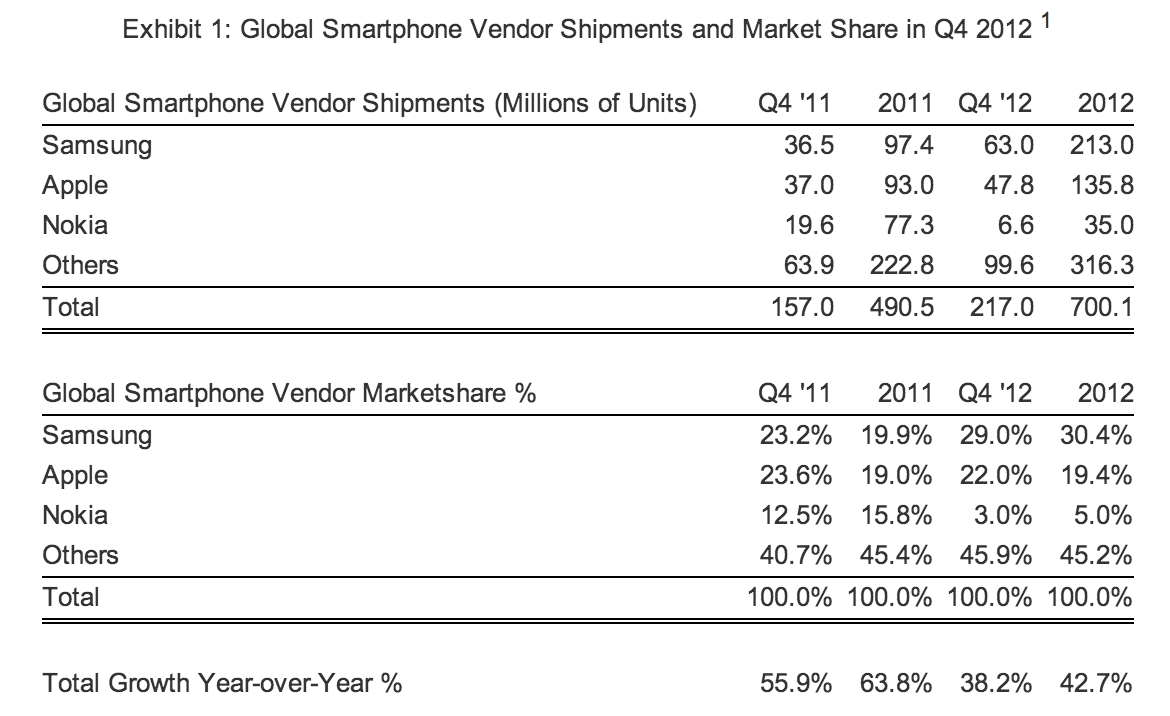

While Samsung has conveniently left specific smartphone sales numbers out of its Q4 earnings release yesterday (as usual), today we get a look at the latest estimates for the quarter coming from research firms Strategy Analytics and IDC.

We know that Apple sold 47.8 million iPhones during the quarter, and today both research firms put Samsung just over 63 million units for Q4 2012. That means Samsung was able to capture 29 percent of the market last quarter (up from 36.2 million units and 22.5-percent of the market in the year ago quarter). Apple is of course a close second among the top five smartphone vendors with 21.8-percent—down slightly from the 23 percent it held in the same quarter last year. In Q4 2011, Apple and Samsung were neck and neck at about 23 percent of the market each.

The increasing market share for Apple, and especially Samsung, over the past year comes at the expense of Nokia. It experienced a drop from 16 percent to 5 percent of the market during the past year.

Expand

Expanding

Close

Strategic Analytics released its latest report today that depicted global smartphone shipments growing to 162 million in Q3 2012, and Apple managed to grab second place with 16.6-percent global share.

“(Apple) shipped 26.9 million smartphones worldwide for 17 percent market share, up from 14 percent recorded a year earlier,” said Strategy Analytics Executive Director Neil Mawston in a press release. “Apple had a solid quarter in the important United States market and this helped to strengthen its global performance.”

Samsung led the charge, however, with a record 35 percent global share. The report mentioned Samsung successfully delivered “numerous hit models,” such as the Galaxy and Galaxy Note, despite competition in stores and courtrooms. Meanwhile, the remaining handset manufacturers, such as Nokia, fell into the “Others” category at 48 percent.

“Samsung shipped 56.9 million smartphones worldwide and captured a record 35 percent market share in the third quarter of 2012. This was the largest number of units ever shipped by a smartphone vendor in a single quarter,” Mawston added.

Samsung and Apple essentially shipped over half of all the smartphones worldwide in Q3—up from roughly one-third just a year ago. Strategy Analytic Senior Analyst Neil Shah therefore noted shipping volumes have “polarized” around the two brands.

According to a report from research firm Strategy Analytics, covering its Global Handset Shipments Forecast for Q2 2012, the company provided insight about the number of iPhones Apple has sold since the device’s launch five years ago on June 29, 2007. The report estimated that Apple sold 250 million iPhones, which accounts for $150 billion in revenue:

“The iPhone portfolio has become a huge generator of cash and profit for Apple. A quarter of a billion iPhones have been shipped cumulatively worldwide in the first five years since launch and Apple reaches its fifth birthday at the top of its game. However, there are emerging signs that the iPhone’s next five years could get tougher. Some mobile operators are becoming concerned about the high level of subsidies they spend on the iPhone, while Samsung is expanding its popular Galaxy portfolio and providing Apple with more credible competition.”

At its Q2 earnings report, Apple announced it sold 35.1 million iPhones during the last quarter, with 365 million iOS device sales to date.

An interesting study out of Strategy Analytics today says that United States and United Kingdom smartphone owners “prefer device screens in the 4.0-inch to 4.5-inch range, as long as the device is also thin.”

“Almost 90 percent of existing smartphone owners surveyed chose a prototype smartphone with a display larger than their current device,” commented Paul Brown, a Director in the Strategy Analytics User Experience Practice. “This trend is driven by increased mobile web browsing ability, as well as engaging video and gaming experiences.”

Not surprisingly, women overall chose smaller phones than men, and existing Android users chose bigger screens than iPhone users. Still, it seems Apple’s customers would prefer a bigger screen.

Kevin Nolan, Vice-President for the User Experience Practice at Strategy Analytics, added, “In order for smartphone owners to adopt larger devices, it is important for handset manufacturers to ensure that mobile devices are not too heavy and that the devices remain thin enough for purses and pockets.”

The data seems to line up with our January poll of 9to5Mac readers in which the majority prefers the next iPhone to be 4-inches or more:

Apple’s iPad maintained its market lead throughout fourth quarter of last year even though it lost some ground compared to the previous quarter due to an influx of Android-based tablets. In fact, Amazon’s dirt-cheap Kindle Fire device that costs just $199 saved the day for Android slates, really. This is the gist of the latest survey by research firm Strategy Analytics that was released this morning.

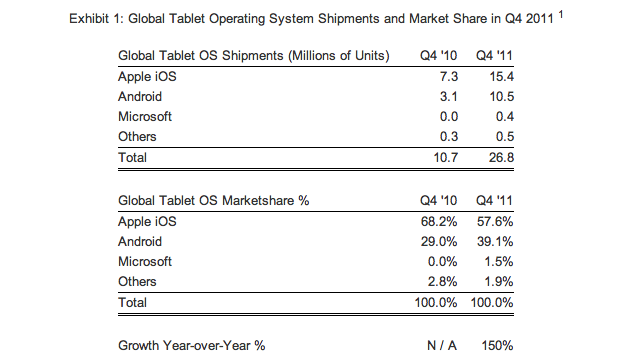

Global tablet shipments reached 26.8 million units in the fourth quarter of 2011— up 150 percent from 10.7 million from the year-ago quarter. Global tablet shipments hit 66.9 million units throughout 2011— a 260 percent increase from just 18.6 million units in 2010. Looking at how tablet vendors performed throughout Q4 2011, the survey recorded a 39.1 percent share for tablets powered by Android. Even though it is a record for tablets driven by Google’s software, Apple sold 15.43 million iPads during the holiday quarter for a healthy 57.6 percent share. This left the remaining 3 percent for tablets outside the Android/iOS tablet duopoly, with Microsoft-driven devices holding onto 1 percent share of the market.

This compares to a Strategy Analytics’ survey for the September 2011 quarter that depicted a 27 percent share for Android tablets in Q3 2011 (up from 2.3 percent in Q3 2010) and 67 percent for iPad (down from 96 percent in Q3 2010). Android tablets are clearly picking up steam, largely based on the success of Amazon’s device that launched Oct. 15, 2011. Still, the iPad is expected to remain king of the hill as analysts expect its lead to maintain throughout 2012.

Strategy Analytics Research Director Peter King opined:

Apple has just released an update for the 2nd generation Apple TV, version 4.4.4 (9A406a). As of now we know the update brings bug fixes, but we’re checking for more. Hit up your Apple TV to download the new firmware or hit up the direct link.

Update: Apple has also released a small update to the iPhone 4S, bringing it to version iOS 5.0.1 (9A406). Hit up the the direct link.

Update X2: Apple has dropped a note saying that this update fixes SIM card issues on the iPhone 4S.

The third quarter of 2011 marks a shift in the cell phone biz as Samsung takes the smartphone crown from Apple and China’s ZTE rises to become the world’s fourth-largest cell phone vendor by volume and Apple slides to fifth place. The bad news for Cupertino arrives just as the company for the first time in years missed Street expectations after shipping 17.07 million iPhones in the September quarter, a modest 21 percent annual growth and a notable 16 percent quarterly decline in units. As you recall, Apple in the June quarter sold 20.34 million iPhones, allowing them to beat Nokia and Samsung and become the world’s leading smartphone vendor, prompting Samsung to stop divulging smartphone and tablet shipments for competitive reasons.

Everyone was waiting for the new iPhone 4S.

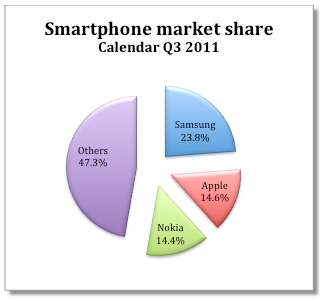

Samsung today posted their quarterly earnings and they passed iPhone by an estimated ten million units. According to Reuters which cited a Strategy Analytics survey, Samsung shipped about 27.8 million smartphones, up nearly four times annually and 44 percent sequentially. This gave Samsung a 23.8 percent global market share in smartphones vs. 14.8 percent for Apple. Such a strong growth is attributed to their Galaxy smartphones, particularly the Galaxy S II model which sold ten million units in the five months since its introduction. Strategy Analytics attributed Samsung’s success to “a blend of elegant hardware designs, popular Android services, memorable sub-brands and extensive global distribution”, adding:

After just one quarter in the top spot, Apple slipped behind Samsung to second position and captured 15 percent share. Apple’s global smartphone growth rate slowed to just 21 percent annually in Q3 2011, its lowest level for two years. We believe Apple’s growth during the third quarter was affected by consumers and operators awaiting the launch of the new iPhone 4S in the fourth quarter, volatile economic conditions in several key countries, and tougher competition from Samsung’s popular Galaxy S II model.

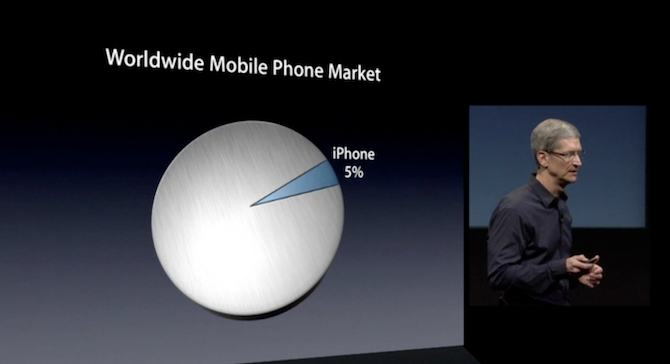

Apple also slid to fifth place in Strategy Analytics’s worldwide cell phone rankings as ZTE shipped 18.5 million handsets for a five percent global market share. Apple CEO Tim Cook said at the October 4 iPhone 4S introduction that iPhone had five percent share of the global cell phone market, hinting at Apple’s phone strategy:

via Fortune