Apple announces 1 billion iOS devices sold

Today during Apple’s Q1 earnings call with investors, CEO Tim Cook announced that the company sold its billionth iOS device back in November.

Expand

Expanding

Close

Today during Apple’s Q1 earnings call with investors, CEO Tim Cook announced that the company sold its billionth iOS device back in November.

Expand

Expanding

Close

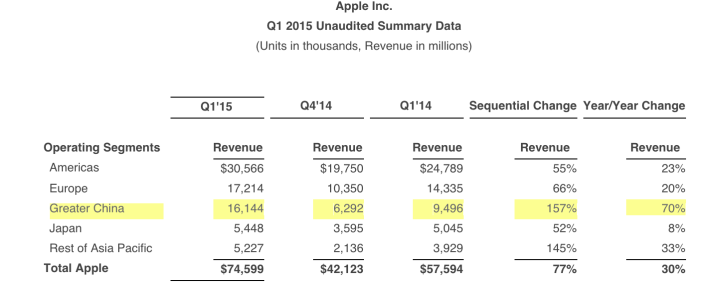

Ahead of Apple’s fiscal Q1 2015 earnings report today, there were signs that Apple had enjoyed significant growth in China and a record number of smartphone sales in the region during the holidays. Today, we get some more insight into that growth, as Apple reported a 157% increase from the previous quarter: revenue of $16.144 billion in Greater China compared to $6.292 billion in Q3.

Expand

Expanding

Close

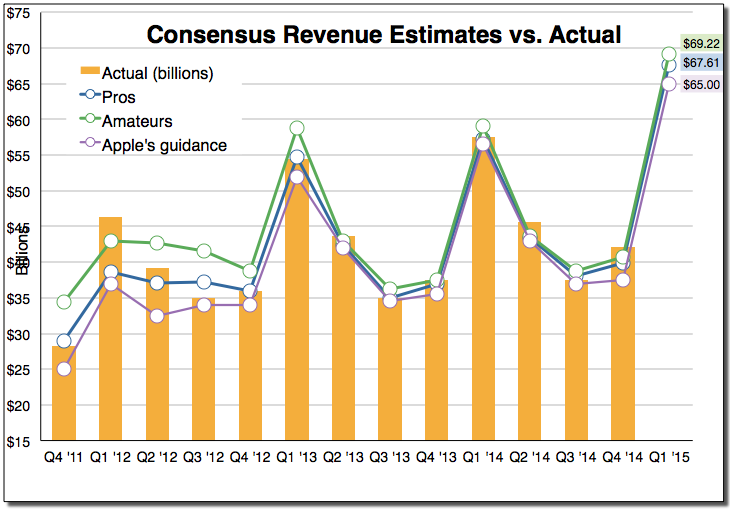

Fortune has done its usual analyst poll ahead of Apple announcing its Q1 earnings tomorrow, and Wall Street is expecting the company to significantly out-perform its earnings guidance of $63.5 to $66.5B.

The consensus among the analysts Fortune polled — 20 professionals and 15 amateurs — is that Apple’s total sales for fiscal Q1 2015 will come in at about $68.3 billion, up 21% year over year.

That would be $1.8B above the upper end of the expectations Apple set back in October …

Expand

Expanding

Close

Apple has announced it is holding its earnings call for company results in fiscal Q4 (covering July, August and September) on October 20th. Following tradition, Apple will announce earnings in a press release about half an hour before the earnings call at 2PM PST. Apple’s earnings for fiscal Q4 will include the first wave of iPhone 6 and iPhone 6 Plus sales, as it went on sale towards the end of the period. However, Apple is unlikely to breakdown the split between new and old iPhone sales, as it only reports total sales numbers for Mac, iPhone and iPad.

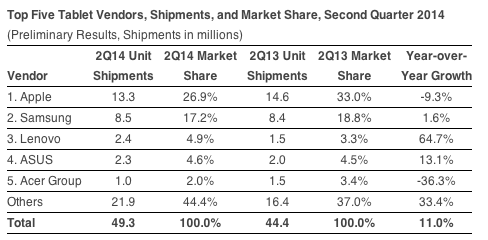

With Apple’s Q3 earnings call this week revealing iPad sales of 13.3 million units for the quarter and Tim Cook making a point of defending the category, today we get a look at how Apple is doing overall with IDC’s latest numbers for worldwide tablet shipments.

While noting that tablet shipments worldwide grew 11% year-over-year, IDC’s numbers show that Apple was able to maintain its lead over Samsung with 26.9% of the market (down from 33% last year) compared to Samsung at 17.2% down from 18.8% the year before. Both lose share to other companies as the category reportedly experienced a lot of growth among smaller companies like Lenovo and Acer while the “others” category grew from 37% to 44% marketshare:

Expand

Expanding

Close

Apple is gearing up for its first major hardware and software launches of 2014. The Cupertino-based company is “tentatively” planning a keynote address in mid-September to announce the iPhone 6 and provide final details on iOS 8, according to sources briefed on the plans.

These people say that the second and third weeks of September are the mostly likely weeks for the event to be held, but they add that manufacturing uncertainties could alter the event’s timeframe. A decision has not been finalized, and sources made it clear that the plans are in flux.

The event will showcase at least the new iPhone 6 with a 4.7-inch screen, the sources say, but a final decision on debuting the larger, 5.5-inch “phablet” model at the event has not been made. The 4.7-inch variant of the new phone is farther along in both internal testing and manufacturing preparation, the sources added.

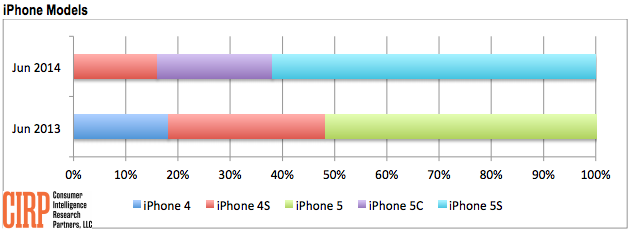

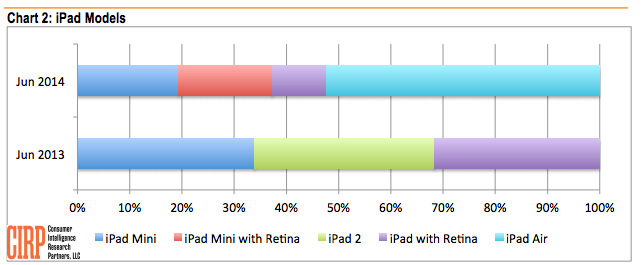

Ahead of Apple’s Q3 earnings call where analysts expect the company to beat its own top-end guidance, Consumer Intelligence Research Partners today shared its latest numbers on iPhone and iPad sales for the quarter.

While analysts are expecting Apple to announce sales of iPhones as high as 40 million units for the quarter representing a 15% increase from last year, CIRP gives us some insight into how iPhone and iPad models sold relative to flagship models last year. It’s also an interesting look at how Apple’s two model iPhone approach is working while continuing to sell previous generations. The iPhone 5s, according to CIRP’s research, accounted for 62% of iPhone sales vs 52% for the iPhone 5 at the same time last year. The data shows Apple is selling more of its most expensive, high-end flagship models as a percentage of its over all sales for compared to last year:

“Once again, Apple’s premium iPhone 5S sold well in the quarter,” said Josh Lowitz, CIRP Partner and Co-Founder. “It appears that in the US, Apple sells the 5S model at the expense of the iPhone 5C, which continues to sell much slower than the similarly- priced iPhone 4S in the same quarter last year. The entry-level ‘free’ or subsidized price point maintains its 16-18% of iPhone sales.”

As for iPad sales, the report notes the iPad Air captured a much higher percentage of Apple’s tablet sales relative to its flagship models last year. “The comparable flagship tablet last year, the iPad with Retina, accounted for less than a third of sales, while the iPad Air has over half. The small format iPads held their own at more than a third of sales, adding the higher-priced iPad Mini with Retina to the product mix. The $399 full size iPad with Retina seems to be stuck in the middle, at only 10% of sales.”

The report covers data for Apple’s fiscal Q3 that includes the three month period ended June 30. Apple’s conference call to announce its Q3 financial results is scheduled for tomorrow at 2PM PT/5PM ET.

Photo: USA Today

Early overnight reports collated by Fortune unsurprisingly show analysts pleased by the higher-than-expected iPhone numbers, with five out of five rating the stock a buy, their price targets ranging from $75 to $252 above yesterday’s closing value. Apple reported iPhone sales of 43.7B against expectations of 38B, and revenue of $45.6B against the consensus estimate of $43.5B.

Katy Huberty, Morgen Stanley: Price target $630

Gene Munster, Piper Jaffray: Price target $640

Brian Marshall, ISI: Price target $600

Brian White, Cantor Fitzgerald: Price target $777

Peter Misek, Jefferies: Price target $625 …

During Apple’s earnings call this evening, Apple CEO Tim Cook announced that the company has sold 20 million Apple TV boxes through the second quarter of 2014. Sharing this number is out of the ordinary for Apple, as it generally doesn’t break down specific sales for its set-top box like it does for other products.

Apple’s decision to give us specific sales information for the Apple TV, however, does corroborate with its move earlier this year to present the device as its own product line, as opposed to an accessory. Cook also said on the call that Apple TV is over a billion dollar market, which means that it is no longer just a “hobby” for the company.

Apple just announced its second quarter results for 2014 with revenue for the quarter coming in at $45.6 billion. That’s compared to the guidance it previously provided of $42 – $44 billion and estimates by analysts averaging approximately $43.5B. Apple’s $45.6 billion in revenue reported today is also up from the $43.6 billion in revenue in the year ago quarter.

Apple just announced its second quarter results for 2014 with revenue for the quarter coming in at $45.6 billion. That’s compared to the guidance it previously provided of $42 – $44 billion and estimates by analysts averaging approximately $43.5B. Apple’s $45.6 billion in revenue reported today is also up from the $43.6 billion in revenue in the year ago quarter.

Break down of device sales for Q2 2014 include 43.7m million iPhones, 16.3 million iPads, and 4.1 million Macs. Compare that to an average of 38M iPhones, 19.3M iPads, 4M Macs, and 3M iPods predicted by the analysts leading up to today. In the same quarter last year, Apple sold 37.4 million iPhones, 19.5 million iPads, just under 4 million Macs, and 5.6 million iPods.

It also reported net quarterly profit of $10.2 billion, or $11.62 per diluted share in contrast to quarterly net profit of $9.5 billion, or $10.09 per diluted share in the same quarter last year.

“We’re very proud of our quarterly results, especially our strong iPhone sales and record revenue from services,” said Tim Cook, Apple’s CEO. “We’re eagerly looking forward to introducing more new products and services that only Apple could bring to market.”

“We generated $13.5 billion in cash flow from operations and returned almost $21 billion in cash to shareholders through dividends and share repurchases during the March quarter,” said Peter Oppenheimer, Apple’s CFO. “That brings cumulative payments under our capital return program to $66 billion.”

Apple is providing guidance for its next quarter of revenue between $36 billion and $38 billion.

The question of the day for Tim Cook and other Apple executives on today’s call will surely be the new product categories that Cook previously said were coming across 2014 and have yet to make an appearance in the first quarter. With Apple’s WWDC developer conference just around the corner, we’ll have to wait and see if Cook gives us any clues of what’s to come during the call today at 2:00 p.m. PST/5:00 p.m. EST. Stay tuned to our live blog for coverage.

Apple’s full press release is below:

Expand

Expanding

Close

Photo: Business Insider

With Apple due to report its quarterly earnings on Wednesday, Fortune has been doing its usual analyst temperature-taking. The 37 analysts who have responded so far expect an average of $43.5B, toward the high end of the $42-44B Apple told the market to expect.

So what are our analysts expecting this week? No surprises, that’s for sure. The average revenue estimate of the 37 analysts we’ve heard from so far — 14 amateurs and 23 pros — is 43.5 billion, just above the midpoint of Oppenheimer’s range.

The amateurs, as usual, are a bit more bullish. They’re calling for earnings of $10.53 per share on sales of $43.66 billion. The pros are not far behind: earnings of $10.18 on sales of $43.42 billion …

With Apple due to report its earnings a week from today, Fortune has run its usual roundup on the numbers analysts are predicting.

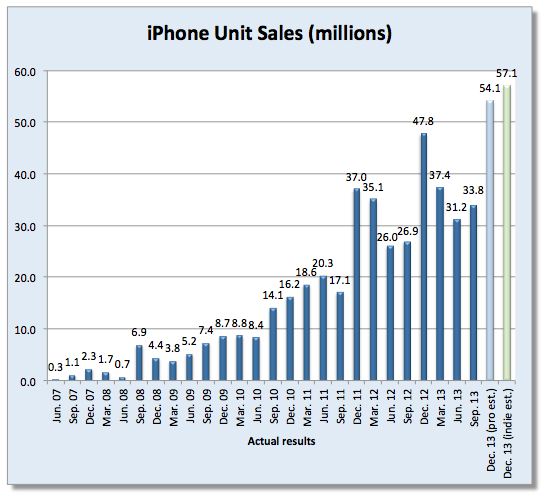

The consensus among the 44 analysts we’ve heard from so far — 27 professionals and 17 amateurs — is unit sales of 55.3 million iPhones, up 16% from the same quarter last year.

It’s a near-certainty the numbers will be high …

Expand

Expanding

Close

While T-Mobile didn’t disclose specific iPhone numbers in its Q3 earnings report this morning, BTIG analyst Walter Piecyk has followed up with numbers from the company’s conference call. According to T-Mobile, iPhone sales accounted for almost 550k units, or 10% of its total 5.6 million smartphone sales including pre-paid and MetroPCS branded devices. Piecyk notes that number is around 15% of the carrier’s post-paid smartphone sales under its own brand, which is down from approximately 950k last quarter. T-Mobile confirmed the numbers in a statement to AllThingsD:

Sales of iPhones represented about 15 percent of T-Mobile-brand smartphone sales, CMO Mike Sievert said. T-Mobile sold about 3.6 million smartphones under its own brand, meaning it sold about 540,000 iPhones in the quarter.

T-Mobile today reported that it sold a record 5.6 million smartphones during the quarter, which includes sales to prepaid customers, accounting for around 88% of total phone units sold. The carrier didn’t have much time to sell the new iPhone 5s and 5c in its third quarter as the devices launched late in September, but the company did make a point of noting that it launched the new iPhones at “very attractive introductory prices of $99 down and $0 down” in its earnings release today. Piecyk notes how that compares to the other guys in Q3:

[tweet https://twitter.com/WaltBTIG/status/397743765474930688]

Expand

Expanding

Close

Following Apple’s earnings results for Q4 2013, which includes a record iPhone sales number for the September quarter, Apple CEO Tim Cook has emailed employees to congratulate them on the results. Cook says that Apple “has never been stronger,” and highlights the products being released this fall. “I am happy to report that Apple’s business has never been stronger, and we are heading into the holidays within amazing lineup led by the new iPhone 5s, iPhone 5c, the stunning iPad Air and iPad mini with Retina display,” Cook says in the memo…

Apple just wrapped up its Q4 earnings call where CEO Tim Cook and CFO Peter Oppenheimer went over some of the numbers discussed in its fourth quarter report, including record iPhone sales up 26% from last year to 33.8m units. Apple’s growth may not be as pronounced as in past quarters, but it appears that with its new iPhones and software it has been able to maintain what looks like more sustainable growth going into the holidays and next year.

Tim Cook hinted new product categories could be on the horizon, but even without a completely new product Apple was able to beat expectations by just about every metric. Here is a roundup of the notable numbers mentioned by Tim Cook and Peter Oppenheimer during Apple’s earnings call today that weren’t included in its fourth quarter results:

Update: Live webcast will be at www.apple.com/quicktime/qtv/earningsq413

Apple will hold its quarterly earnings call to announce results on October 28th, as noted on Apple’s investor website. Typically, Apple’s CEO Tim Cook and CFO Peter Oppenheimer will read prepared statements about the company’s performance, before opening the call to a question and answer session for analysts. The call will begin at 2PM Pacific / 5PM Eastern time. Apple will publish a press release reporting their results about half an hour before the call is due to begin.

![]() As noted by VentureBeat, EA revealed today during its earnings call with investors that for the first time, Apple has become “EA’s biggest retail partner as measured by sales” as a result of the App Store. It’s a big announcement for the publisher that previously sold the majority of its content through retail channels for console games, and it could be a sign that EA will be investing more in iOS and other mobile titles in the months to come. In its earnings release, the company noted that it was “the #1 global publisher in the iOS game market in the June quarter,” and also highlighted a few of its more successful iOS titles, including: The Simpsons: Tapped Out, Real Racing 3, and The Sims:

As noted by VentureBeat, EA revealed today during its earnings call with investors that for the first time, Apple has become “EA’s biggest retail partner as measured by sales” as a result of the App Store. It’s a big announcement for the publisher that previously sold the majority of its content through retail channels for console games, and it could be a sign that EA will be investing more in iOS and other mobile titles in the months to come. In its earnings release, the company noted that it was “the #1 global publisher in the iOS game market in the June quarter,” and also highlighted a few of its more successful iOS titles, including: The Simpsons: Tapped Out, Real Racing 3, and The Sims:

Expand

Expanding

Close

To coincide with Apple’s Q3 2013 earnings release, the company will hold a live conference call to discuss the results at 2 PM Pacific/ 5 PM Eastern Time. Below, we will have a full live blog of the proceedings. We’ll be nothing things of interest.

As planned, Apple today announced its earnings results for the Q3 2013 quarter.

CUPERTINO, Calif.–(BUSINESS WIRE)–Apple® today announced financial results for its fiscal 2013 third quarter ended June 29, 2013. The Company posted quarterly revenue of $35.3 billion and quarterly net profit of $6.9 billion, or $7.47 per diluted share. These results compare to revenue of $35 billion and net profit of $8.8 billion, or $9.32 per diluted share, in the year-ago quarter. Gross margin was 36.9 percent compared to 42.8 percent in the year-ago quarter. International sales accounted for 57 percent of the quarter’s revenue.

The Company sold 31.2 million iPhones, a record for the June quarter, compared to 26 million in the year-ago quarter. Apple also sold 14.6 million iPads during the quarter, compared to 17 million in the year-ago quarter. The Company sold 3.8 million Macs, compared to 4 million in the year-ago quarter.

Apple’s Board of Directors has declared a cash dividend of $3.05 per share of the Company’s common stock. The dividend is payable on August 15, 2013, to shareholders of record as of the close of business on August 12, 2013.

Apple reported revenues for Q3 of $35.3 billion, which is within Apple’s estimates for the quarter of between $33.5 billion and $35.5 billion. This compares to $35 billion in revenues in the year-ago Q3.

Apple also reported net profit of $6.9 billion. This compares to $8.8 billion in profit during the year-ago Q3 quarter.

In terms of product sales, Apple reports that it sold 31.2 million iPhones, 14.6 million iPads, 3.8 million Macs, and 4.57 million iPods. This compares to the 2012 Q3 quarter in which Apple sold: 26 million iPhones, 17 million iPads, and 4 million Macs, and 6.8 million iPods.

Apple CEO Tim Cook on the results:

“We are especially proud of our record June quarter iPhone sales of over 31 million and the strong growth in revenue from iTunes, Software and Services,” said Tim Cook, Apple’s CEO. “We are really excited about the upcoming releases of iOS 7 and OS X Mavericks, and we are laser-focused and working hard on some amazing new products that we will introduce in the fall and across 2014.”

Apple CFO Peter Oppenheimer on the results:

“We generated $7.8 billion in cash flow from operations during the quarter and are pleased to have returned $18.8 billion in cash to shareholders through dividends and share repurchases,” said Peter Oppenheimer, Apple’s CFO.

Apple’s guidance for next quarter (Q3 2013) is revenue between $34 billion and $37 billion.

At 2 PM Pacific time, Apple will hold a broadcasted earnings call. We will conduct a live blog of the call with interesting notes in a separate post. Full press release below:

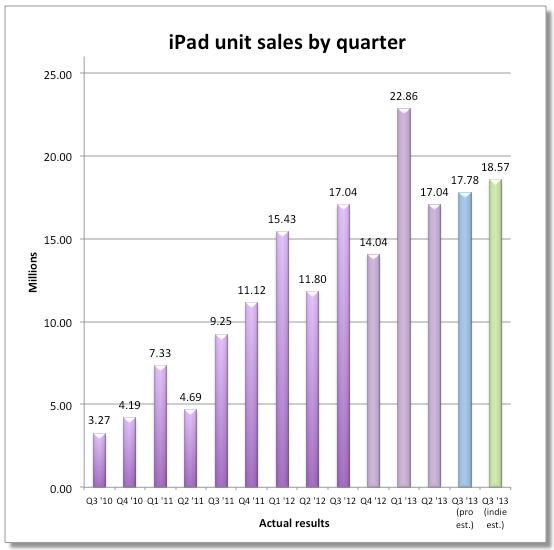

With Apple’s Q3 2013 financial call set to take place later this month on July 23rd and Wall Street expecting near zero revenue growth, today we get a look at what analysts are expecting for iPad sales. With no major product announcements since the introduction of iPad mini and iPad 4 last fall (and only a minor upgrade with the 128GB iPad 4 in January), it’s not all that surprising the consensus from 48 analysts polled by Fortune is that Apple will experience a big drop in growth year-over-year for iPad during the June quarter.

The average estimate of 18.1 million iPad units during Q3 works out to around 6.2% growth compared to 183% and 84% in Q3 2011 and Q2 2012, which some might still consider significant due to the lack of new product announcements and competition from Android tablets:

Expand

Expanding

Close

Fortune is reporting that most analysts expect Apple to report near-zero year-on-year growth when the company reveals its Q3 earnings figures on 23 July.

The pessimistic expectations began just a day after Apple reported its Q2 earnings, with Cowan and Company taking just 24 hours to post a Q3 prediction of $35.4B. More recent analyst estimates gathered by Thomson Financial, and reported on Yahoo! Finance, were marginally lower, at $35.17B. Fortune‘s own preliminary survey of 35 analysts to date is slightly lower still at $35.02B …

Expand

Expanding

Close

Apple will hold a conference call on Tuesday, July 23rd to announce Q3 2013 financial results, according to a note on Apple’s Investor website. The call will begin at 2PM Pacific / 5 PM Eastern time. Apple typically presents prepared statements from Apple CEO Tim Cook and Apple CFO Peter Oppenheimer…

http://youtu.be/9MHbElOIF6A

T-Mobile just released its first earnings report since it started officially carrying the iPhone on April 12th and ‘coincidentally’ the first where it has picked up customers in 17 quarters. The carrier had accumulated 2.1M iPhone users without even carrying the iPhone up until it launched in April, which is up from 1 million in 2011.

T-Mobile tallied approximately 500,000 iPhone 5 sales in the first 30 days which is stronger than you might initially imagine, especially off a launch cycle. Other US carriers who have reported iPhone sales in the millions over 3 months note that about half of their sales are iPhone 5 (the other half are cheaper iPhone 4 and 4S).

The US #4 carrier saw its subscriber base increase by 579,000 customers, a number likely directly correlated to iPhone sales. In addition, T-Mobile will be adding 9 million MetroPCS users over the coming quarters to its ranks. T-Mobile also ran into some legal problems last month and was forced to change its marketing terminology with regards to ‘no-contract plans’ and was forced to offer customers refunds.

T-Mobile launched its subscription-based T-Mobile TV on iPhone last week.

An insightful Reuters blog by financial journalist Felix Salmon suggests that Apple’s surprisingly low share price may be due to the evolving nature of the company leaving it between two sets of investors.

Conservative investors, who like slow-growing stocks with high dividends, are constitutionally uncomfortable with the volatility inherent in the tech world. And technology investors, who are happy taking that kind of risk, want to see substantial growth. Apple, notwithstanding the fact that it’s one of the most valuable companies in the world, is falling through the capital-markets cracks.

Apple always used to be the company which surprised and delighted investors and customers alike. Its guidance to investors was deliberately pessimistic, blowing through those figures when it reported actual revenue and earnings. It was notoriously secretive about new products, launching new ones in a playful manner with Steve Jobs’ famous ‘One more thing‘ moments…

Expand

Expanding

Close