If there’s one thing as certain as the hype when Apple launches a new iPhone, it’s the “Apple is doomed” messages when the new model(s) fail to meet every single analyst prediction, no matter how crazy. Apple could add a matter transporter function to the iPhone 6 and some analyst would be complaining that it only operates on WiFi when they were expecting it to use LTE.

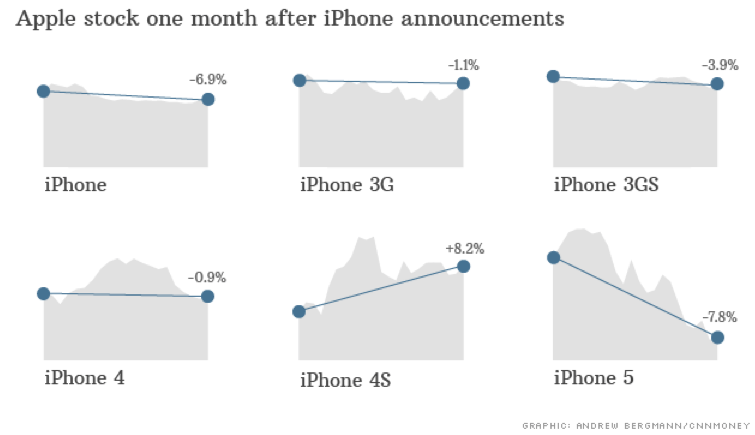

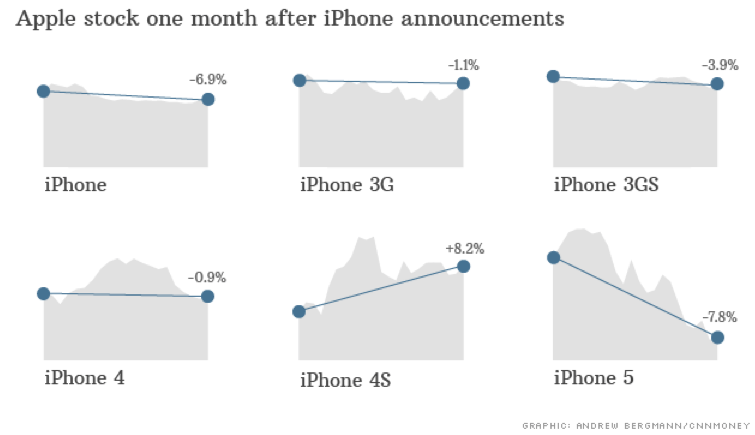

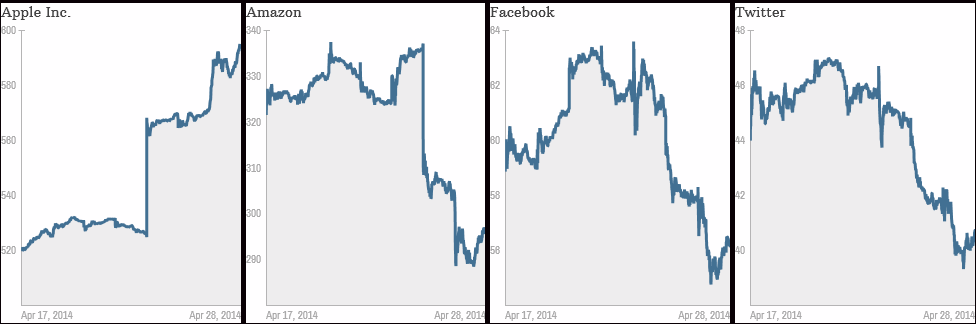

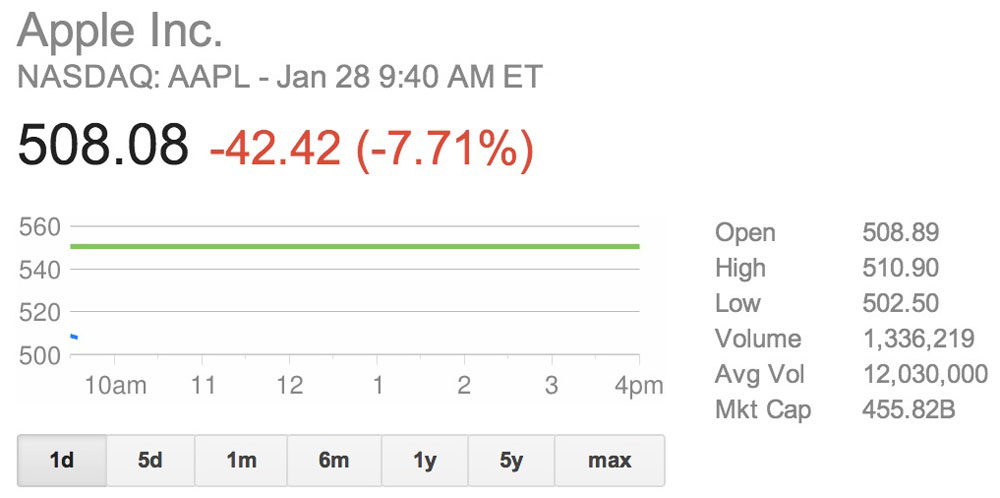

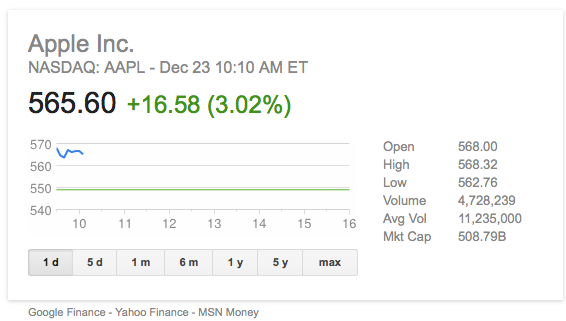

Business Insider pointed to a set of CNN charts which show that, typically, the AAPL stock price is down a month after a new iPhone launch. But any similar dip we might see after the launch of the iPhone 6 is no cause for concern: with the exception of 2013, Apple stock has been climbing since the first iPhone was launched in 2007.

As ever, make your own investment decisions with the aid of professional advice, but there certainly doesn’t appear to be any reason to be spooked if the launch of the new iPhone leads to some investors selling their shares. “Buy on the rumor, sell on the news” is a very common approach.

Downgrading AAPL from a buy to a hold, Reitzes said that while he was excited by the

Downgrading AAPL from a buy to a hold, Reitzes said that while he was excited by the

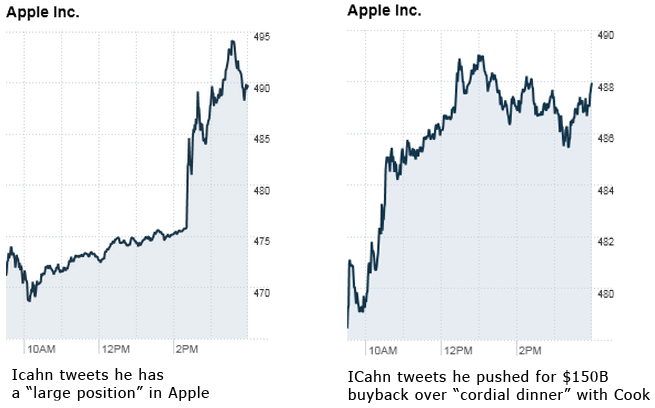

Would be nice to know when he’s about to tweet, eh?

Would be nice to know when he’s about to tweet, eh?