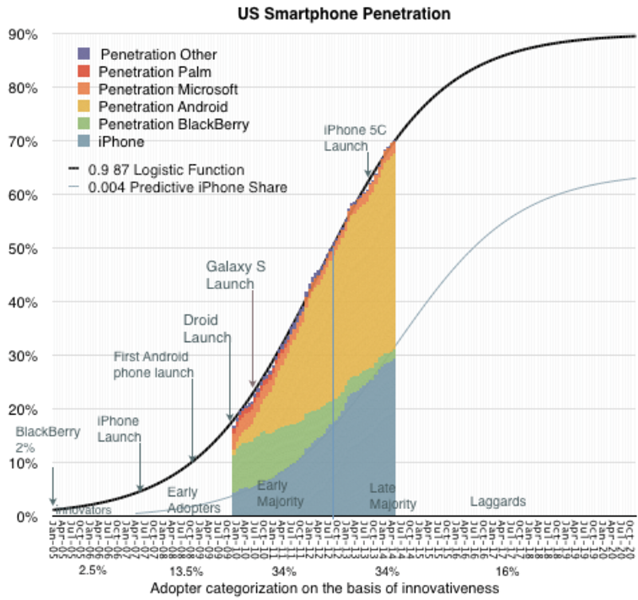

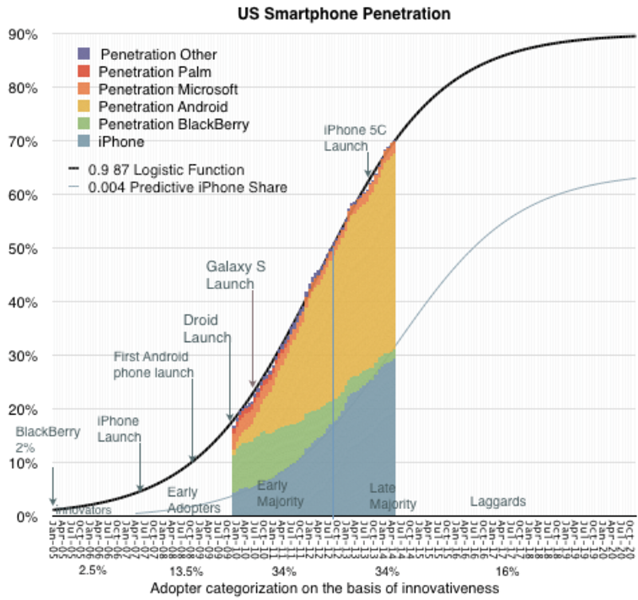

There are early signs that Apple’s market share of the U.S. smartphone market may increase as we move through the ‘Late Majority’ phase and into ‘Laggards’, suggests Asymco’s Horace Dediu.

For those who weren’t paying attention in economics classes in school, new products tend to experience an S-curve pattern to their growth. In the tech sector, Innovators are pretty much synonymous with techies.

Innovators (first 2.5%) need to be sold on the premise of novelty itself. Early adopters (next 13.5%) seek status and exclusivity. Early majority (34%) seek acceptance and Late Majority (34%) seek pragmatic productivity. Laggards (last 16%) seek safety.

If those percentages appear rather random, it’s because they are derived from the shape of the curve – the typical points at which it gets steeper or shallower.

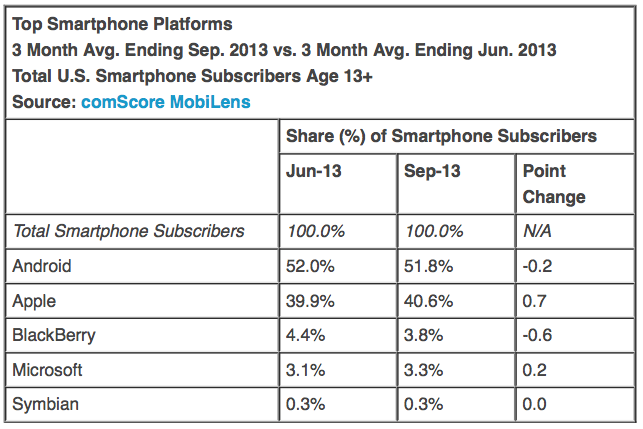

With U.S. smartphone penetration now at 70 percent, we’re about two years into the Late Majority stage, with around two further years of growth to come. What Dediu’s analysis suggests is that iPhone growth has a steadier pattern to it than Android growth, which appears to be more closely driven by product launches and promotions. The more mature a market, the fewer product launches and promotions there are designed to drive adoption.

Why, when we are in a late stage of the market, does the iPhone do well when users are not incentivized to adopt? As we crossed 70% adoption, 1.4 million more users adopted the iPhone than Android.

Even if we look out to the last six months, iPhone added 15.5 million late majority users while Android added 14.2 million. If promotions decrease for the “late late majority” and laggards then would the iPhone do even better relative to Android?

Dediu points to the featurephone market as support for his hypothesis: at the tail-end of the curve, before smartphones took over, the most popular phone in the U.S. was the RAZR – a premium handset.

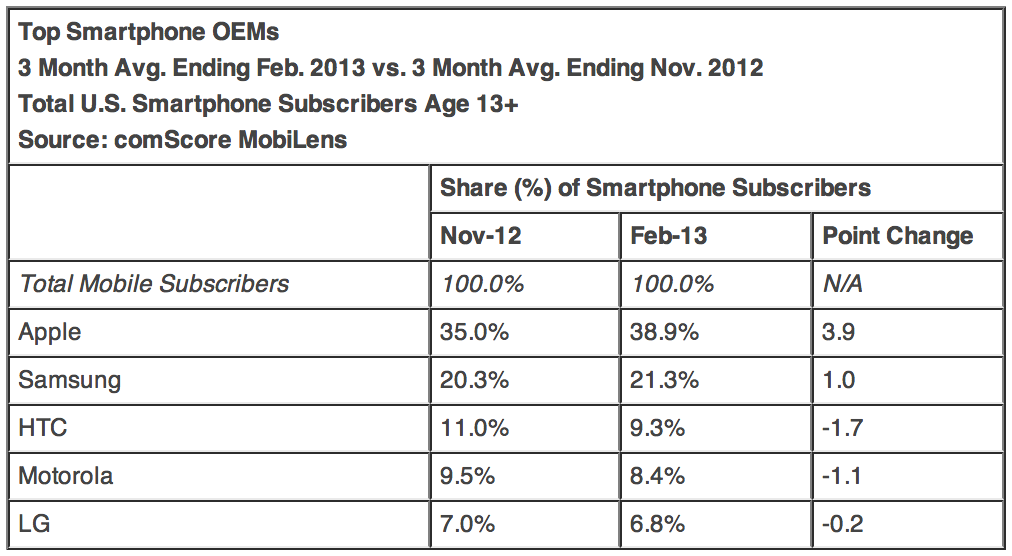

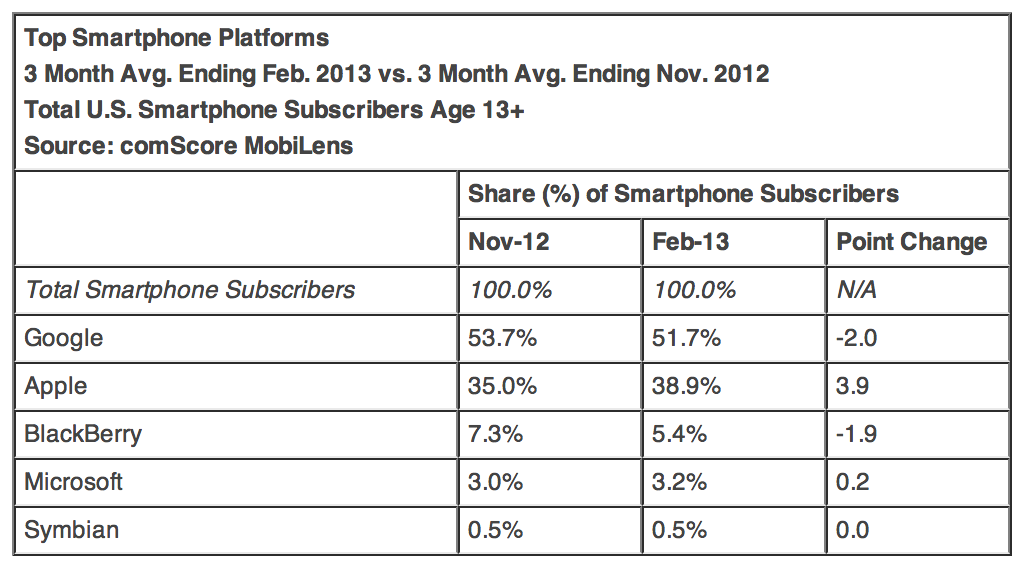

It’s important to point out that the shipped vs. sold argument doesn’t apply to comScore’s results, as its data comes from surveys tracking smartphone subscribers and usage and not sales or units shipped. Google grabs the spot as top smartphone platform at the end of February, but Apple continues to close the gap capturing 38.9-percent of the market (up from 35 percent) compared to Google’s 51.7-percent (down from 53.7-percent):

It’s important to point out that the shipped vs. sold argument doesn’t apply to comScore’s results, as its data comes from surveys tracking smartphone subscribers and usage and not sales or units shipped. Google grabs the spot as top smartphone platform at the end of February, but Apple continues to close the gap capturing 38.9-percent of the market (up from 35 percent) compared to Google’s 51.7-percent (down from 53.7-percent):