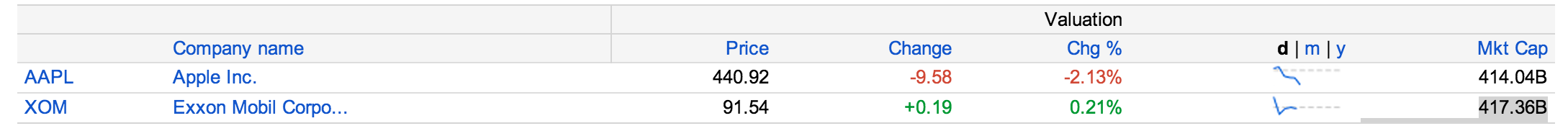

Two days after AAPL hits highest market cap ever, billionaire investor Carl Icahn values it at $1.3 trillion

Two days after Apple set a new record for the highest market capitalization of any company, valuing it at more than $700B, billionaire investor Carl Icahn has suggested the true value of the company is close to double this, at $1.3T.

Icahn, who is one of the company’s ten biggest shareholders with stock worth around $6.5B, says that a realistic valuation of the company would be 20 times its earnings per share. Factoring in Apple’s cash reserves of $178B, that would give a share price of $216–for a total company value of $1.3T.

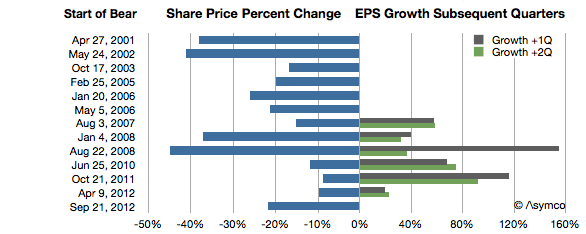

Icahn notes that while he has previously been criticized for over-optimistic valuations of AAPL, 31 analysts have “dramatically increased” their earnings-per-share estimates in the past fortnight.

We have gained further confidence in our thesis, increasing the forecasted EPS for FY 2015 in our model from $9.60 to $9.70, and now believe the market should value Apple at $216 per share. This is why we continue to own approximately 53 million shares worth $6.5 billion, and why we have not sold a single share.

Icahn has consistently urged Apple’s board to increase the pace of its stock buyback program, his last call coming at a time when the shares were trading at $100. At the time of writing, shares were trading at $124.88. Apple recently set another world record, announcing the highest ever quarterly profit of any company.