Apple bringing 1,000 new jobs to Ireland, where Tim Cook describes Microsoft’s Surface Book as “deluded” [Updated]

Update: Apple has since stated that Cook intended to describe the Microsoft Surface Book as “diluted” rather than “deluded.”

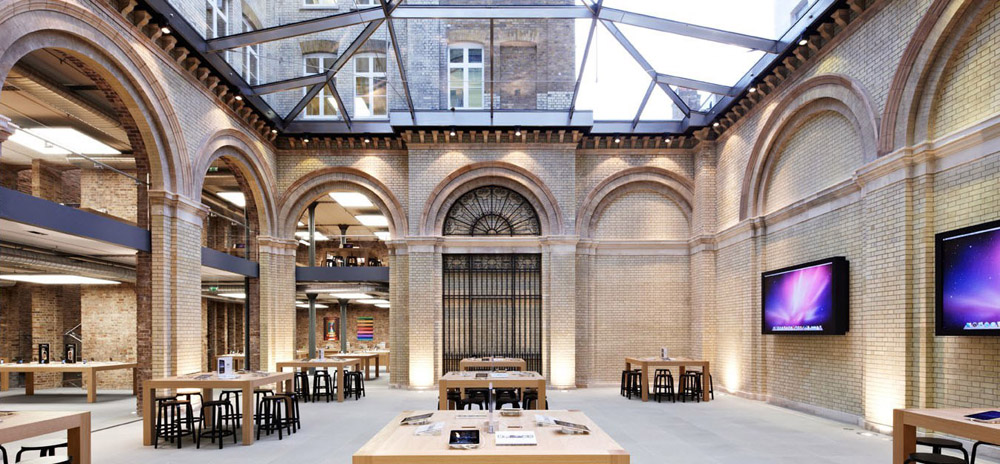

The Irish government has announced that Apple will be employing an additional 1,000 staff in Ireland, the country where the company declares much of its revenue from sales throughout Europe, reports Reuters.

Ireland’s main foreign investment agency, the IDA, said Apple was to add 1,000 jobs to its office in Cork by mid-2017 from 5,000 at present. It said the company had also added 1,000 jobs in the past year.

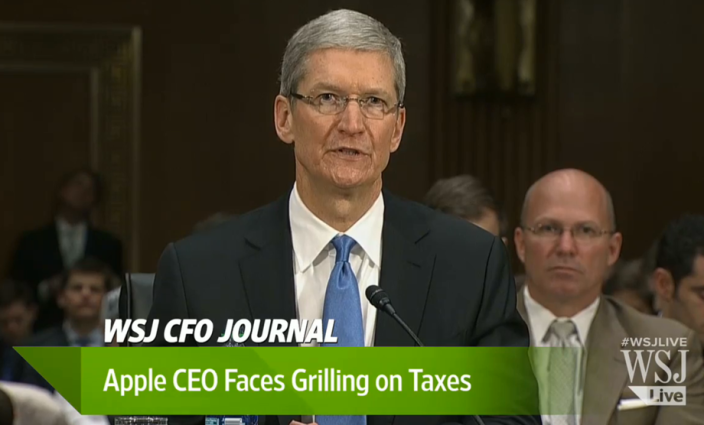

There had been some concern about whether Apple would maintain a significant presence in the country if the European Commission investigation into Apple’s tax dealings in the country went against the company …

Expand

Expanding

Close

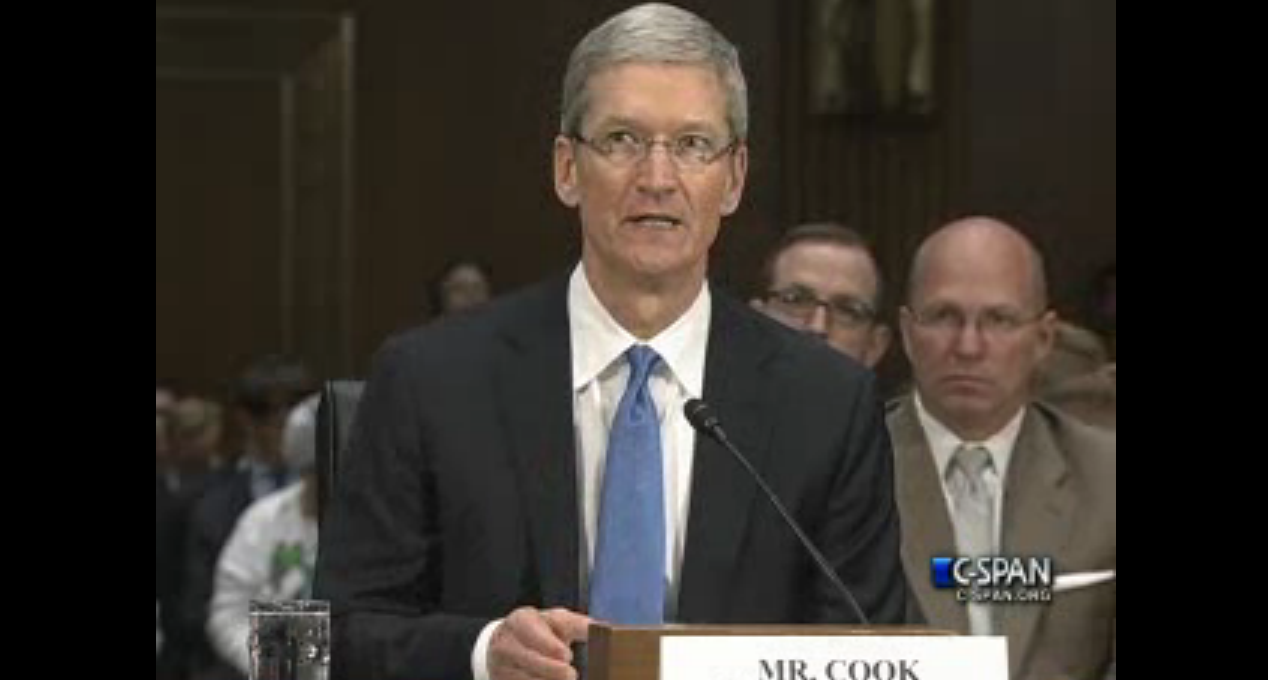

In the midst of the U.S. government’s

In the midst of the U.S. government’s