KGI predicts zero or negative growth for next iPhone, citing weak Chinese economy and limited appeal of Force Touch

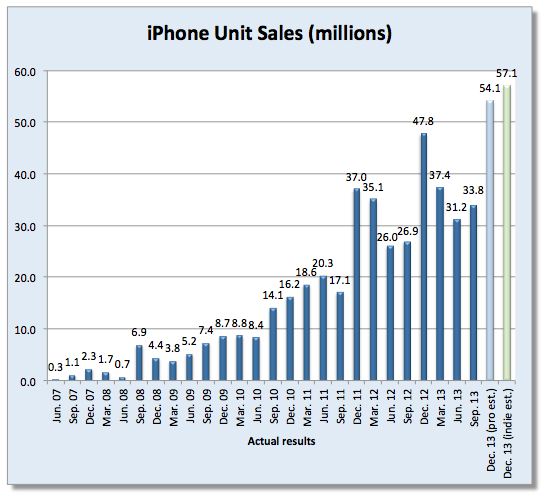

KGI – which has an excellent track record – has predicted a strong possibility of either zero or negative growth of iPhone sales in Q4 2015. The investment note cited by Taiwanese site Apple Daily (via GforGames) forecasts that Apple will sell between 65M and 75M iPhones, compared to 74.5M in the same quarter last year.

We predict iPhone 6S and iPhone 6S could be the first S-series models to see flat or lower shipments versus their predecessors.

KGI bases its pessimistic prediction on two factors. First, the weak state of the Chinese economy. Second, the very same argument I made in my opinion piece yesterday: that the headline feature of the iPhone 6S, Force Touch, doesn’t seem likely to wow customers …

Expand

Expanding

Close