AAPL Company

Breaking news from Cupertino. We’ll give you the latest from Apple headquarters and decipher fact from fiction from the rumor mill.

AAPL is a California-based computer company that became the most successful smartphone company in the world.

Table of contents

AAPL defined by Apple

Here’s how Apple defines itself:

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today, Apple leads the world in innovation with iPhone, iPad, Mac, Apple Watch, and Apple TV. Apple’s five software platforms — iOS, iPadOS, macOS, watchOS, and tvOS — provide seamless experiences across all Apple devices and empower people with breakthrough services including the App Store, Apple Music, Apple Pay, and iCloud. Apple’s more than 100,000 employees are dedicated to making the best products on earth, and to leaving the world better than we found it.

Key AAPL history

From Apple I to iMac

Apple was founded in 1976 by Steve Jobs (Steve), Steve Wozniak (Woz), and (briefly) Ronald Wayne as a business partnership: Apple Computer Company. The following year it became Apple Computer, Inc. The company’s first product was the Apple I, a personal computer hand-built by Woz and sold in part-completed kit form. The Apple II and Apple III followed.

The modern Apple as we know it today began in 1983, with the launch of the first personal computer with a graphical user interface, the Lisa. Way too expensive to succeed, it was replaced by the Macintosh in 1984, launched with the single showing of a Ridley Scott commercial during the Super Bowl. The Macintosh transformed the world’s understanding of what a computer was, and would eventually lead to Microsoft adopting the GUI approach.

Steve Jobs and then Apple-CEO John Scully fell out in 1985, when Steve wanted to focus on the Macintosh while Scully wanted to put more attention on the Apple II, which was still selling well. That led to Steve being forced out of the company and going off to form NeXT.

Apple focused on selling Macintosh models at the highest possible margins, but would eventually fall foul of a mix of unsustainable pricing in the face of competition from Windows machines, and an overly complex product lineup. By 1996, the company was in trouble, and in 1997 Steve was brought back, along with the NeXT operating system, which would eventually form the basis of Mac OS X.

Steve simplified the Mac lineup and had industrial designer Jony Ive work on a whole new look for a consumer desktop Mac, the colorful iMac. The iMac, like the original Macintosh, again changed the world’s understanding of what a computer was, and who should want one.

From Apple Computer, Inc. to Apple, Inc.

In 2001, Apple launched the iPod. Although this wasn’t the first mp3 player, it was massively better than anything on the market at the time, and succeeded in turning a geeky piece of technology into a consumer electronics product with mass-market appeal.

The success of the iPod paved the way into other mobile devices. Apple was working on what would eventually become the iPad, when Steve realized that this was the basis of a smartphone. He diverted the team’s work into this, to launch the iPhone in 2007. The iPad launched later, in 2010.

The iPhone was yet another transformational product. While most other smartphones of the time were clunky devices with a keyboard and stylus, the iPhone was a sleek-looking device operated with a finger, and so simple that no user guide was needed. It was with the launch of the iPhone that Apple Computer, Inc. was renamed to Apple, Inc.

From Intel to Apple Silicon

While the iPhone, iPad, Apple Watch, and more are made with Apple-designed processors, the Mac lineup has historically relied on third-party companies for its CPUs. Over the years, Macs progressed from Motorola 680000 series chips through PowerPC to Intel.

In 2020, Apple began a two-year transition to the final stage in that journey, with Macs too finally getting Apple-designed chips. The first such is the M1 chip, used in the latest Mac mini, MacBook Air, and 13-inch MacBook Pro. Other Apple Silicon Macs followed.

AAPL today

Apple is one of the largest companies in the world. It was the first publicly traded company to hit a trillion-dollar valuation in 2018, $2 trillion in 2020, and $3T in 2022.

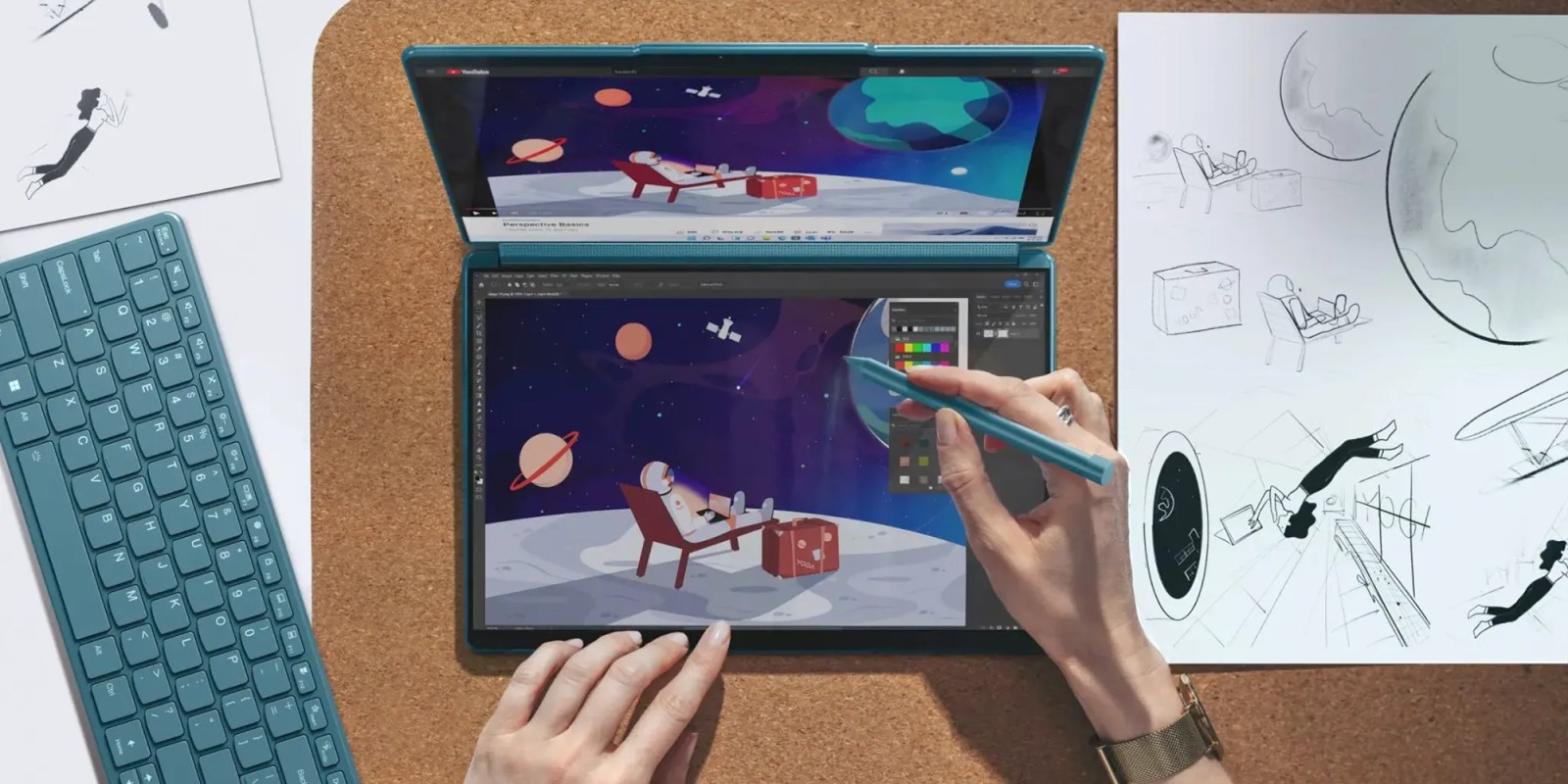

The company’s product lineup includes five different Mac families (MacBook Air, MacBook Pro, iMac, Mac Pro, and Mac mini); four iPad ranges (iPad mini, iPad, iPad Air, iPad Pro); four iPhone 12 models (12, 12 mini, 12 Pro, 12 Pro Max); three main Apple Watch models (SE, Series 3, Series 6); as well as other products, including Apple TV, AirPods, and HomePod mini.

In addition to hardware sales, Apple derives a growing proportion of its income from Services, including the App Store, iCloud, Apple Music, and Apple Pay.